Global equities can provide significant benefits to a diversified investment portfolio, ranging from higher return opportunities, enhanced portfolio diversification, as well as exposure to specific themes and currencies.

In this piece, we provide an overview of how we approach the construction of global equity portfolios, the strategies and styles we adopt to build resilience and maximise opportunity within the portfolio, as well as some of the pitfalls investors should be aware of.

What’s the starting point when building a global equity portfolio?

MSCI indexes are a good starting point for constructing and monitoring portfolios from an investable universe perspective. Investors will often design portfolios that aim to beat the MSCI All Country World Index (ACWI) benchmark, which is a good representation of the full opportunity set, providing exposure to large and mid-cap stocks across 23 developed markets and 27 emerging markets.

According to MSCI, the investment universe covers more than 3,000 companies across 11 sectors and approximately 85% of the free-float adjusted market capitalisation of each market.

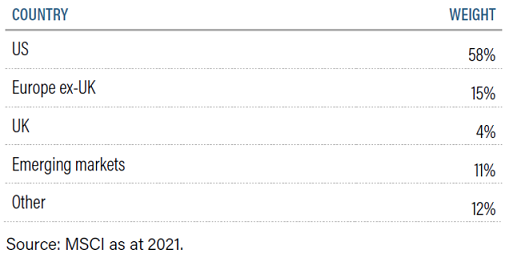

The approximate regional breakdown is summarised below and is a good starting point to understand how a global equity portfolio should be structured.

MSCI ACWI breakdown

How do we approach strategy and style?

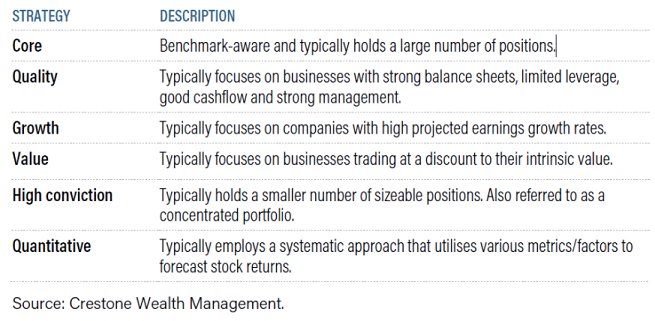

From a strategy and style perspective, we separate our strategies into benchmark-aware/core, quality, growth, value, high conviction, small to mid-caps caps, quantitative and regional markets. Some of the broad definitions of these strategies and styles are summarised below.

While strategies can be generalised under a specific style, over time there can be some overlap. For example, a ‘quality’ strategy may also exhibit a ‘growth’ bias, while a quantitative strategy could exhibit elements of core, quality or value.

Equity strategies and styles

Core strategies help to reduce benchmark risk

Depending on the size of the portfolio, five to eight strategies are ideal for a typical global equity portfolio. As there is generally a desire to reduce the sensitivity of the overall portfolio, this means most exposure should be core, as core and benchmark-aware strategies are generally expected to have low tracking error (i.e. limited deviation from the benchmark).

The main purpose of these strategies is to reduce asset class volatility and to be an anchor for the portfolio. This then enables the portfolio to include strategies with higher tracking error (such as growth, value, high conviction, small-mid cap, and emerging markets) that can potentially generate extra returns.

The sizing of the different strategies is key to generating a smoother return profile for the asset class. Allocating the risk budget to these return drivers should be proportional to the attractiveness of the opportunity from a risk-return perspective.

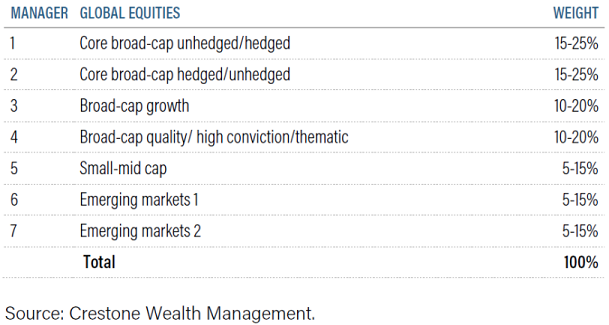

As the table below shows, we tend to allocate a larger weight to the core strategy. Our preference is to utilise active strategies for downside protection. However, core strategies can also be implemented by index exchange-traded funds (ETFs) at competitive fees. This enables the portfolio to utilise the fee budget by gaining exposure to more style-based strategies in less predictable parts of the market.

The pitfalls of under- and over-diversification

High-conviction strategies tend to be benchmark-unaware with high tracking error and can take on the characteristics of growth or value at different points in the cycle. However, the global universe is much broader than the stocks that a high-conviction strategy would generally hold. This means that the investor’s portfolio may lack diversification and is under-exposed to the broader investment universe.

Investors should also resist the urge to use strategies that are not necessarily optimising the portfolio in any way. Unnecessary over-diversification can be costly, dampen outperformance and increase portfolio redundancy. Redundancy risk is where the investor has multiple exposures to the same securities across various funds.

Additionally, the desire to hedge varies depending on the overall portfolio’s hedging strategy. Funds can be a cost-effective way to implement hedging.

With this in mind, we aim to build a global equity portfolio with an allocation to the following strategies at the following weight ranges:

Typical allocations within a global equity portfolio

Areas where we tend to identify gaps in portfolios

Small and mid-cap exposure

Global equity performance has been dominated by giant-cap tech stocks for a prolonged period. The US market is approximately 60% of the global index and the top five publicly traded US companies make up approximately 20% of the S&P 500 index. Concentration in a market with narrow leadership is a risk. Consequently, there is a strong argument for a small and mid-cap (SMID) strategy which captures the opportunity set in the smaller part of the market.

Global SMIDs can act as a good diversifier in an environment where diversifying style has become less effective. The MSCI World All Cap index has exposure to 73% giant and large caps, 19% mid-caps, 6% small caps and 2% micro caps. Most broad-cap strategies tend to only capture large and mid-cap exposure.

Listed small and micro-cap stocks are, therefore, largely ignored, which creates a gap in portfolios. Investment manager skill is particularly important in this part of the market and can be a differentiator in gaining exposure in this space.

Regional exposure

Emerging markets continue to provide a strong investment thesis and diversification opportunities. Similar to small-caps, the degree of dispersion in manager returns in this space tends to be wide. Therefore, manager skill is important. Additionally, active managers can run quality filters on a range of issues, such as environmental, social and governance (ESG) factors, which tend to be more prominent in emerging markets than developed markets.

When considering direct emerging market strategies, investors should recognise the indirect emerging markets exposure through broad-cap strategies. Broad-cap strategies are generally not restricted from investing in emerging markets, unless their mandate strictly prohibits them from doing so. Therefore, on a look-through basis, the portfolio will likely have inherent exposure to the region. The MSCI ACWI has approximately 13% emerging markets exposure.

Thematic exposure

There are several themes at play in global markets that tend to be niche investments that can generate significant long-term sustainable growth. Not all investment managers have the ability to research and understand the full potential of some of these themes. Holdings in these strategies tend to be unique and are generally not found in more traditional broad-cap strategies. A capable investment manager can generate significant returns in some of these themes, such as biotech, energy efficiency, and other disruptive technology.

In summary

The MSCI ACWI provides the primary building block for a global equity portfolio. At Crestone, we believe the key is to ensure the portfolio is well diversified across styles, regions and market capitalisation, as this will ensure it is best placed to deliver attractive risk-adjusted returns without being overly dependent on a particular outcome. There are several additional ways investors can potentially enhance returns from their portfolio, and this includes investing in less researched parts of the market, as well as thematic-based and other opportunistic strategies.

Stan Shamu is a Senior Portfolio Strategist at Crestone Wealth Management. This article is for information purposes only and is not intended to constitute a solicitation or an offer to buy or sell any financial product. It has been prepared without taking into account your objectives, financial situation or needs.