Securitisation and the increased sophistication of the real estate industry have led to new ways to repackage property assets to create a broader menu of investment opportunities. However, the risk, return and liquidity attributes of these investments vary greatly.

This paper provides an overview of different real estate investment strategies based on three risk-return styles (core, value-added and opportunistic) and four quadrants of real estate investing, based on whether they are equity or debt and traded in the public (listed) or private markets.

Risk – return styles

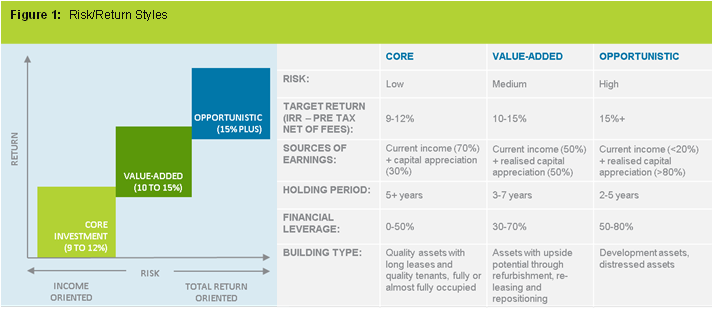

Figure 1 shows three key risk-return styles for real estate investing: core, value-added and opportunistic.

Core real estate investing is buying assets that are well located, leased to quality tenants and funded with modest levels of leverage. Such investments typically target 9%-12% p.a. total returns with the objective of providing investors with secure income plus modest capital appreciation. The income component typically represents a significant majority (circa 70%) of the expected total return. Examples of core investments include CBD office buildings, retail centres and industrial warehouses.

The ability to significantly enhance the value of core real estate is limited compared to value-added and opportunistic investment strategies. Core assets generally require little or no short-term capital expenditure other than normal repairs and maintenance.

However, core investing does not mean passive management. Active management of core assets can add value through initiatives such as improving lease profiles and reducing building operating costs. Core real estate tends to be held for the long-term, typically five years or more. Leverage is generally below 50%.

In recent years, real estate related social infrastructure such as child care centres, medical centres and student accommodation have increasingly been considered as legitimate core investments. There are both listed and unlisted real estate funds focusing specifically on these sectors such as the Folkestone Education Trust, the Generation Healthcare REIT and the unlisted Australian Unity Healthcare Fund.

Value-added investing engages in active strategies to create value in the underlying real estate investments through refurbishment, re-development or leasing-up of vacant space. A value-added strategy typically targets ‘secondary’ assets which for various reasons have depressed levels of income or the value has deteriorated over time relative to the broader market. Through hands on ‘active management’ there is a focus on increasing an asset’s income and hence capital value. Value-added real estate investments will therefore appeal to investors seeking enhanced returns in exchange for higher levels of asset operating risk. These investments target returns between 10%-15% p.a. and typically use modest to high levels of leverage of between 30% and 70%. They have a hold period of between three and seven years, although often at the shorter end, asthe successful execution of the strategy will depend on picking the right time in the real estate cycle to exploit the opportunity.

Opportunistic investing targets a range of higher risk strategies such as real estate development, highly leveraged financing or transactions involving ‘turnaround’ potential (often known as distressed investing), investments with complicated financial structures (including mezzanine debt) or emerging market investments. The focus is on capital appreciation, with the returns typically back-ended and achieved through a sale or completion of a development, often with little income along the way.

Such strategies usually use higher levels of leverage between 50% and 80% and typically target returns of 15% p.a. plus.

Opportunistic strategies require specialised investment and management expertise due to their complexity and to mitigate the higher risk. Investors tend to be sophisticated and well capitalised with a higher risk appetite than core or value-added investors. Opportunistic investing looks at relatively short-term hold periods, in many cases less than three years. The key is to expeditiously exit the investment as the strategy is executed and value maximised.

Value-added and opportunistic investing is not simply the use of high levels of leverage. They require careful analysis of the real estate cycle and market trends to take advantage of dislocations and mispricing in the market.

Four quadrant investing

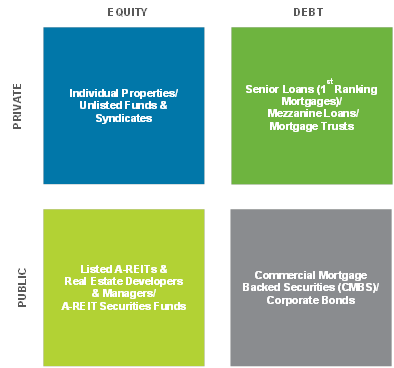

Four quadrant investing refers to the classification of real estate investing across four financial markets - public and private, debt and equity - as shown in Figure 2.

The most common forms of private market in Australia, other than directly owning a building, are unlisted real estate funds or unlisted syndicates which typically own one asset such as an office building or retail centre and have a fixed term of between five and seven years. These investments are traded in the private market, and between purchase and sale, values are derived from private valuations. Such assets are relatively illiquid compared with the public markets.

Public equity refers to investments in real estate investment trusts (A-REITs) or real estate companies whose securities or shares are traded on a stock exchange such as the ASX. The A-REIT market is the most liquid and transparent of the four quadrant markets, and currently comprises 50 A-REITs with a market capitalisation in excess of $97 billion. There are another 29 real estate-related securities that are classified by S&P/ASX as real estate managers and developers.

Private debt represents investments in direct real estate loans or in funds that hold mortgages on real estate, such as mortgage trusts. The loans maybe first mortgages (senior debt) or second ranking subordinated loans such as mezzanine loans. Typically, the investor or lender will receive periodic interest payments from the borrower and a security charge against the property in the form of a mortgage. At the end of the mortgage term, the investor or lender will receive the balance of the mortgage principal. This type of real estate investing is similar to investing in bonds that are held to maturity.

Public debt represents real estate debt instruments such as commercial mortgage back securities (CMBS) which are traded in the public market or unsecured debt (corporate bonds) issued by A-REITs and real estate companies. Access to investing in the public real estate debt market in Australia is almost exclusively limited to institutional or ‘wholesale’ investors.

The four quadrant model of investing emphasises the links between real estate and the capital markets. The income from each of these investments relies on the performance of the underlying real estate despite the fact that the pricing, the risk and the liquidity will depend on which part of the spectrum (debt or equity) the investment occurs and whether it is traded in the public or private market.

Conclusion

Whilst the menu of real estate investment opportunities has increased, not all investment styles and strategies across the four quadrants are suitable for all investors. Most investors in real estate will focus on core real estate strategies and will typically invest in the quadrant that best suits their liquidity requirements. If liquidity is an important factor, an investment in public equity such as A-REITs may be a more viable investment alternative than private real estate either directly or through an unlisted fund or syndicate.

Given the different markets and risk profiles, pricing anomalies in the short term may occur across the three investment styles and four quadrants. A more sophisticated investor may take advantage of these pricing arbitrages and move across the three styles or allocate between the four quadrants according to where they expect to achieve the best relative risk-adjusted returns at different points in the real estate cycle.

Adrian Harrington is Head of Funds Management at Folkestone, an ASX-listed (ASX Code: FLK) real estate funds manager and developer. Folkestone Funds Management offers real estate funds to private clients and select institutional investors.