"Expect volatility but don't panic, would be my view, because before 12 months, I think we'll be looking back, and this event will have passed."

This is the view Magellan's Hamish Douglass delivered to the thousands of investors who packed Sydney's International Convention Centre on Friday night to hear his latest update.

With fears about the coronavirus pushing stocks closer to a bear market, Douglass adopted a relaxed tone, telling investors to sit tight and take a long-term view. He told the crowd of advisers, industry professionals, retail investors and students.

"Our best view is that this may be six times as serious as the seasonal flu.

"While [the virus] is going to affect a lot more people, I think the spread may well be less because of the extreme containment measures. But with the extreme containment measures is going to come a pretty sharp economic impact around the world, which will realistically be three to six months.

"During that period, I would expect a lot of share price volatility as people react to the headlines. I think if we look a little bit longer out, this flu or pandemic or whatever you want to describe it will have its consequences. But the economic effect is likely to pass very quickly."

Douglass avoided discussing the virus for much of the presentation, devoting his time on stage to how interest rates will affect equity valuations and the rise of the Chinese consumer.

But talk of the virus, which dominated headlines for the days leading up to the event, infected audience question time.

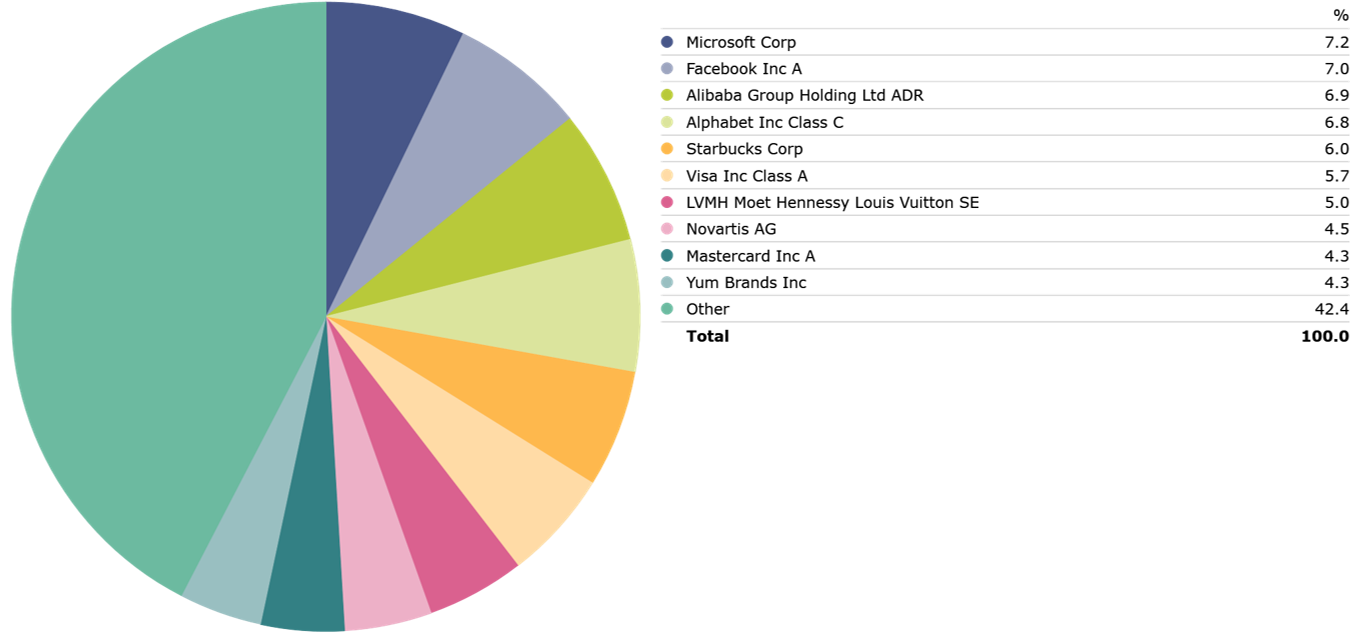

Magellan Global Fund Portfolio Holdings, 31/12/2019

Source: Morningstar Direct

'Buy the dips'

Douglass was more eager to share his view on opportunities in the market as global banks rush to slash interest rates to fight coronavirus.

"While people are panicking and very concerned about the short-term economic impact, what the central banks are doing, and I think they're going to go further here, is they're further reducing interest rates.

"So, when we come out of this, we're going to be even in a lower interest rate world, which is supportive of higher valuations. Once you've lowered, the cost of lifting interest rates is very high. This has a very interesting dynamic for valuations when people's panic stops.

"If there are any severe dips here, my advice to people would be buy, and just expect more volatility. You're very unlikely to pick the bottom of any of the sort of ups and downs. But I expect when we get some calm water, some of the businesses will be reflecting the low interest right, which is kind of a benefit to all this uncertainty."

Magellan sees opportunity in China

Investing in China is clearly on Douglass's mind following the Magellan Financial Group’s first direct investment into the rising global power, with a 6.5% holding in Chinese online platform Alibaba. It also invests in other Chinese-market linked companies such as coffee giant Starbucks and luxury French brand LVMH Moët Hennessy – Louis Vuitton.

On stocks within his own portfolio, Douglass acknowledged that things could get ugly in the short term, but insists he is doing nothing to fundamentally change the portfolio.

"Starbucks closed half their stores in China. It's just said it's going to have a severe impact on the China business in the next three months. We know that. Its share price has been affected somewhat. But in 12 months' time, it won't have any real impact on the long-term value of a Starbucks or a Louis Vuitton."

Within the Magellan Global Fund, Douglass has taken major bets on several US tech names including Microsoft, Facebook and Alphabet, and payments giants Mastercard and Visa.

Starbucks and Alibaba both provided personalised video presentations for the roadshow. Starbucks plans to open a new store every 15 hours in China between now and 2022, Starbucks Chief Executive Kevin Johnson told the audience.

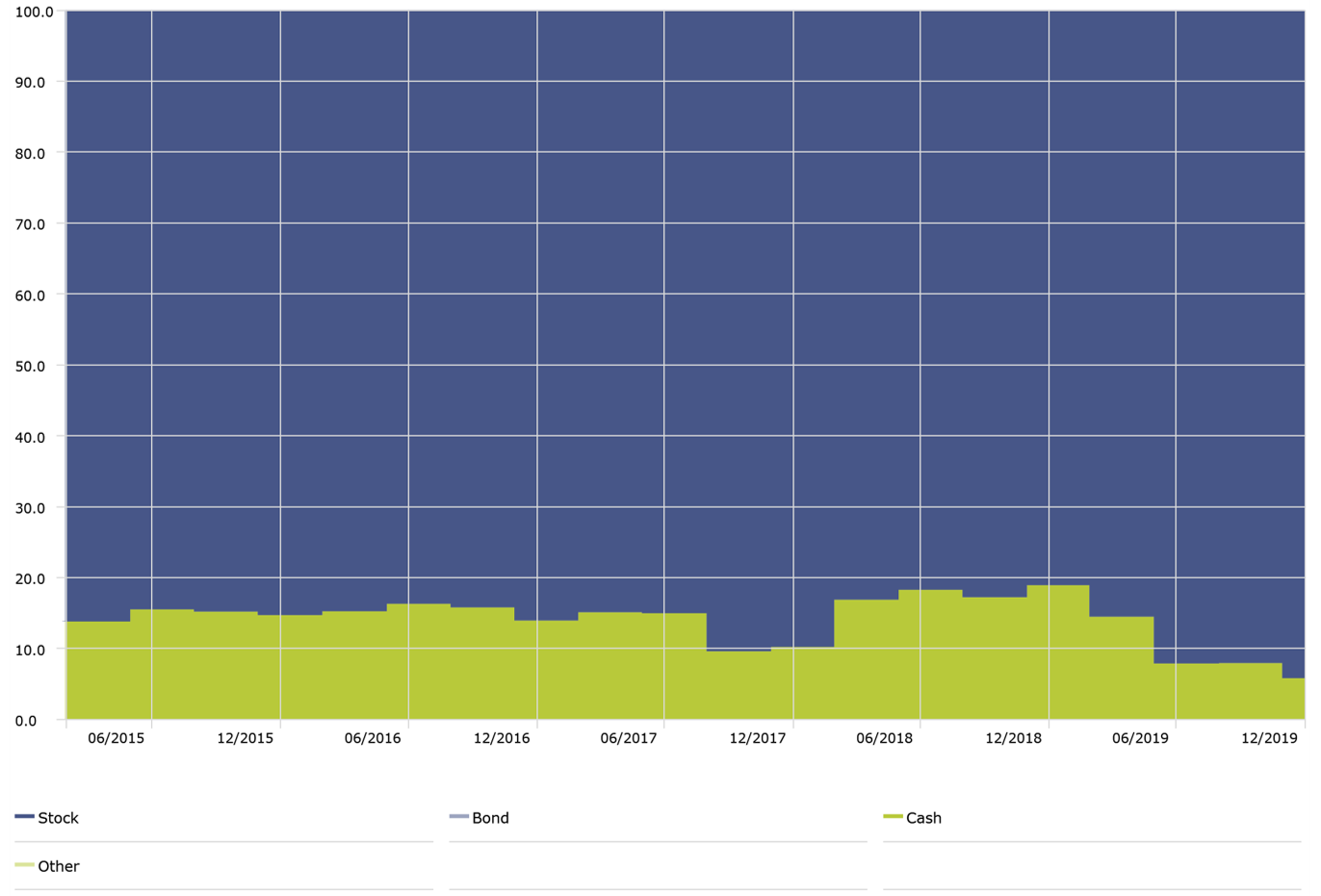

Magellan Global, Asset Allocation, 2015 - 2019

Source: Morningstar Direct

None of the Magellan Global Fund's top 10 holdings (at 31 December 2019), excluding cash, has been spared from the virus. The worst hit is Facebook, down 16% over the last month. NASDAQ is down 16.5% for the month, and the SPDR S&P 500 ETF, a proxy for the S&P 500 Index, is down 13.8%.

Magellan Global has slowly reduced its cash position over the last two years, from highs of 18.35% in mid-2018 to just under 6% at the end of 2019.

Emma Rapaport is Editor of Morningstar.com.au. The author attended 'The Great Repression: Magellan Investor Evening Series' on 6 March 2020 as a guest of Magellan.

Hamish Douglass is Co-Founder, Chairman and Chief Investment Officer of Magellan Asset Management, a sponsor of Firstlinks.