Investing responsibly became mainstream in 2021. In 2022, we expect the discussion with clients to become more nuanced as understanding deepens and they look more broadly at the bigger picture.

Over recent years, many of our clients have incorporated responsible investing into their standard investment process. They focus not only on investing in companies that engage in environmentally and socially irresponsible practices but also against those which display poor corporate behaviour.

Until recently, this would have been achieved through excluding companies from portfolios altogether on the basis of their involvement in certain industries, such as gambling, alcohol, tobacco, thermal coal and firearms. However, such a simplistic approach to investing does not integrate appropriate financial analysis of future growth prospects and risk into the investment decision.

To overcome these limitations, investment portfolio construction incorporates ESG (environmental, social, and governance) integration.

In its broadest sense, ESG integration is the analysis of all material factors in investment analysis and investment decisions, including ESG factors. We can identify companies that are leading or lagging in their industry or sector to pinpoint significant risks relevant to the company or industry. In this way, we minimise investing in those companies whose ESG policies and practices expose them to unacceptable levels of risk.

Examples of possible ESG issues to consider

Environmental factors

- Positive outcomes might include avoiding or minimising environmental liabilities, lowering costs and increasing profitability through achieving energy and other efficiencies, reducing regulatory, legislation or reputational risk.

- Negative impact would include polluting or degrading the environment, adding to atmospheric carbon levels, threatening a region’s biodiversity or cultural heritage or risks associated with climate change, reduced air quality and/or water scarcity.

Social factors

- Social positive outcomes could include increasing employee productivity and morale, reducing staff turnover and absenteeism and improving brand loyalty.

- Negative issues might include sub-standard conditions for production employees in third world countries, aiding human conflict, facilitating crime or corruption, poor product integrity, inadequate health and safety issues for employees’ customers or suppliers, harming the local community, or risks associated with large-scale pandemics or shortages of food, water or shelter.

Governance factors

- Positive outcomes would include aligning the mutual interests of shareholders and management, improving timely disclosures, and the avoidance of unpleasant surprises.

- Negative connotations such as the way companies are run, lack of board independence and diversity, weak corporate risk management, poor corporate culture, excessive executive remuneration, inadequate product/market diversification, ineffective community engagement.

Thinking big: aligning investment outcomes to the UN’s Sustainable Development Goals

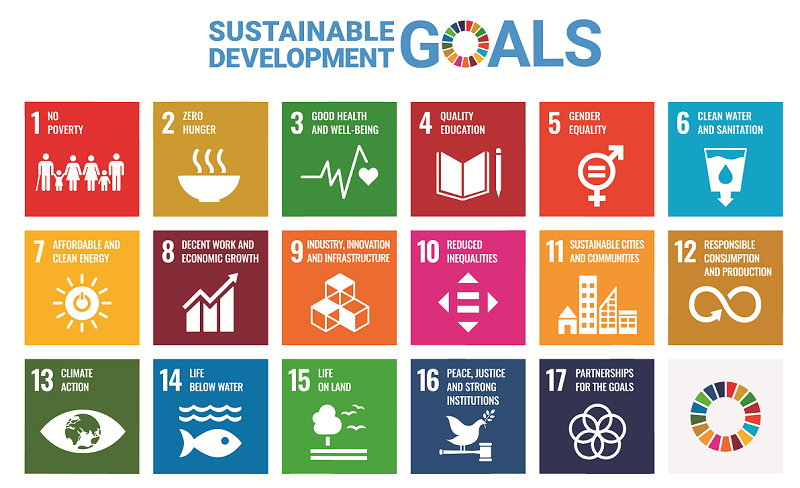

The Sustainable Development Goals (SDG) were set up in 2015 by the United Nations General Assembly and were aimed at creating a better world for all by 2030. We are now six years on, and the SDGs have become the blueprint to achieve a better and more sustainable future for all. They address the global challenges we face, including poverty, inequality, climate change, environmental degradation, peace and justice.

The 17 goals and 169 targets fall into three categories: economic, social and environmental development and provide a good framework to assess an ESG investment portfolio.

Each SDG represents a risk that is presenting challenges to businesses and society and these risks are likely to only continue to grow if not addressed.

Here are two examples of how investors can use SDGs in portfolio construction:

1. Impact of product and services

Mining is without doubt a controversial topic. However, it is important to take a closer look at what is actually being extracted before making a blanket exclusion on all mining companies.

Take coal for example. Access to electricity is important to transform the world, particularly in developing nations, however fossil fuels are responsible for approximately 40% of global carbon emissions, with almost two thirds of these emission from coal. If our view is that the use of coal detracts from SDG 13, climate action, we can exclude companies that have a meaningful exposure to extraction or use of coal from our portfolio.

However, where does that leave you for SDG7, affordable and clean energy? To expand energy access, it is crucial to enhance energy efficiency and invest in renewable energy. Electrification of the grid and transport require materials. Lithium, cobalt and nickel are the most commonly used metals in creating electric batteries. These metals are limited in supply and will be required as the world looks to decarbonize.

The resources and material sector will be essential in delivering the necessary materials to enable the transformation which is critical to reducing carbon emissions. The investment implications of the world’s decarbonisation program are enormous. As many countries and corporations committing to net zero carbon emissions targets by 2050, a massive transformation will be required to attain them. These will play out over decades.

2. Companies engaged in controversy

SDGs provide a means for identifying and then mitigating risks through identify issues to address during our corporate due diligence process.

Corporate scandals can have significant financial repercussions ranging from legal penalties to consumer boycotts. These incidents damage the reputation of both the companies themselves and their shareholders.

We have a framework that considers the severity of incidents, the corporation’s accountability and whether they form part of a pattern of corporate misconduct. We utilise Controversies Research to support investment decisions, including screening and engagement, and to manage reputational risks.

All of this can be compiled into a forward-looking assessment of how controversies are likely to evolve over the next 12 to 24 months. For example, a company that has demonstrated that it has an increase in adverse employee incidents would be concerning for SDG 8, 'Decent work and economic growth', and could potentially change our long-term outlook on the company.

Returns matter but so do values

Regulators, companies, fund managers and investors are being encouraged to recognise the relevance of incorporating ESG factors to enhance corporate transparency and performance, and the measurement of risk. The availability of increasing amounts of ESG data is allowing investors to incorporate these strategies into portfolio construction.

Effective ESG portfolios will include thematic investments which contribute to social or environmental challenges by investing in companies offering solutions to these issues. For example, a fund manager investing with purpose may include social housing in a property fund.

While we maintain a strong focus on delivering strong financial performance, we are not looking to achieve outperformance relative to our conventional portfolios, more so to provide our clients with an alternate investment solution without comprising on returns.

Lisa de Franck is Investment and Advice Manager at financial services firm Crystal Wealth Partners. This article is for general information purposes only and does not consider any person’s objectives, financial situation or needs, and because of that, reliance should not be placed on this information as the basis for making an investment, financial or other decision.