We all have trouble buying stocks that have gone up and selling stocks that have gone down. If that’s you then I regret to inform you that you are being affected by a well-established financial concept called ‘anchoring’.

Source: Wikipedia

You hear the issue every day in a broking office and in stock discussions. It’s when someone says “I can’t buy that because the share price is up X%” or “You can’t sell that, the price is down Y%”. An even more soft-brained development on the theme is when you find yourself saying “It’s down X% so it’s cheap” or “It’s up Y% so it’s expensive.”

It’s the future that matters

Making money in shares is about where the share price is going in the future. Where the share price has been in the past is pretty much irrelevant. What you paid for a stock and what price it was in the past is a distraction from what the company is worth now or in the future and where the market might take the price.

Anchoring, also known as ‘focusing bias’, is the use of a reference point against which to judge value. For share prices it means using past share prices as a reference point for the current share price even though the past price is not a factor in assessing current value.

How often do you reference how much a stock has moved from the lowest price it hit or the highest price it hit? Those prices form an anchor point from which we judge the current price and, left to idly ponder, we tend to develop a bias that says something is expensive or cheap.

Past performance is simply a statement of where the price was. The more important consideration is where the price is now relative to what the company is worth. On the basis that the market's appreciation of the value of a company changes as time progresses, past prices become redundant as a reference point as soon as the value of a company changes, which arguably it does every day.

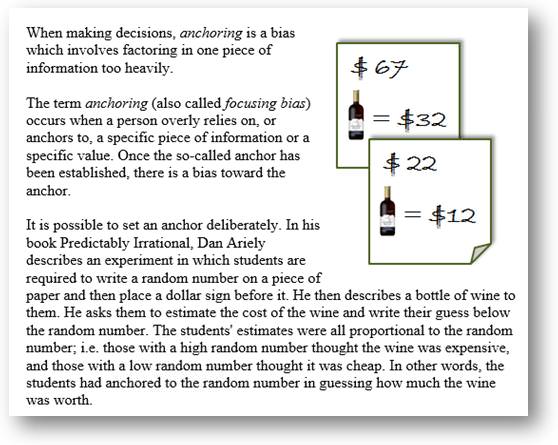

Academic studies suggest that the less known about the subject matter, the more prevalent the use of anchoring. In other words, the higher the level of guesswork involved, the more likely we are to employ anchoring, to use (even randomly generated) reference points to help us make a decision we have to make. It’s grasping for an ‘irrelevant crutch’. There is no wisdom in basing investment decisions on anything other than an estimate of current value.

When forecasters ‘herd’ together

On a related matter there is an interesting phenomenon in forecasting which says that the more uncertainty there is and the more difficult it is to forecast something, the more tightly grouped the forecasts tend to be. You would imagine the opposite but it seems that one of the biggest drivers for forecasters is the fear of getting it wrong, of standing out from the crowd alone ... and being wrong. This manifests itself in 'herding' in the face of heightened uncertainty. When something is difficult to forecast, the moment the first forecaster publishes their forecast, rather than reflect the wide range of uncertainty, others herd to the first forecast. This 'rallying to the flag' creates a tight forecast range which makes it even harder for other forecasters to 'go wide'.

Using anchoring in negotiations

Back to anchoring. Anchoring is also a tool for the smart negotiator.

The skill of the second hand car salesman, for instance, is to put down an anchor as quickly as possible that will then act as a standard for the rest of the negotiation. It is a technique used by flea market stall holders. As a buyer, the worst mistake is to feed into this process by asking the price (rookie error), you’re simply going to open the negotiation at the top price straight away.

A smart buyer will go in hard and early with their own anchor price point so the negotiation starts at the bottom rather than the top and it is the stall holder who has to pull it up, rather than you spending the rest of the negotiation trying to drag it down.

You see anchoring in the stock market all the time. Look out for anyone that starts their assessment of a stock with “It’s up X% from the low”, as they are clearly an amateur or lazy investor with no ‘intrinsic value’ reference point.

You’ll know if your trading is driven by anchoring if you are the sort of trader that buys stocks because they have fallen a lot. This is technically wrong anyway but also ignores the fact that the market’s assessment of the value of the company has been changing constantly for the worse.

Purchase price as the anchor point

The other very widespread use of anchoring is when traders use their purchase price as a reference point. “I’ll sell it if it goes up 10%” or “I’ll sell if it goes below my purchase price.” All very nice but not rational (although, in its defence, anything, even unscientific anchoring, is better than nothing when it comes to having some trading discipline).

The best way to avoid anchoring is to forget the past price as a reference point and simply assess ‘cheap or expensive’ on some other criteria (PE history perhaps, or price relative to an intrinsic value calculation would be more useful).

Meanwhile you can amuse yourself by listening out for anyone (you, perhaps) making comments or decisions on the basis that a stock is up X% or down Y%. Your sole focus is whether a stock is going up or not. Whether it’s gone up or not is irrelevant.

Marcus Padley is a stockbroker and founder of the Marcus Today share market newsletter. He has been advising institutional clients and a private client base for over 32 years. This article is for general education purposes only and does not address the personal circumstances of any individual.