In 1789 Benjamin Franklin wrote in a letter that “nothing is certain except for death and taxes”. Over 200 years later, the certainty of death and taxes remains true, and in superannuation, the connection between death and taxes is significant. Many individuals are rethinking their superannuation strategies in light of proposed changes to the taxation of large balances, prompting renewed focus on estate planning. This has been a catalyst for many super fund members to bring to the forefront the issues of wealth transfer on death.

In this article we will review the taxes payable on superannuation death benefits and consider investment alternatives.

Taxation of death benefits

Where a member has tax dependants, such as a spouse or minor children, any death benefit will be tax free. However, if a benefit is expected to be received by adult children, the tax consequences can be significant. A non-tax dependant adult child is not eligible to receive a death benefit as a pension and any benefit must be paid as soon as practicable as a lump sum.

Taxation of lump sum benefits

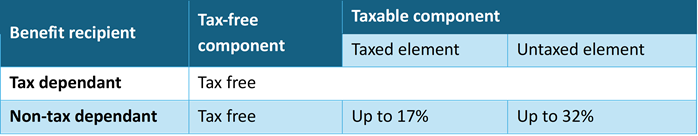

The taxation of lump sum benefits is summarised as follows:

The above rates are maximum tax rates and include the Medicare levy.

An untaxed element arises if a benefit is paid from a constitutionally protected fund (typically state Government funds) or if a tax deduction has been claimed for death benefit insurance premiums for members who are under 65. Most mature fund members don’t have an untaxed element and 17% is the most common tax rate on the taxable component.

Taxation of lump sum benefits paid to non-tax dependants

Where a fund pays a death benefit directly to a non-tax dependant, the fund must withhold tax at 17% of the taxable component - taxed element and 32% of the taxable component – untaxed element. The taxable component is added to the non-tax dependant’s assessable income and a credit is applied for the tax withheld by the super fund. Whilst the tax rates cannot exceed the relevant 17% or 32%, if the benefit recipient’s tax liability is below 17% / 32% they may receive a tax refund.

Other impacts on income

The additional income may cause a non-tax dependant to lose some Government benefits or concessions that are based on assessable or taxable income, as the death benefit increases their income (even though maximum rates of tax applies). Examples include Family Tax Benefit, Government co-contributions, HECS-HELP student debt or the low-income tax offset. In addition, the taxable component is added to income for the purpose of Division 293 tax, the additional 15% tax on super contributions.

Re-contribution strategies

Individuals can use a withdrawal and recontribution strategy to maximise the tax-free component which may minimise the tax payable if a death benefit is paid to an adult child. This involves clients over age 60 making a tax-free withdrawal and recontributing amounts. The strategy reduces the taxable component of a benefit and increases the tax-free component.

However, for members who have a total super balance at 30 June 2025 which is above $2 million, their non-concessional contribution cap is zero meaning they can’t take advantage of a recontribution strategy.

Superannuation alternatives

Taking money out of super may come at the cost of giving up the tax concessions available in super, even if additional taxes are levied on higher balances.

The main alternatives to superannuation for wealth accumulation and transfer of wealth on death include:

- Investment bonds

- Family trusts

- Companies

- Personally held investments

One of the things that many financial professionals and individuals appreciate about these four structures over superannuation is that the tax treatment and legislative framework governing them changes infrequently. This provides greater certainty in future financial planning. A brief summary of each option is provided below.

Investment bonds

Investment bonds provide fully tax paid investments after 10 years, or upon earlier death.

A beneficiary can be nominated to receive the proceeds upon the bond owner’s death. They have the advantage over super that they are not subject to death benefit nominations and can’t be disputed as these are insurance contracts and therefore have certainty over the nominated beneficiary.

One downside is that there is no 50% CGT discount on asset sales by the life insurance company but for many who have more conservative investment strategies, this may not make a material difference.

Bonds are not complex in their ownership structure and unlike family trusts, companies and personally held investments, they don’t require additional accounting and tax administration.

Family trusts

Family trusts can be an effective alternative to super as they can offer wealth transfer that may provide additional tax efficiencies, for example splitting income between ultimate beneficiaries and their family members.

They can also offer asset protection from potential bankruptcy and relationship breakdown.

Companies

Companies offer a flat tax structure of 25% to 30% depending on the size and structure of the company. They also have the advantage of being able to retain and reinvest earnings.

Personally held investments

The investment returns on personally held investments will be taxed at the individual’s marginal tax rate which may be higher than the concessional superannuation tax rate. The capital gains tax discount of 50% applies to assets held for at least 12 months. However, assets can be transferred to non-tax dependants with the option of the individual and the beneficiaries managing capital gains tax.

Case study – Andrea

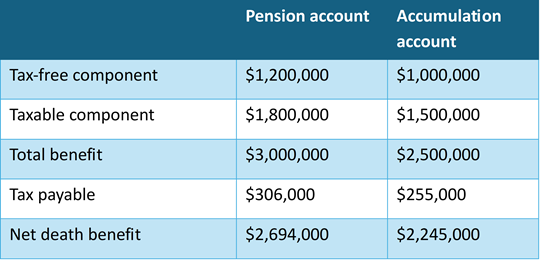

Andrea is age 72, single and has one adult son. Andrea has $5.5 million in super, $3 million in pension phase and $2.5 million in an accumulation account. Both of her accounts are 40% tax free component and 60% taxable component.

If Andrea dies, her son will pay the following tax if he receives the benefits directly from her super fund:

This results in total death benefit tax of $561,000, a net death benefit of $4,939,000.

If Andrea withdrew her superannuation and invested in an insurance bond, her son would not pay any super death tax. Andrea would have a lower tax concession on her investment income but may be prepared to forego this in order to save her son $561,000 in tax.

Conclusion

Potential changes to superannuation law may be a timely reminder to review superannuation estate planning objectives. Speak to your financial adviser to explore whether alternatives such as investment bonds or family trusts could provide a more tax effective outcome for your family unit.

Julie Steed is a Senior Technical Services Manager at MLC TechConnect. This article provides general information only and does not consider the circumstances of any individual.