The majority of investors hold a diversified portfolio no more than half invested in equities. The share exposure often declines with age as retirees seek capital preservation, and even young people place their super in balanced funds. Delight in the noisy 'all-time highs' is far from universal, with millions of Australians missing the big gains. Stockmarket analysts live in a blinkered world of screens focussed on share investments, as one told AAP this week:

"The local bourse is on fire and then some! It's a thing of beauty and local investors are pleased as punch. Australia is historically a bit of a laggard compared to our US counterparts but we're mixing it up with the big boys at the moment."

Better to ignore the bluster and consider the words of Howard Marks in 2013:

"Another mistake that people often make is that they compare themselves with others who are making more money than they are and conclude that they should emulate the others’ actions ... after they’ve worked. This is the source of the herd behaviour that so often gets them into trouble. We're all human and so we’re subject to these influences, but we mustn’t succumb. This is why the best investors are quite cold-blooded in their professional activities ...

Too little scepticism and too much eagerness in an up-market – just like too much resistance and pessimism in a down-market – can be very bad for investment results."

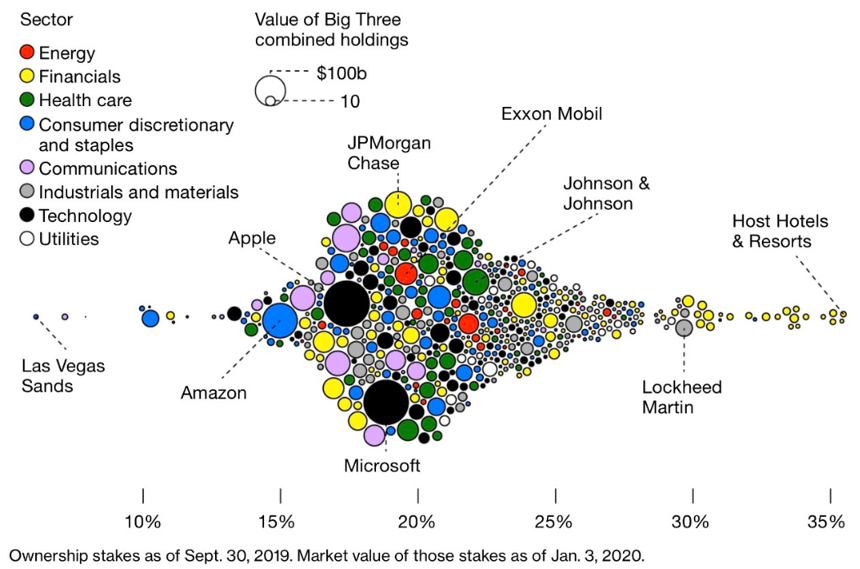

The biggest investment news last week was the world's largest investor, BlackRock, moving away from thermal coal and making sustainable investing a new priority. As a major index provider under the iShares banner, it's a massive issue because the Big 3 index providers (BlackRock, Vanguard and State Street) now own on average 22% of a typical S&P500 company. The table below shows they own 18% of Apple, around 20% of US banks and up to 35% of some companies. Their actions will influence hundreds of companies, often behind closed doors.

Data compiled by Bloomberg.

Social trends guide investment results, and David James provides a detailed review of Australian demographics. The ageing and composition of our population point to both opportunities and traps. He explores our role in Asia, and on the same tack, Glenn Freeman reports on three large Australian companies whose fortunes depend on China.

Ashley Owen's amazing database demonstrates how much Australian shares have delivered in a diversified portfolio, and he reveals the four components that make up sharemarket returns. What drives your portfolio's performance? Then Richard Dinham shows why investing during retirement differs from saving in the earlier accumulation phase.

The selling fee debate on LICs and LITs shows no signs of abating, with Christopher Joye writing in The Australian Financial Review, " ...conflicted selling fees could determine the fate of the advice industry and the Treasurer's political future." Wow, there are 25,000 financial advisers out there that millions of Australians rely on. In a more sober assessment, Jonathan Rochford identifies three vital points everyone is missing, and I agree with him.

Olivia Long then provides guidance on early access to super for victims of the bushfires and other emergencies, and Dubravka Cecez-Kecmanovic explains that despite enthusiasm for the use of algorithms and AI, they will not lead to the impartial and efficient outcomes most are expecting.

And while the popular press frothed that Labor leader Anthony Albanese has dropped the previous franking credit proposal, all he actually said was: “We won’t be taking the same policy to the next election.” Which means that like the euthanasia laws, it could come back from the dead.

Graham Hand, Managing Editor

For a PDF version of this week’s newsletter articles, click here.