When you retire, your salary stops. From that point on, you need to fund your lifestyle using your own savings plus any Age Pension income you might become entitled to.

For wealthy people, this might be easy, even without an age pension. For those with little, it can also be straightforward, if they’re able to live on the age pension as this provides them a lifetime income stream.

But for those in between, referred to here as ‘middle Australia’, the maths to get this right is difficult. A key issue is that no one knows how long each retiree will live. It’s therefore not possible to calculate how much someone can safely draw from super as you don’t know when their balance needs to reach zero.

The key points summarised below form the basis of an Actuaries Institute Dialogue Paper A Framework to ‘Maximise’ Retirement Income, which I co-authored alongside Andrew Boal.

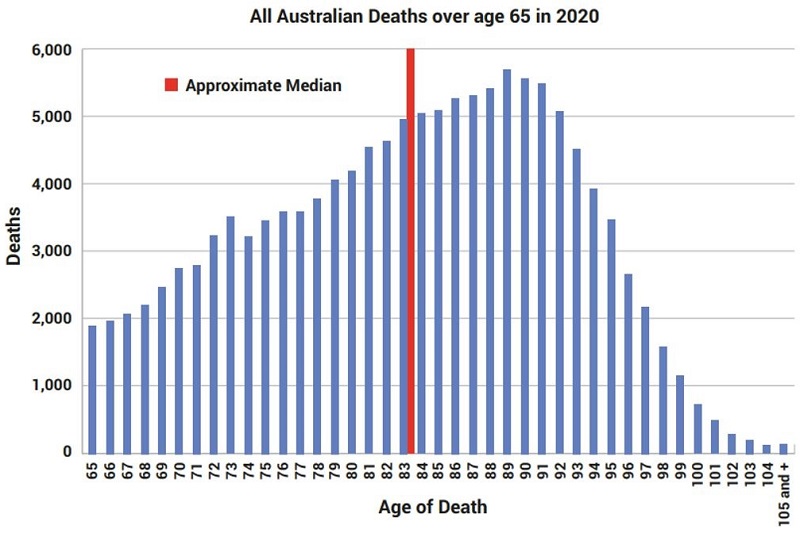

The following chart illustrates the actual age of death for all Australian retirees who died during 2020 as published by the ABS. Nobody can predict how long they will live.

Source: Australian Bureau of Statistics figures. Note: median is the 50th percentile.

In Australia’s retirement conversation there can be a lot of confusion around the terms ‘retirement income’ versus ‘retirement spending’ and ‘investment income’.

'Investment income’ is a term used by the Australian Taxation Office (ATO) to include interest, dividends, rent and income you receive from trusts.

‘Retirement income’ can be broken down into two categories:

- For assets outside superannuation, it is likely to mean the investment income that ends up in your bank account and can be spent (or re-invested).

- For superannuation assets, it’s likely to mean the amount drawn down out of your superannuation fund and paid into your bank account to spend. With most super funds, this is a choice you have to make, subject to a minimum level. There can be a disconnect between the investment income earned on a superannuation fund’s underlying assets, the amount that is drawn out each year and the amount that is actually spent by the retiree each year.

When we examine the needs of middle Australia retirees, it’s clear they’re likely to want their income from superannuation or their SMSF to last for life. It means their ‘retirement income’ should end upon the death of each individual, rather than ending at a pre-set age (e.g. based on ‘average’ life expectancy).

In order to fully maximise their retirement income, retirees would have to consume all the capital in their superannuation fund as well as all the investment earnings (i.e. there would be no death benefit payable from superannuation).

Measuring retirement income

So how do we quantify retirement income if it’s based on drawing down a balance over an uncertain timescale?

An approach used in other countries when doing retirement projections is to base the figure on a lifetime annuity formula. This is the formula an insurer or defined benefit pension fund would use to calculate the annual income that could be provided for life.

What is a lifetime annuity?

A lifetime annuity is a product that provides you with an income for the rest of your life, which you buy with your superannuation or other savings. With a traditional annuity, the payment level is guaranteed by an insurer and continues for as long as you live. The amount of income you receive from the annuity is based on multiple factors, which include:

- Your age and sex (which indicate how long you’re likely to live)

- The amount you invest

- What options you select (common examples are to have a lump sum benefit in the event of an untimely death, or to have income that increases with inflation each year)

As an indication, a 65-year-old male investing $200,000 in a lifetime annuity with an early death benefit and payments that increase with CPI for life may get an income of around $10,000 per year (as of September 2023).

What is a lifetime income stream?

The term ‘lifetime income stream’ encapsulates a broader range of products that let you use your superannuation or savings to buy an income that lasts for life. Lifetime annuities are a just one example of lifetime income streams. Other examples are:

- Guaranteed lifetime pensions. These are the same as lifetime annuities but are provided by a superannuation fund not an insurer. Public sector pensions are an example of these. The government Age Pension is also a guaranteed lifetime pension (so long as means-testing doesn’t apply to you).

- New lifetime income streams. In 2017, SIS reg 1.06A was introduced to allow a broader range of lifetime income streams, including ones that pass on the benefits of investing in growth assets whist still guaranteeing that payments can continue for life. Since 2017 at least 5 new products have been launched in Australia. An example is Generation Life’s LifeIncome product (an investment-linked annuity).

Government reviews have consistently observed that retirement incomes can increase between 15-30% by combining lifetime income products with an account-based pension. In effect, lifetime products redistribute money that would otherwise be paid as death benefits later in life. Individuals who pass away leave behind reserves that get used to increase and protect the annual incomes that are paid to all customers.

Balancing risk and reward

The idea of referencing a particular product type to inform strategy can be met with a form of skepticism from some practitioners – with comments like “you cannot do that, it’s about strategy first, not product”. Perhaps this reaction is due to unfamiliarity with the importance of annuities as a risk management tool globally and historically, or a perception that annuities are poor value for money (due to traditional annuities providing long-term investment guarantees in addition to longevity).

In the field of investments, cash is often regarded as an ‘risk-free’ benchmark for making decisions. Before investing in risky assets, investors assess the merits of taking on risk in the hope that they can do better than cash returns. Cash is used as a reference point for this decision.

Similar thinking can be applied to retirement income. With retirement income, the three main risks are: uncertain lifespan, uncertain inflation and uncertain investment returns. The asset that protects from all these is the traditional inflation-linked annuity. Retirees may be willing to take on risk in the hope that they can do better than this ‘risk-free’ income level, but it’s important to have a benchmark to measure expectations against.

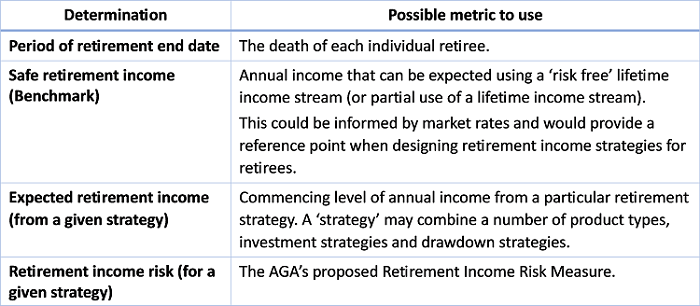

In 2018, the Australian Government Actuary (AGA) proposed an Income Risk metric that can apply to all retirement products, including the account-based pensions that most super funds currently offer in retirement. The risk metric is calculated by simulating projected year-by-year payments from a particular retirement strategy under a full range of market sequences. This gets compared with a benchmark level of income up to an age where the vast majority of the population would have passed away. The results from the simulations are summed up to give a single metric that captures market, inflation, and lifespan risk at once.

If an individual wants to be, say, 90% confident that their retirement income plan will last as long as they live, then they need it to last up until the age that gives them a 90% chance of covering their potential lifespan.

Maximising retirement income (in light of risk tolerance)

The highest expected retirement income (i.e. based purely on averages) might be to invest in growth assets and draw down savings to zero at life expectancy. But we need a framework for making informed decisions and trade-offs. A possible framework is as follows:

A lifetime annuity gives a benchmark ‘safe’ level of retirement income that other strategies can be compared against. Where a strategy involves taking on some risk, this should come with sufficient reward – in a way that reflects the retiree’s risk preferences and other needs. The Australian Government Actuary’s Retirement Income Risk Measure is a good example of how risk could be measured an assessed. It involves sophisticated stress testing through a full range of market sequences that retirees might experience.

Ultimately, a long-term risk-return framework is needed when designing retirement strategies.

Jim Hennington is a consulting actuary and specialises in retirement income and strategy. He is the Founder of Apricot Actuaries and an active member of the Retirement Incomes Working Group.