Since 2018, State Street Global Advisors has compiled the Global Retirement Reality Report, which includes results for Australia.

The global context for the 2022 report is familiar territory. The last two years has seen the return of three of humanity’s great scourges; war, disease and, yes, inflation. Much of what we observe in the Australian results reflect this environment. However, Australia has experienced significant changes in its retirement system which have also influenced the survey outcomes. Notable among these are the Your Future Your Super (YFYS) reforms, aggressive superannuation fund consolidation, the launch of the Retirement Income Covenant and upheaval in the financial advice sector.

Finding #1: Income and age are more important than the passage of time for retirement confidence

The interaction of the Age Pension, Superannuation and Healthcare makes the Australian system particularly complex. Yet 59% of Australian respondents, when asked who had primary responsibility for making sure they had an adequate income in retirement, answered with a simple “Me”.

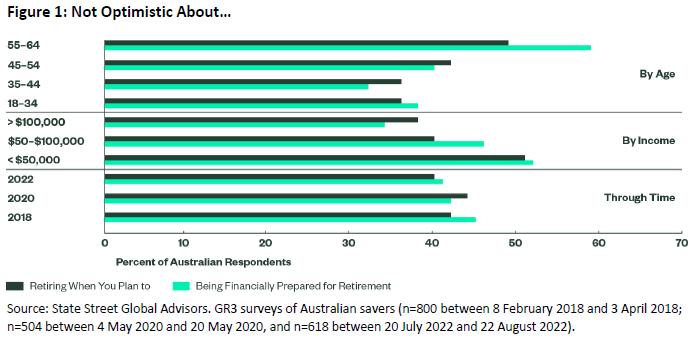

Against this backdrop around 40% of Australian respondents have little confidence in preparedness for, or timing of, their retirement. The proportion has changed little from 2018 to 2022 despite system changes. Dig a little deeper into the 2022 results, and this lack of confidence is particularly evident among those on lower incomes and those closest to retirement. There is clearly still work to be done by both industry and government in simplifying, explaining and confidence building for our national retirement system. Australia is not alone here of course, with a lack of optimism particularly prevalent in the UK.

Finding #2: The last two years of turmoil have changed financial plans in Australia

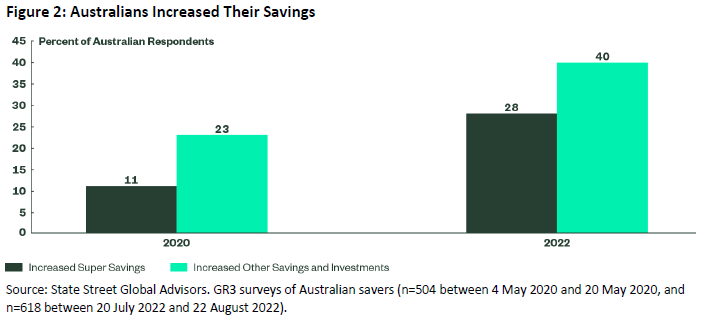

With turnover in the workforce and changing patterns of work in several industries, we asked respondents whether they have changed their thinking on when, and how, they might retire. Australia stands out in our global comparison with 34% of respondents indicating a changed outlook compared to 25% in the sample from US, UK and Ireland. At the same time, more Australians reported a short-term increase in savings both within superannuation and in other savings and investments, than others surveyed. In 2020 we saw a muted, but still noticeable savings response to COVID, however in 2022 the increased rate of short-term saving was more pronounced.

The last two years has brought one particular concern to the forefront for our respondents. Inflation topped the list of factors that most negatively affected retirement confidence in the survey, both for Australia (65% included it in their top 3) and the rest of the world (70%). With an emerging economic slowdown and rising interest rates, respondents were also concerned about mortgage or rent costs (35% in Australia), and about being able to continue to find spare funds for retirement (29%).

Finding #3: Retirement income is messy, but Australia is at least starting in the right place

How to make the shift from “accumulation” to “decumulation” is one of the more vexing problems facing policy makers and the superannuation industry. The industry is still grappling with exactly what the new Retirement Income Covenant does, and doesn’t, require. However, the three principles encapsulated in the Covenant are broadly supported by the survey findings: maximising expected retirement income, managing expected risks to the sustainability and stability of retirement income, and having flexible access to funds.

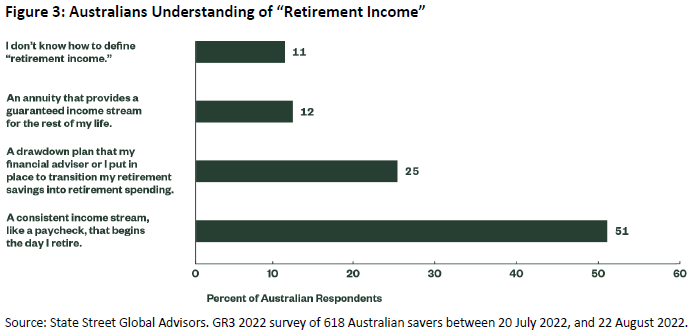

Interestingly, while many in the industry think of “retirement income” primarily as a drawdown of superannuation assets, only 25% of Australian respondents selected this definition. Rather, 51% of the Australian survey respondents preferred a simpler and more direct definition, “a consistent income stream, like a paycheck, that begins the day I retire”. The definition suggests a need for stability and certainty, and for both superannuation and the Age Pension to be captured.

Yet, in the mind of our respondents, stability and certainty should not be at the expense of flexibility. Given stylised retirement product choices, the winner was a retirement product that provided flexible access to savings in the early years followed by stable income in later years.

Of relevance to nascent superannuation Retirement Income strategies, is the early retirement years where budgeting is of most concern to respondents. Only 21% of Australian respondents were more concerned about budgeting for later years. This could reflect the backstop of the Age Pension as well as a behavioural “present bias”. However, it could equally reflect an expectation that successful management of finances in the early retirement years is a prerequisite to financial soundness in later years. When we asked Australian respondents for their biggest concern when planning their retirement finances, 31% selected “outliving savings”. As a side note, only 8% identified “Not leaving a bequest” as their biggest financial planning concern, which may be a welcome finding for policy makers.

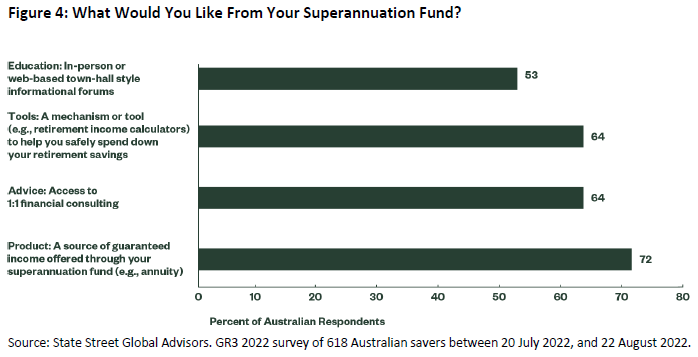

A final note on the survey responses and Retirement Income strategies. Consistent with the legislation, many published strategies include a mix of products, tools and calculators, educational information, and advice. When we asked Australian respondents what they would like to see from their fund, several things were noteworthy. Firstly, every choice was selected by at least half our Australian respondents – a general sense of “more is better”. Secondly, education was the least popular, which should give pause to those who believe education is a panacea. Advice outranked education. Finally, and perhaps most intriguing of all, the top selection was a good product, described in our survey as have guaranteed income and even using the word “annuity”. Granted, 56% of Australian respondents said they weren’t exactly sure what an annuity is or how it works, but intriguing nonetheless.

Finding #4: Most Australians would prefer to stay where they are

55% of the Australian respondents would prefer to get their retirement income solution from the superannuation fund that they are already using. This was appreciably higher than the 43% recorded among respondents in other countries and likely reflects at least three features of the Australian industry. Firstly, many funds have been successful building positive brand with their members. Secondly, the industry has continued to invest in retirement solutions – even if the focus to date has tended to be on advice, education, and communication rather than product. And finally, unlike other markets, superannuation funds in Australia are largely independent of the employer, and so retirement is not a natural trigger for leaving a fund.

Finding #5: Sustainability matters to retirees

Think what you may about sustainability, but it certainly matters to respondents in our survey, and Australians recorded even stronger responses than their global peers. While 52% of respondents outside Australia expected sustainability to “happen as standard on my behalf”, the survey showed a 65% response rate for Australians. There were four exclusion categories that each attracted more than 50% of Australian respondents: tobacco, controversial weapons, gambling, and violators of international norms (human rights etc).

Finding #6: Fee pressure is not going to abate any time soon

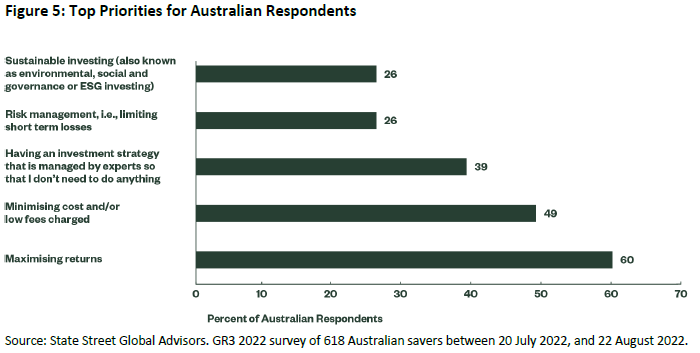

Debate continues to rage within the industry over passive versus active management, including the role and impact of fees on investor outcomes. The YFYS performance test may have made the debate more visible and consequential, but it certainly didn’t create it.

Maximising returns is the dominant priority among global as well as Australian respondents, while risk management (expressed as short-term loss) is a lower priority across the globe. However, minimising costs appeared as a stronger priority in Australia than the rest of survey, where it was a clear second to maximising returns. Over 20% of Australian respondents had it as their top priority.

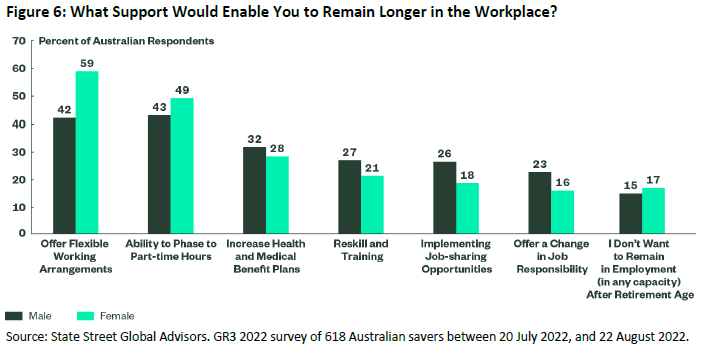

Finding #7: Gender matters in superannuation

Along with others, the Australian Human Rights Commission has called out the gender gap in superannuation savings, largely because superannuation is linked to paid work and women are more likely to move in and out of the workforce to care for family members. Consistent with this, the Australian survey results suggest that flexible working arrangements are much more important for women than men as retirement approaches.

Women are far less optimistic they will be financially prepared for retirement (18% vs. 38% for men) and are less confident that they will be able to retire when they want to (17% for women vs. 38% for men).

Jonathan Shead is Head of Investments, Australia at State Street Global Advisors. The views expressed in this article are the views of the author as of 30 December 2022 and are subject to change based on market and other conditions. The information provided does not constitute investment advice and it should not be relied on as such. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon.