In his excellent book, ‘Range. Why Generalists Triumph in a Generalist World’, David Epstein tells the story of the figlie del coro, literally, ‘daughters of the choir’ in Venice in the seventeenth century.

The all-female figlie dominated European music for a century, becoming famous celebrities and inspiring great composers like Vivaldi. Yet they had humble origins, with many beginning their lives as orphans.

So what was the secret behind the figlie’s remarkable musical success?

Versatility.

Unlike many musicians, the figlie didn’t specialize in one instrument. Instead, they learnt to sing and to play every instrument their institution owned. Some of the instruments the figlie learned are so obscure that today they remain completely unknown.

It was this extreme versatility, developed over many years, that gave the figlie a unique power: they could discover the essential concepts that underpinned, not just one instrument, but all instruments. The figlie didn’t master individual musical instruments, they mastered the abstraction of all musical instruments. This allowed them to effortlessly move between musical instruments, relying on useful generalisations, rather than instrument-specific techniques.

The value of versatility

This same ability can also be found in many of the world’s great investors – the ability to abstract away the specifics of a particular domain, leaving only the important underlying principles upon which great investments can be made.

Warren Buffett’s Berkshire Hathaway is a large conglomerate of many different kinds of businesses, from insurers, to rail, to utilities, to industrial manufacturers, retailers and even auto dealers. At the same time, Berkshire has a $US200 billion investment in tech giant Apple.

How is it that one man (or perhaps two, if we include his partner Charlie Munger) can build such an impressive portfolio of seemingly unrelated investments?

The same question could be asked of Jeff Bezos and Amazon. How could Bezos build such a disparate empire across retail, enterprise computing, consumer hardware, video and digital advertising?

Buffett and Bezos both have the unique skill of stripping away detail and get to core principles of successful investing and business building.

But they can only do that because they had years of diverse experiences that allows them to see the common principles that work across multiple domains.

And we see the benefits of multidisciplinary versatility not only in investing. Tennis great, Roger Federer, grew up skiing, wrestling, swimming, skateboarding, basketball, handball, table tennis, badminton and soccer. Federer has cited his diversity in experience and skill development as important drivers of his superior hand-eye coordination.

In a complex, ever-changing world, where domain-specific information is becoming commoditised and readily available, ‘multidisciplinary’ investing has become one of the true sources of an investment edge. Successful investments are often found at the intersection of multidisciplinary insights.

Investors need to not only develop their own multidisciplinary investment process, but also learn to identify managers who have the skills and structures that allow them to harness the power of multidisciplinary investing.

From specific to generalist investing

If investors are to develop the skill of converting domain-specific insights to general economic principles – and unlock successful investments at the intersection of multidisciplinary insights – they need to become ‘versatile’.

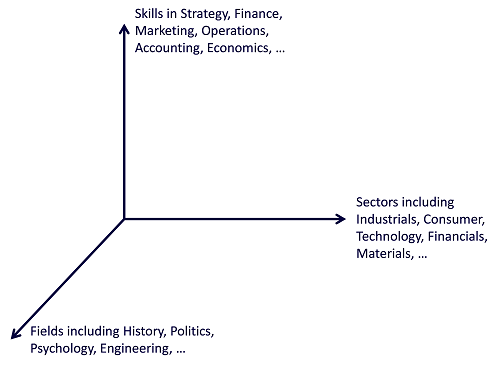

In the context of investing, we would define versatility as the ability to successfully employ a wide range of mental models to comfortably traverse along the unique dimensions of a set of multidisciplinary experiences, knowledge, and skills.

In his famous 1994 address to USC Business School, Charlie Munger shared his views on what he calls ‘Elementary Worldly Wisdom’ as it relates to investing.

“You’ve got to have models in your head. And you’ve got to array your experience – both vicarious and direct – on this latticework of models… And the models have to come from multiple disciplines – because all the wisdom of the world is not to be found in one little academic department.”

Munger goes on to stress the importance of mathematics, probability, accounting, engineering, psychology and building a deep understanding of human nature.

The common factor underpinning massive (unrelated) winners, Costco and Amazon

When investors become versatile across multiple domains, they become skilled at converting domain-specific insights into economic principles common to all domains.

Investing great, Nicholas Sleep, owned a long-term investment in Costco, the big box retailer. At the same time, he owned Amazon, the ecommerce and cloud computing hyperscaler. But his thesis for both investments was essentially the same.

Sleep abstracted away the specifics of the businesses – most of which were totally different – and saw powerful ‘flywheels’ that were gaining momentum and would be very difficult for competitors to overcome.

Sleep saw that both companies, Costco and Amazon, were building scale and sharing the benefits of those scale advantages with customers. This, in turn, drove customer growth and increased loyalty which, in turn, drove more scale.

Sleep’s many years spent developing multidisciplinary experiences and skills enabled him to convert the specifics of Costco and Amazon to the important underlying economics principle of a powerful ‘flywheel’.

Becoming a multidisciplinary fund

Despite the undoubted power of multidisciplinary investing, the investment industry is still largely built on the principle of specialization.

Most investment firms are structured as ‘pods of domain specialists’. An analyst covering banks, for example, has likely covered banks exclusively for the last decade and has little, if any, experience in other domains.

A multidisciplinary-based investment team looks quite different. They are typically characterised by:

- A team of generalists, rather than a team of specialists

- A relatively flat team structure that enables ‘cross-pollination’ of ideas and perspectives

- A team of individuals with diverse prior experiences; and

- Incentive structures that encourage group success over individual success.

That is exactly what we are seeking to do at .

Montaka’s investment team is structured in a way that seeks to emulate the multidisciplinary success of the investing greats. Each team member is a generalist from day one and covers businesses across multiple domains.

Multiple team members also overlap on the same industry – and even the same business. By bringing together multiple team member perspectives, and drawing on their multidimensional set of prior experiences, we increase the probability that we will uncover the important underlying economic principles that can lead to a substantial investment opportunity.

Unlocking the multidisciplinary magic

For three decades, NASA couldn’t predict solar particle storms. It was an important problem to solve because the radioactive material ejected from the sun can gravely damage astronauts and their equipment in space.

Yet, as Epstein points out in Range, the problem was solved in 2009, just six months after NASA decided to ‘crowdsource’ ideas for solutions from the general public.

A retired engineer from rural New Hampshire used a completely different methodology to rapidly solve a problem that stumped NASA’s smartest mathematicians.

Esptein’s core idea is that the magic happens – the true insights are generated -- at the intersection of multidisciplinary ideas and experiences. That is also true in investing.

Andrew Macken is Chief Investment Officer at Montaka Global Investments, a sponsor of Firstlinks. This article is general information and is based on an understanding of current legislation.

For more articles and papers from Montaka, click here.