This piece stands back and looks at longer term valuation, which can go from absurd optimism to “they’re dead” valuations.

How absurd did Magellan get at the peak?

At $74.90, Magellan shares were priced by investors at $13.65 billion. So at peak crazy, Magellan (MFG) was priced at 12.7% of funds under management (FUM) and 38.4x P/E of annualised net profit before performance fees. This at a time other listed global funds managers were priced at ~10x P/E and fractions of the FUM percentage.

Not at the peak, but part-way there, at a price of $55.20/share in August 2019, MFG placed $275 million of shares with the rationale being to fund a new retirement product (since dumped) and costs associated with a new trust and other “balance sheet strengthening” purposes.

However, in our view, the placement has eventually been put to excellent use.

Principal investments

One of the clear indicators to MFG outsiders that objectives other than running a top-class global funds manager had entered the equation emerged in September 2020, when MFG made the first of three significant external principal investments in three months. The least logical has been sold with a very good return, and the other two are an excellent fit.

In December 2020, MFG acquired what eventually turned into 11.6% of Guzman y Gomez, a fast food chain. The eventual investment of $102.7 million was turned into $140 million (before costs) in 17 months. Bluntly, this appeared to be a hubristic investment, irrespective of its financial success.

In September 2020, MFG acquired a 40% economic interest in Barrenjoey Capital Partners Group Holdings (Barrenjoey), at a cost of $156 million.

MFG have numerous personal linkages with Barrenjoey, mainly from the coterie of highly talented ex-UBS personnel who formed the new business. These folks know each other and their skills. From a standing start, Barrenjoey had 348 employees by 30 June 2022.

Barrenjoey’s accounts break the company into 'established business' – corporate advisory, equity capital markets and cash equities/research. That business generated $227 million in revenue in the latest year and an operating profit of $57 million – before IT establishment expenses – and $44 million of IT is expensed, not capitalised.

Based on compensation expenses in the FY2022 year, the business is built for revenues of well over $300 million even in mundane markets, using US peer group comparisons. That should categorically take the business to profitability. Moreover, with some global brokers pulling away from equity financing (prime broking) – notably Credit Suisse – and others constrained by global parents, Barrenjoey should be able to find a real niche, since many of the personnel operated within a highly decentralised UBS Australia, which had 'special dispensation' from Zurich. Because they made so much money.

MFG carries the Barrenjoey investment using equity accounting at $133 million in the accounts – below the cost of their $156 million commitment. It might be accounting standards but makes no sense. Based on the total Barclays investment ($120 million for 1,819 preference shares), MFG’s investment could notionally be valued at $264 million, valuing Barrenjoey at $725 million based on economic interest or 4.5x book value. Is it unrealistic to envisage Barrenjoey earning (say) $70 million p.a. in two years from a far greater range of activities? We think not.

Magellan invested $20 million for ~17% of Finclear in November 2020. Finclear was founded in 2015 and has grown organically but also by two significant acquisitions, notably that of the largest clearing broker in Australia, Pershing Securities in 2021. Finclear executes, clears, and settles between 15 and 50% of all retail transactions that go through the Australian ASX on any given day.

Given the difficulties being experienced by the monopoly clearing agency in Australia (ASX) in replacing its main holding system (CHESS) we see Finclear as having intriguing opportunities over the medium term and a highly complementary investment to that of Barrenjoey for Magellan.

Conservatively, 45% of Magellan's market capitalisation is investments

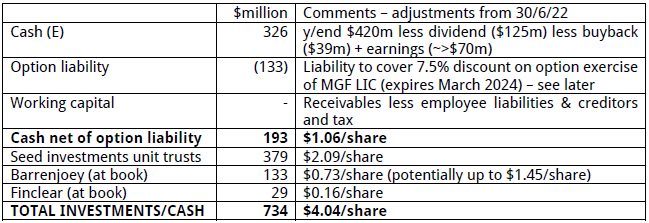

We estimate MFG to be holding over $4/share in cash, seed and other investments as follows:

All growing funds managers seed new vehicles, the larger ones in larger ways. But the massive decline in MFG’s equity capitalisation, along with the Guzman y Gomez investment sale and some innate conservatism, has left MFG with cash estimated at >$1.00/share, seed investments in MFG funds of over $2.00 a share and the two (in our opinion) really smart “market plumbing” investments, on the books (combined) at $0.90/share, but in our view worth much more. All up, on our estimates, ~$4.04/share or $737 million against an equity capitalisation below $1.6 billion.

On that basis, at current prices of $8.94/share, MFG’s three funds management businesses are priced by the equity market at a maximum $4.90/share or $889 million, or 1.77% of FUM. Is this realistic?

Magellan FUM and a rough valuation

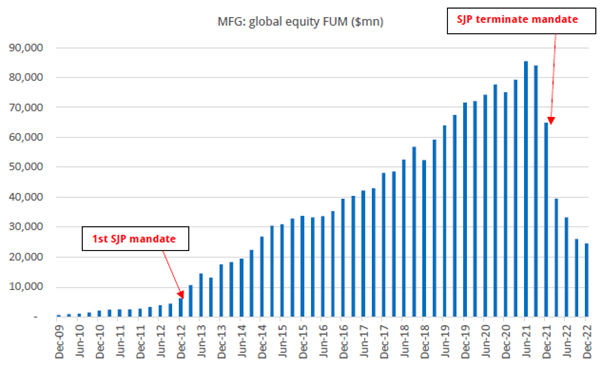

We estimate MFG now has global equity institutional funds (excluding infrastructure) of below $7 billion. All but ~$400 million of Airlie’s $8.5 billion of FUM is institutional. The rapid decline of MFG institutional funds shows the domino like effect of this type of money.

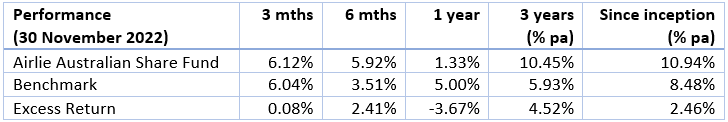

Airlie, an exclusively Australian equity manager, was acquired in March 2018 for $97.1 million – exclusively in MFG shares. The acquisition price was consistent with our metrics for institutional managers at 1.61% of FUM. Airlie’s performance has been excellent over a three-year period, and FUM has grown to $8.5 billion, including $400 million in the retail fund.

Based on interpolating the same metric to current FUM, despite the 5% FUM retail component, implies a value of ~$137 million for Airlie.

Hence, the guts of MFG’s valuation has to be the price applied to the 'retail' global equity business. We estimate MFG has just over $14 billion of retail global equity FUM, of which $2.7 billion is contained within the closed-end version of the Magellan Global Fund (ASX: MGF). This fund will struggle to raise new equity even via option exercise.

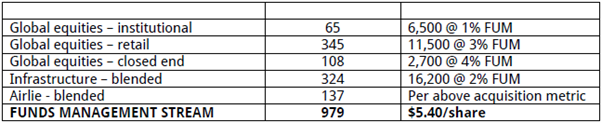

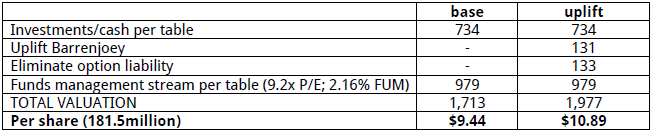

We estimate using simple industry metrics that MFG’s fund management stream can be valued at just under $1 billion:

This fund management valuation can be cross-checked very simply against MFG’s consolidated operating metrics. MFG’s consolidated revenue from funds management averages a base management fee of ~62bps; on the current level of FUM ($45.3 billion) this equates to annual revenue of $281 million (average FUM of $53.8 billion and hence annualised revenue in H1 FY2023 will be above this). In recent presentations, MFG have reiterated funds management business operating expenses of $125-130 million.

Hence, at the $45.3 billion level of FUM, MFG’s funds management business should produce pre-tax “cash” profit of ~$151 million, or $106 million after notional tax, excluding performance fees. Our valuation cross check therefore equates to 9.2x notionally fully taxed funds management profit at current FUM. That is in the lower echelon of the cohort group.

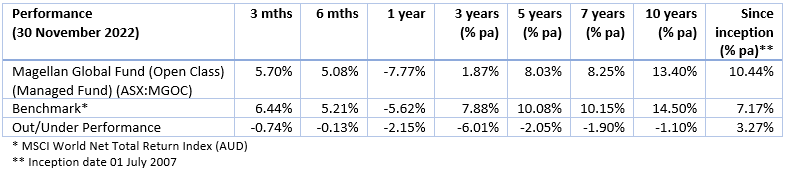

Magellan’s core fund performance appears to be levelling off, but not yet significantly improving – that takes time. The clear hole left by the ill-fated Chinese-tech play can be seen in the 3-year per annum numbers, below:

Magellan valuation and concluding thesis

We conservatively value MFG at $9.44/share based on 31 December 2022 FUM; being more liberal, we see scope to lift this to just under $11/share based on eliminating the option exercise liability and revaluing the Barrenjoey investment to reflect the entry price of Barclays:

Whilst the 31 December 2022 MFG share price is only marginally below our base valuation, we see multiple areas of optionality for MFG to add shareholder value. Our valuations offer nothing for the capacity to generate performance fees, nor the inherent beta to equity markets – which we acknowledge may take time to play out.

However, we suspect equity markets are moving to a dynamic where stock picking rather than index-beta – which MFG have used to advantage in the past – will be a more important determinant of fund performance relative to benchmark. This does suggest Magellan have an above average chance of improvement (as do Platinum) and thereby start to redeem their reputation. The chance of new institutional mandates is virtually nil in the next three years, but the slowing of retail redemption is far more important.

And what about those investment banking skills?

Is it beyond the realms of possibility that Magellan may get together with Barrenjoey to build a FULL investment banking “powerhouse” with funds management, broking, M&A/ECM, stock lending and a strong capital base to boot? Given that the investments and funds management businesses of MFG make up roughly 50/50 of the current valuation, a separation and merger of Barrenjoey is hardly rocket science for smart bankers with a clear motivation. As we know from the extravagant rating of Macquarie (MQG) Australian investors would likely relish the thought. That clearly is an option not priced into MFG at current levels.

Hence, we have built a moderate portfolio position, with scope to add further if (very) sloppy equity markets derail FUM, which we see as the main risk to the position.

Andrew Brown is Executive Chairman of East 72, a leveraged investment company operating through its subsidiary entity, East 72 Investments. This article contains general information only; it does not purport to provide recommendations or advice or opinions in relation to specific investments or securities. It has been prepared without taking account of any person’s objectives, financial situation or needs and because of that, any person should take relevant advice before acting on the commentary.

This article has been extracted from East 72's Quarterly Report #26.