From 1 October 2021 rollovers to and from SMSFs can only be processed via SuperStream.

Overview

SuperStream is the electronic system used to transfer money and data to super funds and is used to process employer contributions to APRA-regulated funds and for rollovers between super funds. It can also be used for certain ATO release authorities.

The move to include SMSFs in SuperStream rollovers has been welcomed by many SMSF fund members who have experienced delays in receiving rollovers to SMSFs. The SuperStream protocols require paying funds to process the rollover of a member’s benefit electronically and within three days of receiving a valid request.

Many SMSFs have mature members who are not anticipating receiving any further rollovers so they have paid little attention to the SuperStream requirements. However, if members decide to wind up their SMSF and rollover to a retail fund, they will generally need to register for SuperStream before the SMSF can process the rollover. SuperStream, however, can be activated at any time and can be expected to be established within days.

In-specie rollovers are not covered by SuperStream and may continue to experience delays. Members may also initiate a rollover via their MyGov account or by requesting the rollover from the paying fund.

ASIC’s requirement for an SMSF’s investment strategy to consider an exit strategy may require SMSF trustees to consider SuperStream as part of their next regular investment strategy review.

What is required for an SMSF to be SuperStream ready?

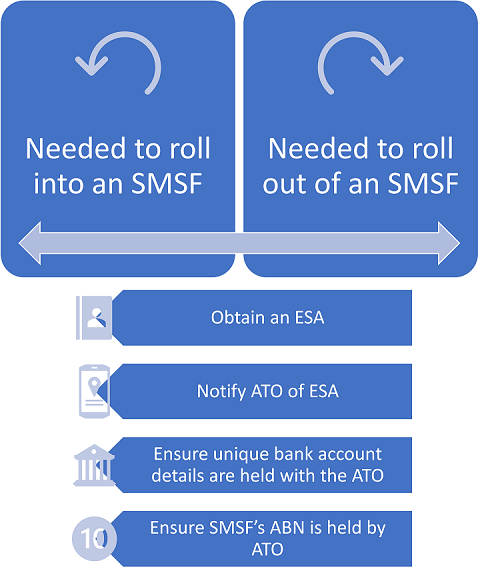

Most professional administrators are SuperStream ready, and many have been using SuperStream to process rollovers for some time. Where an SMSF doesn’t use professional administration services they will need the following:

- An electronic service address (ESA) which is provided by most SMSF software platforms, administrators, tax agents and some third-party suppliers. The ATO provide a list of ESA suppliers on their website - ATO ESA providers

- A unique bank account recorded with the ATO

- A Unique Superannuation Identifier (USI) which is the fund’s Australian Business Number (ABN)

Verifying member details

The fund that is paying a rollover is also required to use the ATO’s electronic services to verify the SMSF and member details. Details include that:

- the SMSF status is complying or regulated

- the TFN of the member requesting the rollover is associated with the SMSF

- the SMSF bank details are held by the ATO

- the SMSF’s ESA is held by the ATO

The process should reduce delays in verifying the bone fides of the receiving SMSF - if the ATO is happy, the paying fund should be happy!

The ATO has been active in identifying SMSFs where the fund is not recorded as holding a unique bank account. If an SMSF changes bank account details, the fund will need to advise the ATO of the updated account details.

Processing a rollover

The paying fund has three days from receiving an actionable rollover request to process the payment. If the rollover request has incomplete information, the trustee of the paying fund must request the required information within three days. Additional time may be allowed if the paying fund needs to sell down assets.

Whilst the prompt receipt of rollovers into SMSFs is welcomed, there may be many practical reasons why an SMSF is not able to action a request to rollover to another fund within the three-day timeframe. In the absence of professional administration, it is not always possible to accurately calculate a member’s entitlement within three days. In addition, the sale of assets to make the cash payment may take longer than the time allowed.

Where one member is leaving because of a dispute with another member, further difficulties in meeting the required timeframes may occur.

Another requirement of the SuperStream system is that the trustee of the receiving fund must allocate the rollover to the member’s account within three days of receipt of the funds. For SMSFs without professional administration, a minute regarding the allocation may be required.

Conclusion

SMSFs expecting to receive member benefits rolled over from another fund will need to ensure they are registered for SuperStream prior to the member requesting the rollover. Likewise, registration will be required before an SMSF trustee can rollover a member benefit to another fund.

Julie Steed is Senior Technical Services Manager a Australian Executor Trustees. This article is in the nature of general information and does not consider the circumstances of any individual.