As geopolitical tensions continue to heat up, incentives seem skewed towards the emergence of a more multipolar world, presenting interesting considerations for investors when it comes to thinking about the world’s largest multinationals in the decades to come.

Despite concern about China’s rocky post-COVID recovery and longer-term growth, its strategy to align with the developing world (46% of global GDP and 86% of population) provides a significant demand base for emerging multinational champions to thrive and advance the evolution from ‘Made in China’ by foreign companies to ‘Made by China’.

Deglobalisation – just a convenient narrative?

Growing US and China tensions have been likened to a new cold war due to the potential scale of the conflict and economic heft of the players. But in contrast to the US-Soviet era, the global economy is more integrated than ever with China contributing circa 15% of global trade.

Any strategy to cut China out of the developed world would prove costly and difficult, despite the public threats to do so. China’s share of global trade has in fact increased by 1.8% since the US began increasing tariffs in late 2017.

The US and broadly the West have rarely allowed ideology to stand in the way of mutual self-interest in external relationships, including its relationship with China. The key difference today is that the West is now threatened by the rise of China’s mercantile and political power, and there is evidence of this:

- Prior to distorting effects of COVID lockdowns on consumption, China’s consumer goods market neared parity with the US in 2019 (~$6 trillion), having grown at a rate of 15% p.a. over the prior twenty years vs. 3.5% p.a. in the US.

- Western share of global GDP and trade is falling and political influence in a global context will likely be highly correlated to this trend.

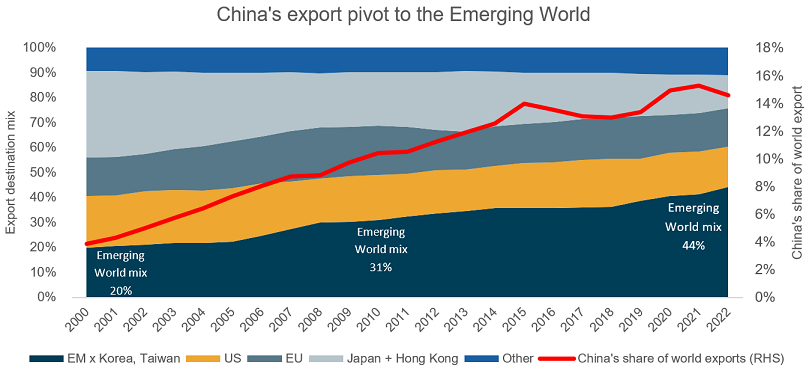

- As the developing world share of Chinese exports grows (currently 46%), the West’s trade related influence over China will continue to decline.

Whilst the tail-risk of a dislocation is growing, there remains a powerful incentive for the two super-powers (the US and China) to co-exist for the sake of shared economic prosperity.

Just as mutually assured destruction prevented a US-Soviet military conflict, the risk of mutually assured stagflation, as coined by Absolute Strategy Research, is a significant incentive for both sides to pursue a controlled, gradual decoupling ahead of uncontrolled ideological conflict.

Chinese soft power

Since President Xi was awarded a third term and the economy reopened after three years of lockdowns, China has re-engaged with the rest of the world.

Numerous delegations of business heads and politicians have been hosted, while China’s role in brokering an agreement between Saudi Arabi and Iran provides evidence of China’s growing influence.

Reinforced by the recent G7 communiques, the US (and the West) is projecting an increasingly hawkish stance towards China and this view has rare bipartisan support at a time when the Republicans and Democrats are more divided than ever.

However, while China and the US may well slowly decouple, they will inevitably remain highly coupled to the rest of the world, with China positioned to take trade market share in an increasingly multipolar world.

China’s foreign policy has increasingly looked towards the developing world across Asia, Latam, Africa, Russia and the Middle East for geopolitically aligned partners - historically by offering outward foreign direct investment relating to infrastructure (e.g. Belt and Road initiative) as well as via direct lending. This also represents a material addressable demand opportunity for Chinese companies. This cohort comprises a population of 6.7 billion people, 86% of the world and growing at 1.2 percentage points (ppts) faster than advanced economies, and US$45 trillion of GDP, 43% of total world which has grown at 2ppts faster than advanced economies over the last 40 years.

Exports from China to the developing world have increased in share by 13ppts since 2010, while the share to the US has reduced by 2ppts to 16% over the same period, as you can see in the image below.

Source: General Administration of Customs People’s Republic of China and IMF.

Also notable is that as China takes trade market share across the developing world, the prospect of de-dollarisation grows both from a push to pay for imports in Renminbi (RMB), and as these countries’ desire to diversify their foreign reserves away from USD.

This shift is still in its early stages with the RMB representing less than 2% of global forex reserves - far lower than its 15% share in global GDP. Hence, the USD’s reserve currency status remains intact, though the pre-conditions for a slow erosion are in place.

In parallel we have seen the US push toward moving manufacturing locally and to nearby countries such as Mexico, in place of China. We expect however that high costs may limit these actions to leading edge semiconductor and other strategic technology, especially where its availability aids China in its military and security ambitions. Consequently, China will need to put further resources behind the development of advanced computing and global collaboration on the advancement of key technologies will more broadly diminish.

A downstream move for Chinese manufacturing

China is already a global leader in manufacturing and according to Morgan Stanley, leading in 28 out of 47 key security industries (for example, in renewable energy and rare earth metals) and remarkably, in 18 of these technologies, it has over 50% share of the global market. The US is leading in only eight.

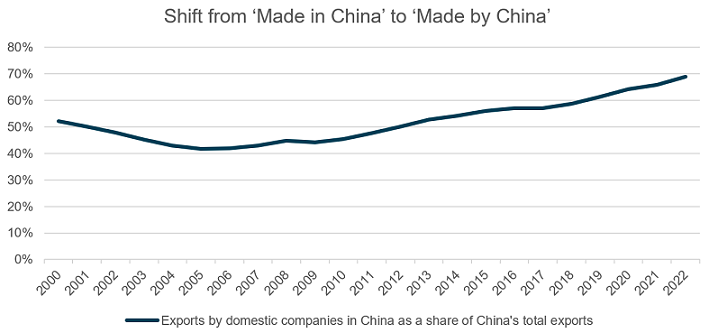

As mentioned above, more broadly, there has been a shift from ‘Made in China’ by foreign companies based in China to ‘Made by China’ by home grown Chinese companies.

Source: China customs

This is either as the owner of the intellectual property (IP), as in the case of the domestic Electric Vehicle (EV) brands where China has successfully moved downstream to now become the world’s largest auto exporter by volume, or by owning the IP along the supply chain.

For example, Chinese homegrown suppliers now develop and manufacture critical components for the iPhone 14 that account for 25% of the bill of materials, compared to just 3%, or $6 of an iPhone 4 in 2010, mostly relating to assembly.

What are the next generation Chinese multinationals?

The domestic scale that will inevitably accrue to Chinese businesses, strategic focus on R&D and expansion into other emerging markets will make it difficult to keep them out of developed markets.

We assess that the significant and durable growth opportunities of many of these emerging multinationals are mispriced as investment opportunities in the market today.

Three of those opportunities that can’t be ignored include Midea Group, Sany Heavy Industry, and Contemporary Amperex Technology.

Midea Group Co Ltd

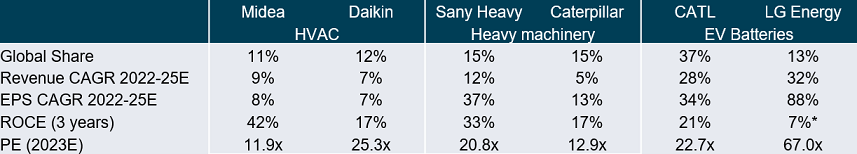

Midea (SHE:000333) made its entry into household appliance manufacturing in the 1980s, initially as the manufacturing partner of the Toshiba brand which it acquired in 1998. It has since developed to be one of the largest air conditioning manufacturers in the world with circa 11% of total industry revenue according to Deallab.

An efficient cost structure and investment in distribution has allowed Midea to price competitively and grow market share both domestically and overseas. Over half of exports are to emerging markets which are suited to its value-oriented products and will exhibit structural growth from higher penetration and upgrades to lower energy intensive units.

This is not to say that the company is ignoring advanced economies where for example it is a sponsor of Manchester City Football club. Building on its success in air conditioning, the acquisition of German robotics business Kuka in 2017 for US$5bn leverages Midea’s mega scale manufacturing experience and extends its addressable market opportunity to industrial automation technologies. Midea’s PE of 12x and high RoCE compares favourably at almost half the multiple of Japanese competitor Daikin.

Sany Heavy Industry Co Ltd

Sany Heavy (SHA:600031) is China’s largest construction machinery business and is also a top five global player. Founded in 1995 by Liang Wen Gen who remains Chairman and major shareholder, it began its globalisation effort in 2012 with the acquisition of German concrete machinery company Putzmeister. It now operates production bases in India, Brazil, USA and Germany.

Sany’s competitive edge has come from leveraging the established heavy equipment parts supply chain in China and leading with value. Servicing is offered at cost in China and 20-30% cheaper than western peers in export markets which operate servicing and fleet management as a profit centre. This has allowed Sany to gain a leading position in emerging markets which account for over 60% of export sales and is a large potential profit opportunity as these markets mature.

Profitability in their international operations has already improved with scale and the market consolidation potential remains material. For example, Sany is the number one equipment maker in Indonesia but currently has only 20% share despite a narrow focus on the small to mid-sized segment. Domestically the macro slowdown has weighed on margins and the stock is priced at 20x cyclically low 2023 earnings, a likely attractive entry point assuming some recovery in domestic demand.

Contemporary Amperex Technology Co Ltd

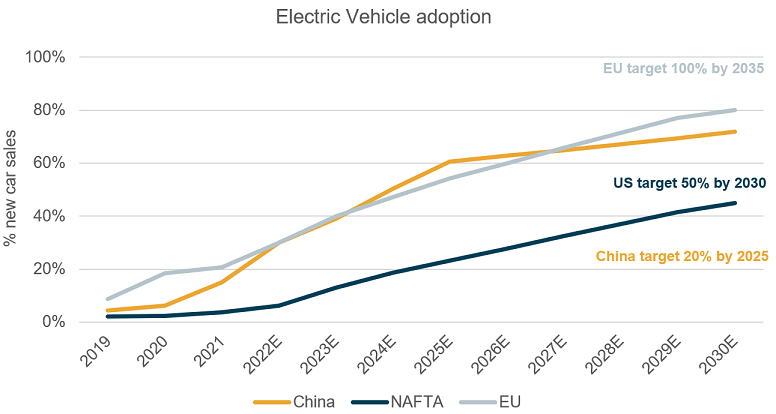

Electrification is the largest reset in manufacturing of automobiles since the emergence of mass-production and has offered an opportunity for China to quickly gain a foothold in the US$2.9 trillion per year industry. China’s target of EVs accounting for 20% of new vehicle sales was achieved in mid-2022, more than three years ahead of schedule. Chinese auto manufacturer’s ability to meet the market, where 58% of total auto sales are for vehicles priced below US$22,000, was key to their success. The recently launched battery electric vehicle from Chinese automaker BYD, priced at US$11,000 with a 405km range, is a good example of mass market capability.

Source: NBS, LMC, Bloomberg, IEA, Antipodes

Contemporary Amperex Technology Co Ltd (CATL, SHE:300750) has grown to be the world’s largest EV battery company, with over a third of global market share and over half of the market share in China. It was established in 2011 by founder, Robin Zeng, who built his fortune making low-cost lithium batteries for consumer electronics and identified the early strategic importance of EVs.

Scale, efficient manufacturing techniques and continued heavy investment in R&D results in at least 10% higher energy density from a CATL battery pack versus competitors. This performance gap has widened in each of the last three years despite aggressive competition. CATL boasts more auto OEM customers than any other battery producer and has recently expanded to licensing deals in the USA with Ford and Tesla. These partnerships reflect the company’s leadership in LFP (Lithium Iron Phosphate) technology and are coming despite the US’ geopolitical preference to partner with South Korean and Japanese battery makers.

As EV penetration increases across the world, the growth in adoption will need to come from the mass segment, for which CATL’s batteries are best suited. CATL’s ability to maintain a performance gap should see the company able to defend its position in this large and growing industry. At a FY23 PE of 23x, with earnings growth of 30% into 2024, CATL looks attractively priced versus inferior peers on higher multiples.

Source: Factset, Deallab, SNE research, * based on 1 year due to company being listed in Dec 2021

John Stavliotis is an Emerging Markets Portfolio Manager at Antipodes Partners. Antipodes is affiliated with Pinnacle Investment Management, a sponsor of Firstlinks. This article is general information and does not consider the circumstances of any investor.

For more articles and papers from Pinnacle and its affiliates, click here.