According to the US Department of Treasury, there are 38 active sanction programs. Are these programs working? Historically, sanctions have worked because there has been widespread global support in limiting a country’s access to foreign investment and products. Support these days is splitting along Global South/North lines with countries in the BRICS (Brazil, Russia, India, China, South Africa) family finding ways to circumvent the sanctions and thus minimising their effects.

Sanctions on China do not appear to be working because of its economic strength and changing relationships with BRICS countries. China’s monthly trade surplus continues to increase with July 2024 being around US$100 billion. This surplus is in both US dollars and Renminbi, and as a result, China has become the largest creditor country in the world and is lending the currency (USDs) of the largest debtor country in the world, i.e., the USA which also has the world’s reserve currency.

Countries subject to sanctions are circumventing them through a range of actions:

- Trading in local currencies to avoid the US controlled SWIFT system

- Pricing discounting on their products

- Finding new markets

- Adjusting supply chains

- Creating new alliances.

For the above reasons and because the US is selectively applying the sanctions and, in many cases, hurting its allies, sanctions are no longer working with the force they used to.

Below are some examples of sanctions and their consequences:

1. Huawei - In 2019, the US government placed sanctions on Huawei, a Chinese technology company over concerns of spying through its technology and specifically the mobile phone. Readers may recall that Huawei’s Deputy Chairperson, Meng Wanzhou was arrested at Vancouver International Airport on an arrest warrant from the US who sought her extradition from Canada for fraud and conspiracy to commit fraud by circumventing US sanctions on Iran. A political solution was reached, and she was released.

Huawei responded to these sanctions by developing supply chains outside of US control and increased its product range and invested in start-ups further growing its profitability. US corporations have had to find alternative products to Huawei which have turned out to be more expensive or have had to find ways to work around the sanctions.

Interestingly, it has been the Pentagon (US military) that since 2019 each year asks and receive a sanction waiver because of its dependency on Huawei products which the US government will not provide to US corporations.

The US government continues to pressurise non-US companies, e.g., Dutch company ASML that earns half its revenue from China to discontinue trading with Huawei. ASML's share price has collapsed because of the sanctions.

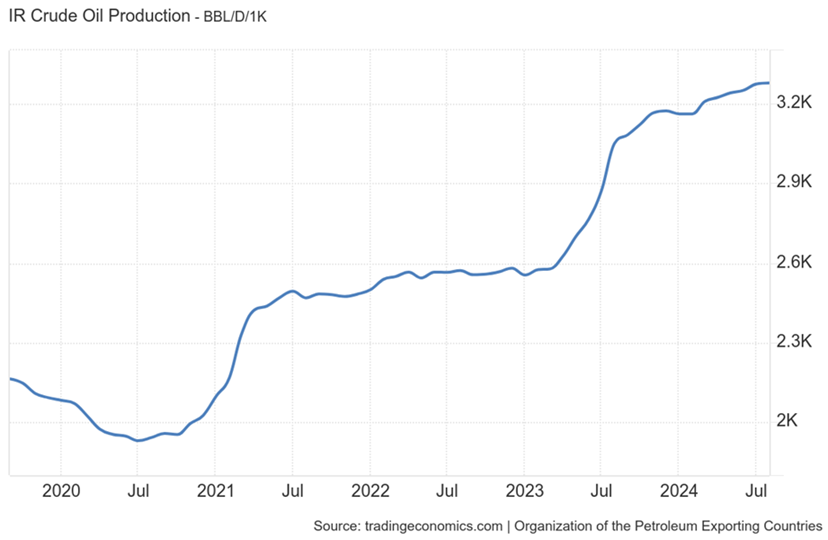

2. Oil - Both Iran and Russia are under US oil sanctions, yet their oil revenues have grown. In July 2024, according to Russian budgetary data, its oil and gas revenues grew by 41%. Since 2020, Iran crude oil production has gone from about 1.75m barrels per day to 3.3m barrels per day as shown in the graph below.

Figure 1: Iran Crude Oil Production

Iran sells its oil in non-USDs and at a discount to China, India and South Korea, a close US ally.

3. Batteries - CATL, a Chinese company, is the world’s largest producer of batteries for Electric Vehicles (EVs) producing batteries for Tesla, VW, Toyota, etc., The US Secretary of Defence, wants to ban CATL products. Time will tell as there are enormous implications for the US and world’s car industry, if this ban occurs. This will be a 1st import ban of Chinese products, as the US has relied on tariffs for imports and bans for exports.

4. Flight paths - US sanctions require US airlines, e.g. United, Delta to fly around Russia, increasing flight times and fuel costs because of the extra distance. This is forcing prices up for western airlines while Chinese airlines that can fly over Russia are now taking market share because of these sanctions. One of British Airways most profitable and popular routes was London to Beijing. This flight now takes 11.5 hours on British Airways, whereas on Chinese airlines who are flying over Russia, the flight time is 2 hours shorter and their lower cost structure means increased market share and profitability. Passengers may not like the movies and food on Chinese airlines, but they do like the cheaper price and shorter flight time. Consequently, British Airways is giving up this route because it can no longer compete because of the US sanctions. This is another example of US sanctions hurting US allies.

5. Graphite - Batteries need graphite and China has a monopoly on refined graphite. In 2023, China imposed strict export controls on graphite in response to US sanctions. The major expansion plans of US corporations in building new factories to produce batteries are now slowing down because these factories need graphite. China mines 66% of the world’s graphite, it controls 60% of the synthetic graphite and it produces 98% of the anodes. More recently, in response to US sanctions, from 15 September 2024, China the world’s largest exporter of antimony has set down very strict export controls. Antimony is a critical mineral used in armour-piercing ammunition, infrared sensors and precision optics, as well as solar panels.

Sanctions are no longer as effective as in the past and not likely to be in the future, if the world continues down the multi-polarisation path.

Michael McAlary is CEO of Chairmont Group and Managing Director of WealthMaker Financial Services, a family office that provides investment, financial planning and mortgage broking services. This article is for general information only and has been prepared without taking into account your personal objectives, financial situation or needs.