The age pension has recently gone up because of the rising cost of living. It’s great to see the increase but along with keeping on top of rising costs, there are now additional challenges and opportunities.

It’s also worth thinking about how the pension increase changes how much you could borrow against the equity in your own home via the federal government’s reverse mortgage scheme.

Here’s our guide on how the changes could impact you.

Which retiree are you?

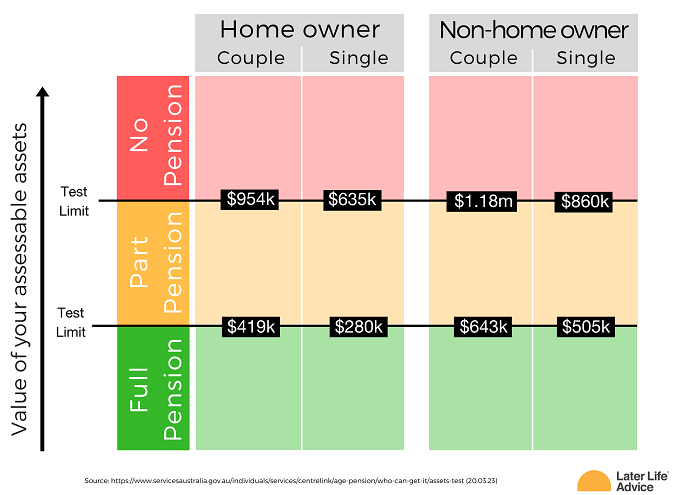

All age pension eligible Australians fit into a category based on their assets, their relationship status, and whether they have a home or not. In the table below, a green band means full rate pension, red means no pension at all, and like a traffic light, amber is somewhere in-between.

Recent changes in the age pension mean you may have changed category and if this is the case, you may have work to do. Where do you fit in?

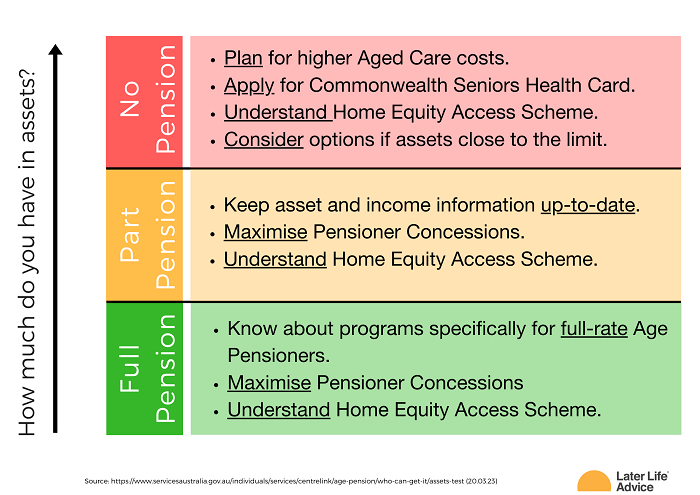

What should you be doing now?

Below is our action plan. It all depends on what type of pensioner you are, but many people should consider making the best of the changes.

Check if you are a full-rate pensioner

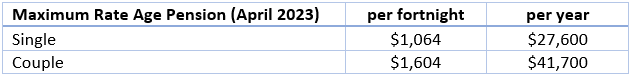

Check your fortnightly pension to make sure you are receiving the maximum. If you think you are a full-rate age pensioner, and you are not getting the full-rate in the table below, you may need to update information held with Services Australia.

Part-pensioners: make sure your information is up-to-date

If your rate of pension is less than the rates in the table above, you are a ‘part-pensioner’. The assessable assets reduce the amount of age pension you get by a formula. For every $10,000 worth of assets over a set limit, pensions are reduced by $780 per year.

It's worth checking that the correct value is on file for your car or caravan (current value not new), and any changes in the value of your savings and investments.

More people can get the age pension and the Pensioner Concession Card

The upper limit for someone to receive a part pension (i.e., to not be assessed to get the full rate, but any amount greater than zero) is now higher.

This is good news for people close to the limits who have been eyeing off the benefits of having a Pensioner Concession Card, as this can be much higher than the actual amount of age pension received.

Every age pensioner receives a Pensioner Concession Card.

You can now borrow more with the Home Equity Access Scheme

Homeowners can borrow against their property using a government-run reverse mortgage scheme known as the Home Equity Access Scheme.

The amount you can borrow is linked to the maximum rate of the age pension, so the recent increase means the amount that can be borrowed has also increased.

It is government run, and at 3.95 %, the current interest rate sits well below other reverse mortgage rates in the market. Of course, this could change, but for now the scheme looks attractive.

You can access the loan even if your income and assets mean you are not eligible for an age pension. This can be useful if your assets don't generate enough income.

Aged care costs are increasing

The rules around aged care are complex, and the impacted of the pension changes on you will depend on your financial situation and the aged care decisions you make.

With higher cost of living comes higher interest rates, and these rates are part of the cost of aged care. The cost of paying for residential aged care accommodation by a daily payment instead of a lump sum has become more expensive.

Furthermore, the daily fee all residents pay is based on the rate of age pension. So that has gone up too.

There’s no need to worry or panic about these changes. But it is important to understand how they impact on your situation, for better or worse.

Brendan Ryan is a financial adviser and Founder of Later Life Advice. This article is for general information purposes only and does not consider the circumstances of any person. To find out more about your action plan visit our website.