We start the new year with some previous highlights. Chris Cuffe has selected his favourite articles from 2019, and our free ebook collates 30 of my interviews with leading global and local financial markets experts.

Who picked it in 2019?

Hardly anyone expected the massive 2019 equity market rally, and showing the difficulty of the forecasting game, consider the top three stockmarkets for 2019. First, Russia up 39%, despite US sanctions and illiquid markets. Second, Greece up 38%, subject to an IMF bailout amid a financial crisis a few years ago, when we were told nobody pays their taxes. Third, Ireland up 25%, with its exposure to Brexit and EU doubts. So much for investors hating uncertainty and geopolitical risks. The best commodity was palladium and the strongest currency among 130 tracked by Bloomberg was the Ukrainian hryvnia. Who knew? We have White Papers on 2020 outlooks here and here for those planning their portfolios for the new year.

30 interviews with investing experts from around the world

Even after my four decades in this business, these chats were full of new discoveries. For example, it was fascinating to meet a few times in California with Nobel Laureate, Harry Markowitz, the father of Modern Portfolio Theory. He was the first to specify assembling a portfolio based on maximising expected returns from assets for a given level of risk. He described to me his 'moment of truth', the time he went 'aha!'.

Article highlights from 2019

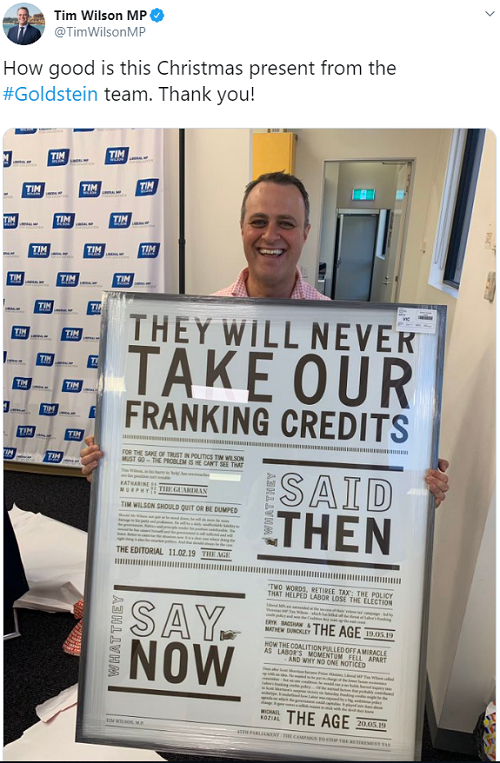

On Chris's selections, the leading subject in the first half of the year was Labor's franking credits policy, which generated over a thousand responses across many articles. The Coalition is still savouring its win on this policy (Goldstein is Tim Wilson's electorate):

Chris mainly focusses on articles which raised issues we will continue to debate in coming years. In addition to these 2019 highlights and the ebook, Lex Hall provides a selection of summer reading for those relaxing over January, as well as a short video on 2019 highlights and 2020 prospects. Plus for anyone who missed two popular articles, we rerun the OK Boomer 'fess up' and the summary of the fruitless search for yield without risk.

Graham Hand, Managing Editor

For a PDF version of Chris Cuffe's favourite articles from 2019, click here.