Japanese passenger rail volumes remain solid with the Rugby World Cup and Tokyo Olympics providing continued support. Japan’s proposed 500km/h Maglev train between Tokyo and Osaka represents another example of the country’s world leading infrastructure. Gas utilities in Japan face growing competition but we believe market concerns are overdone and value is there for patient investors. We invest in Japan today for its quality infrastructure assets, attractive valuations, under geared balance sheets and increasing focus on shareholder returns.

Japan never ceases to impress

I recently returned from a trip to Japan where I met with more than 20 infrastructure companies including passenger rails, airports, gas and electric utilities and renewable energy companies. I also spent time with government officials, customers and suppliers to gain additional perspectives on these companies’ businesses.

I have been travelling to Japan for many years now. The country never ceases to impress. The food, the people, the language, the cleanliness, the bright lights and shops, the enduring traditions and unique culture.

Japan enjoys some of the most advanced and well-maintained infrastructure on the planet (ranking 5th out of 140 countries in the 2018 World Economic Forum Global Competitiveness Report). The country is famous for its high-speed bullet trains ('shinkansen'), which have been serving the country for more than 50 years and are renowned for their blistering speed and ‘to the second’ punctual service.

The country’s aging and declining population represents a structural headwind that puts pressure on corporate earnings. Many Japanese companies have been forced to look overseas for growth, and the country is enthusiastically embracing tourism.

This trip reinforced my view that Japan is now increasingly opening itself up to the world. Where once it was rare to hear any language other than Japanese spoken on the street, now it happens constantly.

Japanese Rail: nobody does it better

Japan’s passenger rail network is the busiest in the world, carrying almost 30% of global rail passengers, more than all of Europe combined.

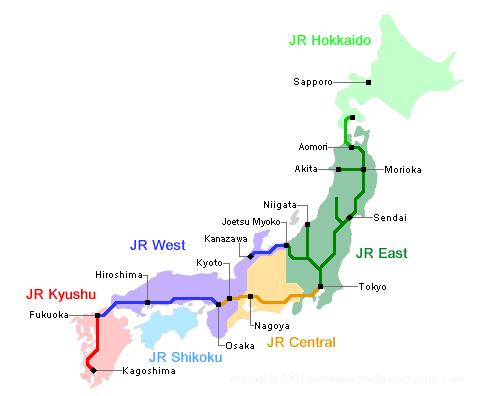

Map of Japan’s Passenger Rail Network

Source: Japan Rail Guide

Source: Japan Rail Guide

Japan’s rail network was privatised in 1987 when six passenger rail companies were created with JR East, JR Central and JR West being the three largest. We like Japanese passenger rail companies for their high barriers to entry, strong free cash flow and predictable earnings.

JR Central is the owner and operator of the world’s busiest high-speed railway line today. Every year, JR Central transports more than 150 million people along the 515km route between Tokyo and Osaka. This train line is a cash cow for the company producing over Y1 trillion yen ($US900 million) in revenue per year.

In 2014, JR Central started construction on a Y9 trillion (US$84 billion) Maglev project. At over 500km/h, it will be the fastest bullet train in the world with a speed almost twice that of the current shinkansen.

The first part of the project will connect Shinagawa Station in Tokyo to Nagoya in 2027 and will cover the distance of 286km in 40 minutes (instead of 86 minutes today). Over 85% of the line will be underground passing under urban cities and mountainous terrain. The line will then be extended by 153km to Osaka with plans for this to be open by 2037. Once complete, commuters will be able to travel from Tokyo to Osaka in just 67 minutes, rather than the 142 minutes it takes today.

Some days you really love your job

Whilst in Japan, I attended the JR Central Investor day. The highlight of the day (in fact the year …) was an opportunity to take a test ride on the 42km track which has been constructed to test their new driverless Maglev trains.

Japanese companies have been slow to adopt corporate governance best practice but they are moving in the right direction. This investor day was another example of the improvements being made.

Excitement had been building all week at the prospect of travelling on what will be the fastest train in the world (by some margin) when it opens in 2027. I had assured my wife that it was safe and my kids that I would take plenty of photos and videos. It did not disappoint.

The train quickly accelerates with superconducting magnets and propulsion coils pushing the train forward. At around 150km/h, the train suddenly levitates 10cm off the ground and the ride becomes smooth. As the speed increases, the stability increases. Managements view is there is no risk of derailment, an important consideration in such an earthquake prone country.

Within a minute, we were travelling over 400km/h. It was at this stage that the noise started to increase. I would compare it to the noise you might hear when flying at altitude on an aeroplane. The company is aware of this issue and is confident they can reduce this noise ahead of the opening in 2027.

We eventually reached a speed of 500km/h, faster than any train on the planet (the fastest train in the world today is in China at around 420km/h). We stayed at this speed for over 2 minutes, an experience I will never forget.

JR Central’s share price has materially underperformed the index and its peers over the last six months on concerns the Maglev project may come in late and over budget. Spending the day with management gave me confidence that these investor concerns look overdone and that at below 10x PE these risks are reflected in the company’s current valuation multiples.

Growth optionality in property for JR East

JR East, the largest of the JR companies, carries more than 6.5 billion (yes billion) passengers per year on its 12,300 trains. For context, Amtrak, the largest passenger rail network in the US, carries just 31 million passengers per year. JR East services the Greater Tokyo region and its population of over 35 million people. Tokyo remains the one area in Japan where the population continues to grow each year.

Whilst in Tokyo, I was given a 1-on-1 tour of JR East’s Y500 billion (US$4.6 billion) Shinagawa redevelopment project. Shinagawa is the last major land parcel to be developed in Greater Tokyo. The redevelopment site covers almost 14 hectares and will include seven new buildings (scheduled to open between 2024 and 2027) plus a new railway station (Takanawa Gateway Station) that will open in time for the Tokyo Olympics.

Digital image of the new Takanawa Gateway Station and three of the seven new Shinagawa buildings

Source: JR East

Shinagawa is located just 12 minutes from Haneda International Airport and will be the location of JR Central’s Maglev Shinagawa station, which is due to open in 2027. At 8x EV/EBITDA and 1.2x Price/Book, I believe the market is underestimating the value of JR East’s property assets and that the stock will re-rate in the coming years as investors realise the growth optionality offered by this and other redevelopment projects.

Inbound tourism playing out for JR West

We started investing in JR West mid 2018 following a period of material stock price underperformance. The market was concerned about structural headwinds for their commuter train network and volumes had been weak on their shinkansen network. But on the ground due diligence and a close monitoring of inbound tourism numbers confirmed that a strong tourism story was playing out in Japan, in particular in the Kansai region. JR West owns much of the passenger rail network in this region and is well positioned to benefit from an increase in tourist numbers.

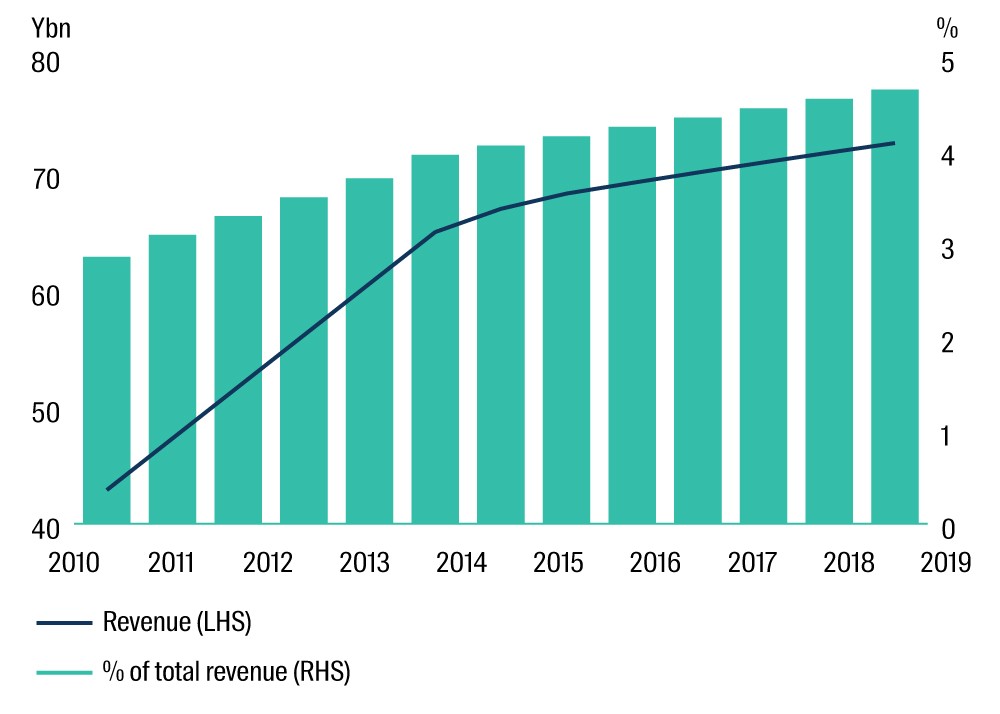

JR West – Inbound tourist revenue (as % total revenue)

Source: First Sentier Investments, Company reports.

We invested in JR West for its attractive valuation, underleveraged balance sheet, increased focus on shareholder returns and inbound tourism story. The stock has rebounded considerably in the last 12 months causing us to trim our position in recent months.

In-bound tourism story to continue

Whilst in Osaka, I was also given a tour of Yumeshima Island precinct. Yumeshima is an artificial island, which once complete will cover an area of 390 hectares. It will be the venue for the Osaka 2025 World Expo and is the proposed venue for Osaka’s Integrated Resorts bid later this year. Japan is looking to follow the example of Singapore and Macau in opening its first Integrated Resort – large-scale entertainment complexes that combine casinos with hotels, restaurants, conference centres and retail spaces. Three venues are likely to be chosen, with Osaka and Yokohama (near Tokyo) the two favoured cities.

Spending time with Osaka government officials and seeing the development taking place (over 90% of the island has already been reclaimed) confirmed the strong inbound tourism story that is likely to continue in Japan for many years to come.

Japan’s energy reliance

A country with limited natural resources, Japan imports over 90% of its energy needs. As it recovered from World War II and its economy rapidly expanded, it became hugely dependent on fossil fuel imports, notably oil from the Middle East. The oil crisis of 1973 brought this commodity reliance into focus and the country shifted its energy policy rapidly towards nuclear. By 2010, nuclear made up 30% of the energy mix with forecasts for it to reach 50% by 2030.

In March 2011, an earthquake and tsunami caused widespread devastation on Japan’s east coast, including a meltdown at the Fukushima Daiichi Nuclear Power Plant. This event changed Japan’s energy future forever. Japan had 54 nuclear reactors operating at the time but within a year, this had been reduced to zero. Today, more than eight years later, just nine nuclear reactors have reopened. Nuclear power remains a deeply contentious issue within Japan with many people opposed to their reopening.

Nuclear can play an important role in producing low carbon emitting electricity. We just think it is too risky when positioned on perhaps the most earthquake prone country on the planet. We screen out the Japanese electric utilities from our 'core infrastructure' universe owing to their highly volatile earnings and reliance on nuclear energy to generate power.

Liberalisation of gas and electricity markets

Japan’s gas retail market was liberalised in April 2017, allowing new entrants to enter a market previously dominated by the big three city gas suppliers - Tokyo Gas, Osaka Gas and Toho Gas. It followed the liberalisation of Japan’s electricity market a year prior. Gas companies are now free to enter the electricity market, and vice versa.

Tokyo Gas confirmed that competition remains keen in the Tokyo region with electricity provider Tokyo Electric Power (TEPCO) winning 80% of the 1.1 million gas customers lost to date. However, Tokyo Gas has been able to offset lost gas customers with a larger increase in new electricity customers. Tokyo Gas is targeting 2.4 million electricity customers this year, which they look likely to achieve. We believe the market has over reacted to competition concerns and that Tokyo Gas are well positioned to increase its net customer numbers over coming years. The company has a strong balance sheet, and has been increasing its dividend and buying back stock in recent years.

Competition has been even fiercer in the Kansai region in which Osaka Gas operates. Electricity provider Kansai Electric Power (KEPCO) have led a very aggressive marketing and pricing campaign to win new customers. Whilst this strategy has won them new customers, they continue to lose money in their gas business. I met with KEPCO at their Osaka head office where management confirmed a recent change of strategy, with a focus on profits not volumes going forward. This change should benefit competitor Osaka Gas in the near term.

Similar to Tokyo Gas, we think the market has overreacted to competition concerns and that Osaka Gas remains well placed to grow earnings from current levels, particularly with overseas projects such as Freeport LNG in the US coming online this year.

Osaka Gas: safety first

Whilst in Osaka, I did a tour of Osaka Gas’s largest Liquefied Natural Gas (LNG) Terminal. The Senboku LNG Terminals are located 40 minutes south of Osaka City. They account for 70% of Osaka Gas’s overall gas supply and 7% of Japan’s total gas supply. Whilst the terminals are clearly aging (Terminal 1 was built in 1971 and Terminal 2 in 1977), what stood out was the huge emphasis placed on safety.

It was interesting to see the additional safety measures that were put in place post the Fukushima disaster in 2011. Whilst that earthquake did not hit this region, tsunami barrier walls have been built around key units, and all vehicles are now kept in secured areas that are fenced off from key facilities and equipment (to avoid them crashing into units in the event of a tsunami).

Conclusion

Japan is easy to travel around – online ticket bookings, signs in English, fast and efficient infrastructure - and the country is opening itself up to the world like never before.

Investors have historically been frustrated by Japan’s poor corporate governance and structurally challenged demographics. However, for long-term investors, Japan provides a way of gaining exposure to high quality infrastructure assets trading at attractive multiples.

We invest in Japan today for its quality infrastructure assets, attractive valuations, under geared balance sheets and increased focus on shareholder returns. Our strategy is overweight Japan via holdings in key assets such as JR East, JR Central, Tokyo Gas & Osaka Gas.

Trent Koch is a Portfolio Manager at First Sentier Investors (Australia) Ltd, a sponsor of Firstlinks. This material contains general information only. It is not intended to provide you with financial product advice and does not take into account your objectives, financial situation or needs.

For more articles and papers from First Sentier Investors and CFSGAM, please click here.