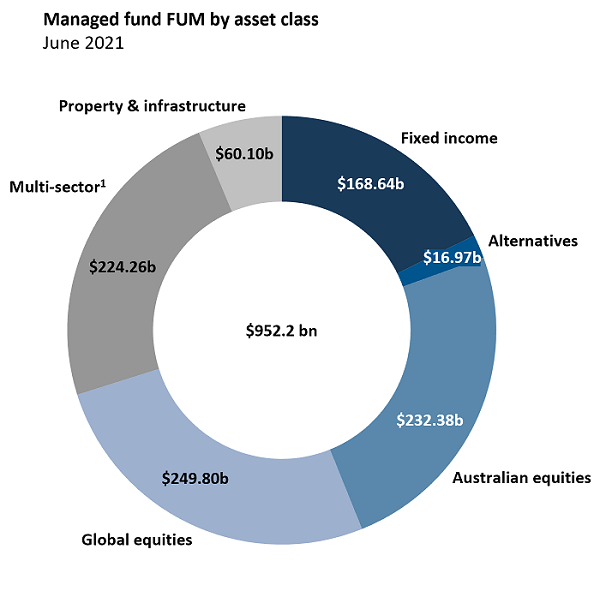

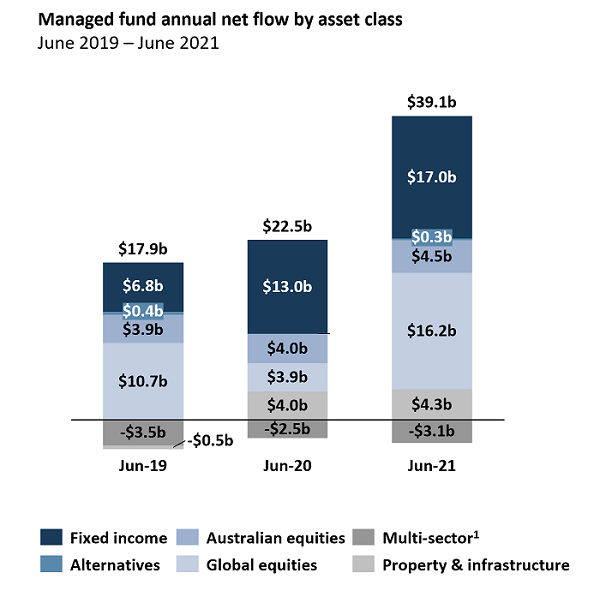

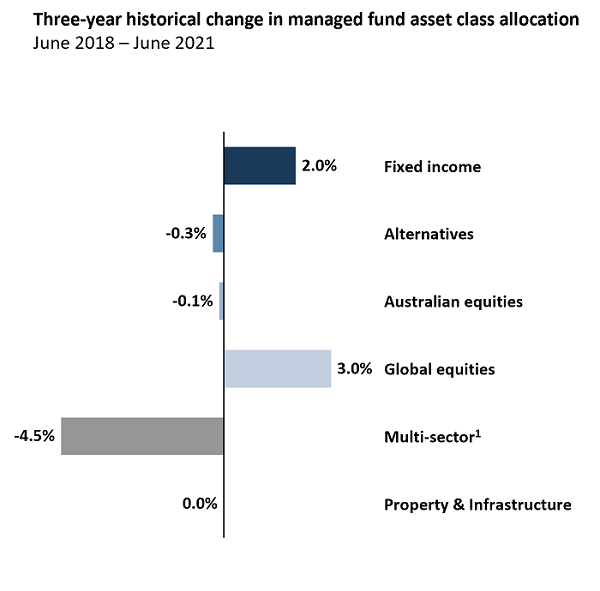

Fixed income is typically the quiet achiever in the Australian retail asset management industry. Recently, it has benefited from strong net flows with the mass exits from term deposits due to ultra-low rates and a steadily declining risk profile across the retail asset management industry as the market continues to mature and shift towards a retirement focus.

The role of fixed income in Australian retail asset management

Source: NMG Managed Funds Review (June 2021)

1 Multi-sector FUM and net flows excludes that attributed to MySuper

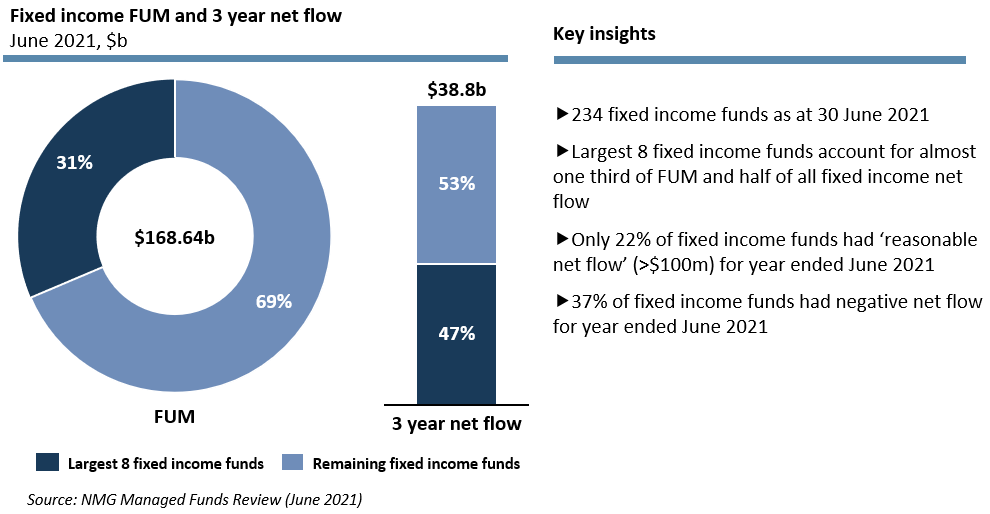

However, that tailwind is not treating all fixed income funds equally, and there is only a handful of winners.

Concentration of fixed income funds

As part of our engagements on building portfolios, advisers and their clients state they have different primary core objectives in their fixed income allocations:

- Yield: nil (or very limited) potential for capital loss while seeking to generate a consistent yield

- Defensive: reduce the volatility versus the growth asset allocations

- Diversifier: lower risk than growth assets but still generate some returns.

While these objectives are not mutually exclusive (in fact, most advisers have a primary and secondary objective), the primary objective has a significant impact on the types of products used and the resulting allocations.

Which fund managers are the winners?

Those eight products grouped in the exhibit above currently receiving half of fixed income net flow are particularly relevant to one of the objectives, and are therefore heavily supported by investors who use that as their primary approach to allocating to fixed income.

The leading funds are:

- Ardea Real Outcome Fund

- La Trobe Australian Credit Fund

- Janus Henderson Tactical Income Trust

- Vanguard Global Aggregate Bond Index Fund

- iShares Australian Bond Index Fund

- Vanguard Australian Fixed Interest Fund

- Franklin Absolute Return Fund

- PIMCO Diversified Fixed Income Fund

Instead of trying to appeal to all investors, these funds recognise they may be too hot or too cold for some objectives. Instead, they understand where they are ‘just right’ for a particular objective that advisers want from their fixed income allocations, and then target their product, sales and marketing activity accordingly.

Just as we have seen with equity fund allocations moving away from benchmark-relative products towards a barbell approach with a blend of passive and high conviction product, we are seeing fixed income allocations shift away from traditional products towards those targeted to one of these core objectives.

For fixed income managers, this means finding a 'Goldilocks' position, and making sure products are ‘just right’ and designed to meet one of these primary fixed income objectives.

David Hutchison and Andrew Cummins are Partners at NMG Consulting, part of the NMG Group. This article is general information and does not consider the circumstances of any investor.