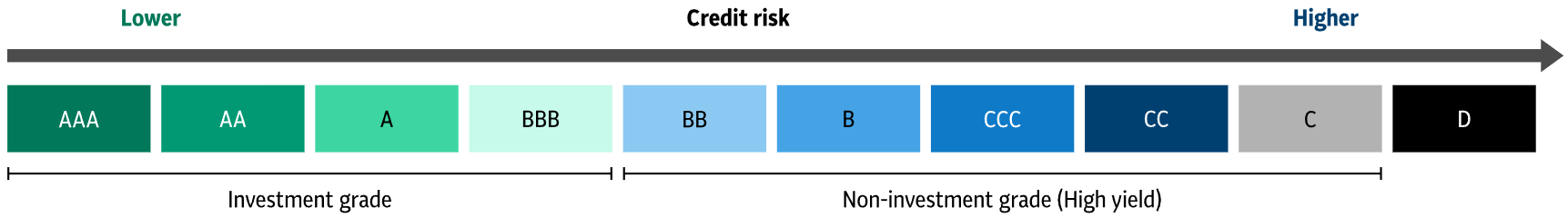

High yield bonds are fixed income securities that credit ratings agencies rate between BB and C grade and are also known as ‘non-investment grade’, indicating they are below an investment grade credit rating. High yield bonds are typically fixed rate securities issued by corporations, and they generally pay higher rates of return than investment grade securities to compensate for their higher credit risk.

Credit ratings are determined by one or more independent rating agencies, who assess the credit worthiness of an issuer or security, and the probability of default. Credit ratings provide investors with an independent and transparent way to measure the credit risk of fixed income assets;

- A higher credit rating indicates a greater ability of the issuer to meet its financial obligations i.e. pay back their debt. Investment grade securities have a credit rating between AAA and BBB.

- As credit risk increases, these securities are classified as non-investment grade – or a high yield security. To compensate for higher credit risk, high yield securities offer the potential for higher yielding returns.

- A credit rating of D would indicate the security is in default.

Source: References Standard & Poor’s rating methodology.

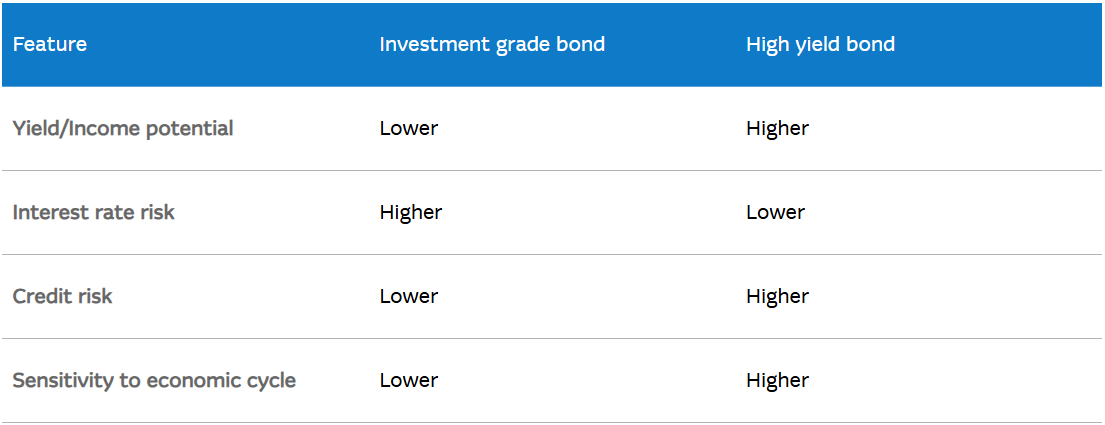

High yield vs investment grade bonds

The global high yield market is highly diversified, covering a broad range of sectors and security types. Ford, United Airlines, Tesla and Netflix are just a few examples of major corporations that have depended on tapping the high yield credit market to fund their growth phase at some point. High yield securities range from corporate bonds, bank loans and emerging market debt to hybrid or subordinated debt securities, as well as structured securities.

High yield bonds generally have higher credit risk than investment grade bonds, because high yield bonds are typically issued by companies with lower credit worthiness. Securities with lower credit ratings are more sensitive to a downturn in economic cycles as this can increase the potential for corporate defaults.

High yield bonds generally have lower interest rate risk compared to investment grade bonds. This is because high yield bonds offer higher coupon payments to compensate for their higher credit risk and a larger portion of the bond's return is received earlier, which reduces the bond's duration and, consequently, its sensitivity to interest rate changes. High yield bonds also often have shorter maturities than investment grade bonds, meaning that the bond's price is less sensitive to interest rate changes, as the bond will be repaid sooner. Lastly, the prices of high yield bonds are more influenced by changes in credit spreads, while investment grade bonds are more sensitive to interest rate movements because their credit spreads are narrower and more stable.

Here’s how investment grade and high yield securities compare.

Why invest in high yield?

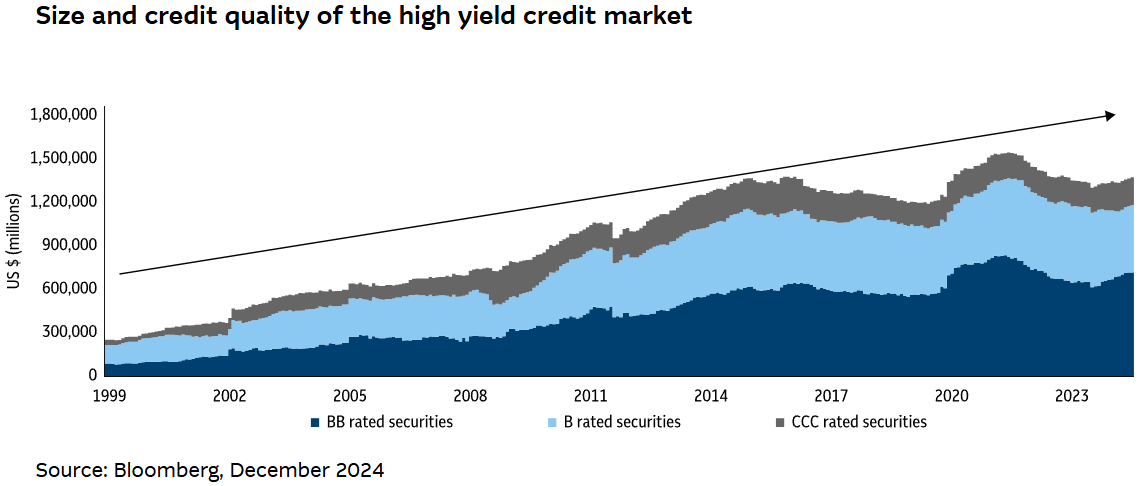

The global high yield market is well-established, having first originated over 40 years ago. At US$2.7 trillion (including bank loans), it’s larger than the ASX300 and is continuing to grow in size and improve in credit quality. In particular, the issuance of BB rated securities – the highest credit quality in the high yield market – have experienced a steady increase over the past 20 years, becoming the largest component of the market.

The global high yield market is also highly diversified when compared with investment grade credit, which is typically dominated by financial corporations. Global high yield opportunities exist across a broad range of industries including technology, industrials, communication, energy providers, and consumer goods.

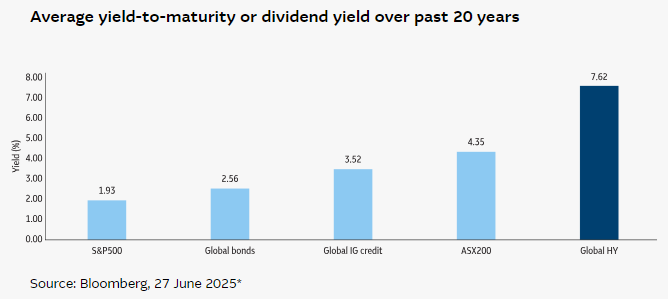

As shown in the graph below, the average yield generated by the global high yield market has been notably higher over the past 20 years than other traditional asset classes, including both traditional fixed income and equities.

An allocation to high yield can provide an opportunity to enhance the level of yield in a traditional equity-bond portfolio, as this chart indicates.

* Past performance is not a reliable indicator of future performance. The following indices have been used to represent the different parts of the fixed income investment universe above: Global bonds – Bloomberg Global Aggregate Index; Global investment grade corporate – Bloomberg Global Aggregate Credit Total Return Index; Global high yield – Bloomberg Global High Yield Index. Yield-to-maturity is the return that would be earned over the next year if there were no changes to interest rates and assuming there are no changes to the underlying investments. The number which is quoted is before fees. Yield-to-maturity is not the actual return that an investor can expect to receive by investing in these indices. Average yield-to-maturity has been calculated as the average of the daily yield-to-maturity over the last 20 years or since inception of the relevant index. Dividend yield is the annual dividend income on an equity position divided by the current market price of that equity position and has been calculated as the average of the daily dividend yield over the last 20 years.

How to invest in high yield

Many alternative high yield credit assets – such as private debt – tend to lock capital up for an extended period and offer limited liquidity windows. However, high yield securities are now easily accessible as exchange traded funds (ETFs), listed on a stock exchange.

Blair Hannon is Head of ETFs, ANZ at Macquarie Asset Management. This is general information only and does not take account of investment objectives, financial situation or needs of any person and before acting on this information, you should consider whether this information is appropriate for you.

The Macquarie Global Yield Maximiser Active ETF (ASX: MQYM) offers an actively-managed strategy focused on high yielding credit opportunities in global markets. You can learn more about it here. It is also available as an unlisted managed fund.

Risks and important information (click to expand): All investments carry risk. Different investments carry different levels of risk, depending on the investment strategy and the underlying investments. Generally, the higher the potential return of an investment, the greater the risk (including the potential for loss and unit price variability over the short term). The risks of investing in this Fund include:

- Investment risk: The Fund seeks to generate higher income returns than traditional cash investments. The risk of an investment in the Fund is higher than an investment in a typical bank account or term deposit. Amounts distributed to unitholders may fluctuate, as may the Fund’s NAV unit price, by material amounts over short periods.

- Manager risk: There is no guarantee that the Fund will achieve its performance objectives, produce returns that are positive, or compare favourably against its peers, or that the strategies or models used by the Investment Manager will produce favourable outcomes.

- Income securities risk: The Fund may have exposure to a range of income securities. The value of these securities may fall, for example due to market volatility, interest rate movements, perceptions of credit quality, supply and demand pressures, a change to the reference rate used to set the value of interest payments, market sentiment, or issuer default.

The Target Market Determination (TMD), available at macquarie.com/mam/tmd, includes a description of the class of consumers for whom the Fund is likely to be consistent with their objectives, financial situation and needs.

The Fund(s) mentioned above may have multiple classes of units on issue. A separate class of units is not a separate managed investment scheme.

This information has been prepared by Macquarie Investment Management Australia Limited (ABN 55 092 552 611 AFSL 238321) the issuer and responsible entity of the Fund(s) referred to above. In deciding whether to acquire or continue to hold an investment in a Fund, an investor should consider the product disclosure statement for the relevant class of units in a Fund, if any, and the Website Disclosure Information available at macquarie.com/mam or by contacting us on 1800 814 523.

Other than Macquarie Bank Limited ABN 46 008 583 542 (“Macquarie Bank”), any Macquarie Group entity noted in this document is not an authorized deposit-taking institution for the purposes of the Banking Act 1959 (Commonwealth of Australia). The obligations of these other Macquarie Group entities do not represent deposits or other liabilities of Macquarie Bank. Macquarie Bank does not guarantee or otherwise provide assurance in respect of the obligations of these other Macquarie Group entities. In addition, if this document relates to an investment, (a) the investor is subject to investment risk including possible delays in repayment and loss of income and principal invested and (b) none of Macquarie Bank or any other Macquarie Group entity guarantees any particular rate of return on or the performance of the investment, nor do they guarantee repayment of capital in respect of the investment.