Since the depths of the GFC and the early stages of the economic recovery in 2009, there has been more of a focus on the ‘macro’ economic environment than ever before. While there is a frenzy of reporting and analysis with each GDP data release, it is IML’s view that world growth will remain subdued for many years to come.

Deleveraging and China are long-term factors

Our reasoning is that most countries in the western world such as the USA, Australia and large parts of Europe would take many years to deleverage the debt accumulated by households and governments. While many commentators were excited about China and convinced it could continue to lead the world out of its downturn, it was clear to us that China’s GDP could not continue to expand at the double digit rate of growth indefinitely.

In addition, China’s economy was transitioning from growth led by fixed asset investment towards a more service sector-led economy. This of course has direct implications for Australia as the service sector is less commodity-intensive than fixed asset investment. The growth in demand for many of Australia’s exports such as iron ore and coal would not be as strong as it was in the previous decade. The huge expansion in the supply of commodity exports, as many Australian companies spent tens of billions to ride the China wave, is clearly not good news for Australia’s resource sector.

The deleveraging of debt and China’s economic transition are long-term factors that will have an influence beyond the next quarter’s GDP numbers. The economic outlook is broadly set and unlikely to change significantly in the short to medium term.

What is also clear is given the lacklustre outlook for global economic growth, that low interest rates are here for a long while. Investors need to focus on the key question: “How do I find opportunities for income and capital growth for the future given this environment?”

Focus on ‘micro’ - what and why?

Stock selection will be the key to successful investing in future. The banks and resource sector which dominate the Australian share market and have traditionally been the core of portfolios, are unlikely to drive investors’ returns going forward. Banks are experiencing low credit growth and higher capital constraints due to changing regulations. Resource companies have to deal with lower commodity prices driven by oversupply and softer demand, in particular as China transitions.

Our portfolios that focus on the ex-20 sector of the Australian share market provide a broader and more diverse opportunity set containing stocks in sectors such as the gaming, packaging, utilities and healthcare which are not represented in the top 20 stocks. We look for companies with a strong competitive advantage, recurring and predictable earnings, capable management and an ability to grow over time. We aim to buy these companies when they are trading at what we deem a reasonable price.

The focus is on identifying companies with the ability to generate earnings growth despite the expected lacklustre economic conditions of the years ahead, especially in the following ways:

- Acquisitions

- Restructuring

- New products

- Contracted growth

- Market share gains

Sector prospects vary

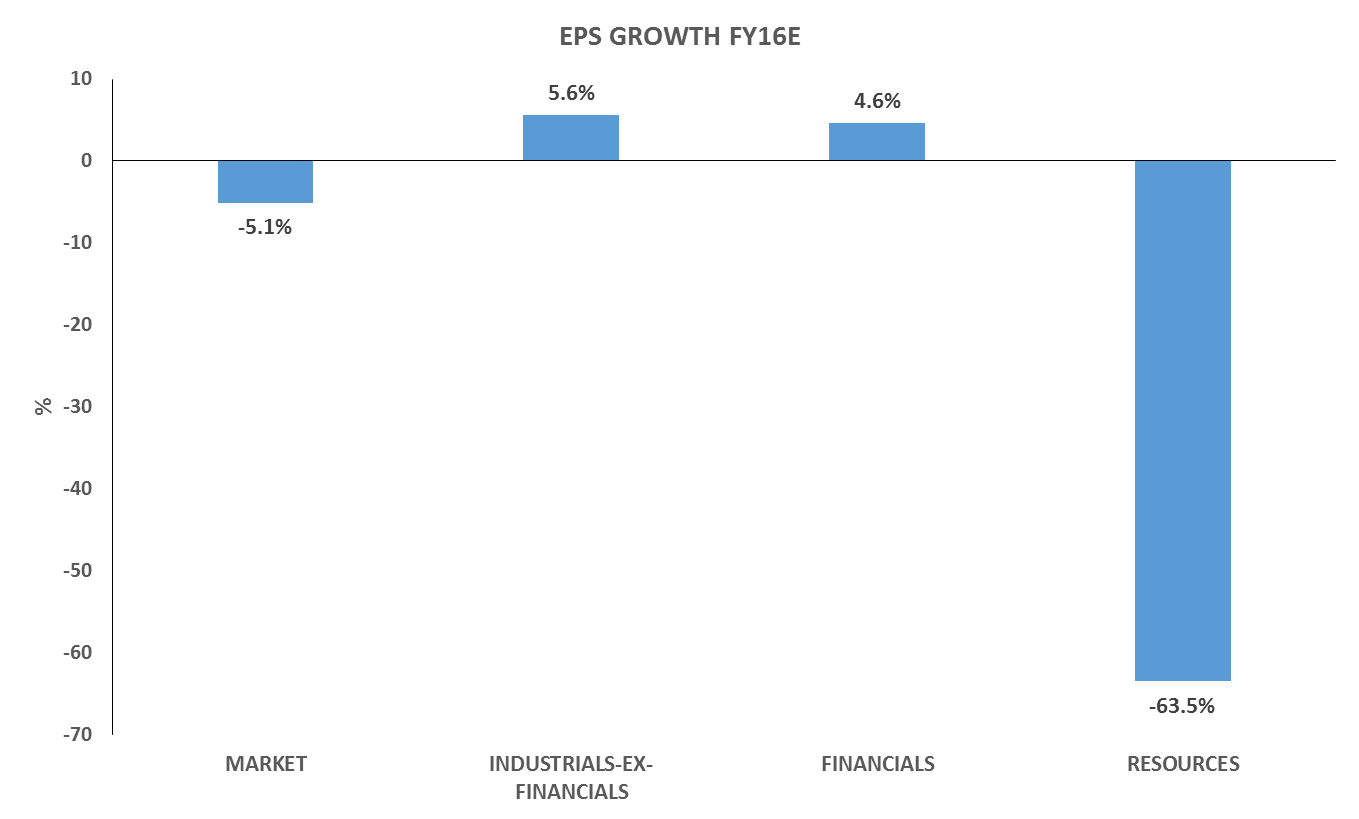

The varying prospects for growth for the whole S&P/ASX200 is depicted below. The estimated eps growth forecasts for FY16 are based on consensus estimates, although our forecast for the eps growth for financials is lower than this.

Estimated consensus EPS growth financial year 2015-2016

Source: UBS, Consensus, 1 February 2016

Our focus remains on finding the quality companies with internally-driven growth strategies. Fortunately, there are a number of quality non-bank industrial companies that are coping well with the current economic environment, but identifying them early and then carrying out intensive research remains the key.

Companies with internally-driven growth strategies

Examples of companies that we have bought and which meet our quality criteria as well as internally-driven growth strategies include:

Acquisitions - Steadfast and Pact

Steadfast and Pact are both market-leading companies in their respective fields of insurance broking and rigid plastic packaging. They should grow steadily in the years ahead thanks to their low risk bolt-on acquisition strategy of buying small competitors at low multiples where they can generate cost synergies and earn stronger returns.

Restructuring – Fletcher Building and Caltex

Fletcher Building and Caltex are also market leaders, respectively in New Zealand building materials and fuel distribution. Both are restructuring by selling or closing loss-making or poor-returning divisions (sand quarries for one and an oil refinery for the other). This will lead to better cash flows and returns to shareholders in the years ahead.

Contracted growth – Spark Infrastructure and Hotel Property Investments

Spark Infrastructure is a regulated utility which owns monopoly infrastructure (electricity poles and wires) and HPI owns a portfolio of pubs all leased to Coles for long terms. Both companies have contracted growth. Spark’s return on its assets are set by various government regulators while HPI’s returns derive from long leases on its extensive pub portfolio and accompanying liquor licences to Coles. This should ensure the growth in earnings and distributions to shareholders over the medium term almost irrelevant of the economic environment.

Market share gains – Clydesdale Bank

Clydesdale Bank is one of the longest-established banks in the UK. After a chequered history under the ownership of National Australia Bank, the company has now listed as a separate entity on the ASX. The bank has not grown its mortgage book under the ownership of NAB as everything was put on hold for a number of years as NAB decided its future. With a newly appointed Board and a focussed and experienced management team implementing a sensible strategy, we are confident that this newly-listed bank will progressively increase its market share of new mortgages.

Dividend yield and dividend growth are also critical

Companies paying a sustainable, growing dividend stream are attractive in all market conditions for three key reasons:

1) Historically the share market has delivered returns of around 9-10% p.a. so if one can find a company which can pay a sustainable growing yield of 4-5% you are almost half way there.

2) Dividends are the part of investors’ returns the company controls and are more dependable than relying on capital growth from the share price which depends on the state of the market. No matter how impressive the management team is, they cannot control the share price or your annual capital return.

3) In times of falling markets, stocks with strong dividend yields tend to hold up better than the overall market and they tend to recover quicker as investor confidence returns.

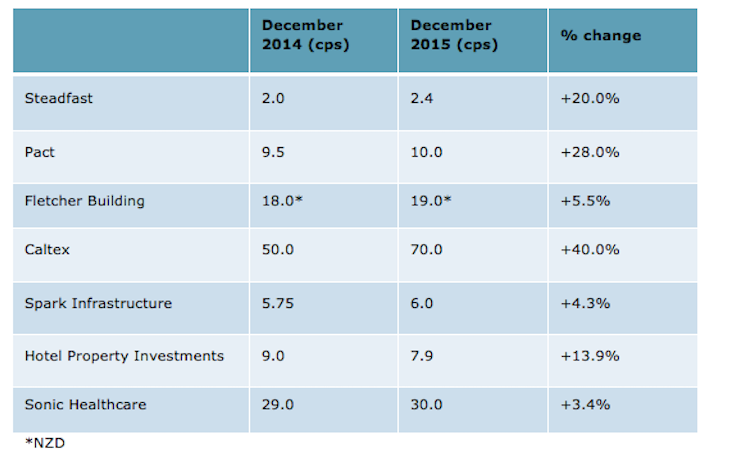

While the headlines have been dominated by BHP and Rio significantly cutting their dividends and speculation about banks maintaining theirs (and ANZ already has), many companies identified above continue to grow their earnings and dividends, despite the challenging economic environment:

In a world where economies continue to flat line and conditions for most companies remain challenging, focusing on the ‘micro’ issues and stock selection is key.

Our job is to identify these companies and buy them at a reasonable price, as we believe these companies will deliver solid returns for investors over the next three to five years through a combination of capital appreciation and income. Finding these companies is the focus of the IML investment team as we strive to deliver returns to QVE shareholders.

Anton Tagliaferro is Investment Director at Investors Mutual Limited (IML), which is the investment manager of QV Equities Limited (ASX: QVE) as well as unlisted funds. This article is general information and does not consider the circumstances of any individual.