Introduction

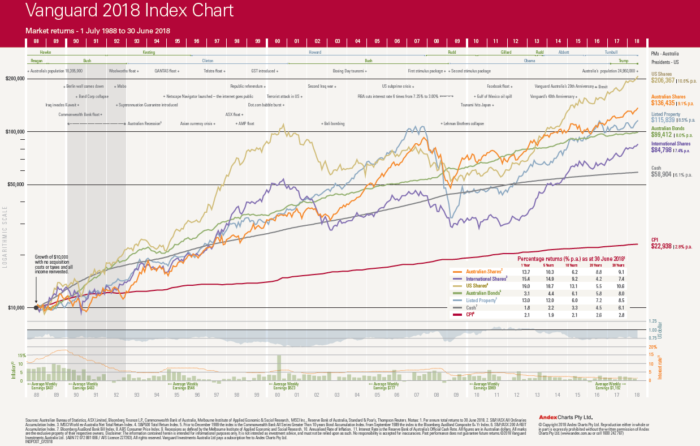

Editor's note: We like to share useful resources with our readers, and Vanguard has updated its Interactive Index Chart on this link.

It shows market performance of various asset classes since 1970, and allows the reader to compare the growth of $10,000 invested in these asset classes over historical periods.

Developing a plan

Buying your first home. Travelling the world. Enjoying a full and rewarding retirement.

When you invest, it’s important to have a plan in place to give yourself the best chance of achieving your goals. Without a plan, it’s easy to get distracted. You can end up trying to time the market, chasing performance and missing out on potential long-term returns. With a detailed and measurable plan, you know where you’re heading. Along the way, you don’t know exactly what each day will bring.

While you can’t control investment markets, there are things you can control when it comes to investing, such as focusing on the long term, diversifying your portfolio across asset classes, and making sure you don’t pay more than you need to invest.

Focus on strategic asset allocation

Building an investment strategy framework, one that aligns your risk profile with your investments, provides a solid platform for you to achieve your goals and expectations.

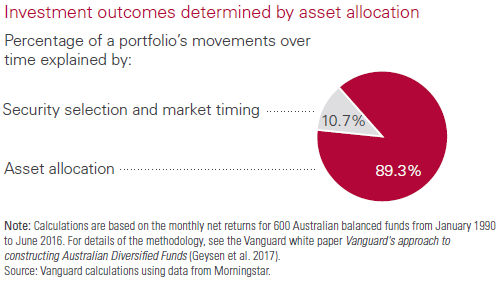

Research shows that the key to long-term investment performance is effective asset allocation. The chart below is from a study Vanguard conducted which looks at the returns of 600 Australian balanced funds across more than 25 years. It found that asset allocation was responsible for 89.3% of a diversified portfolio’s return patterns over time. This leaves only 10.7% for factors such as market timing or securities selection.

That’s why it is important to dedicate time to asset allocation decisions before you start investing. It can mean the difference between achieving your goals or simply aspiring to them.

Invest for the long term

Market cycles play out against a backdrop of economic, social and political events and many investors can’t resist trying to assign causes to every hiccup in the markets. But it’s often impossible to explain market activities until long after the dust has settled.

Markets are unpredictable and trying to time them means you must get two important decisions right: when to get out and when to get back in. This means there is a risk of having to pay a higher price to get back into the market, as well as missing out on the growth from any market recovery. Allowing emotions to drive investment decisions, be it overconfidence in rising markets or fear in falling markets, rarely serves investors well.

Historical market returns show that those who ignore the emotional swirl of short-term market conditions and focus on the long term are rewarded for their patience and discipline.

Diversify

The Vanguard Index Chart illustrates the benefit of diversifying investments across asset classes to help reduce volatility and smooth out returns over time. Diversification often starts by investing across different asset classes but it also includes holding a spread of investments within an asset class across a range of companies, industries and even countries.

While this strategy doesn’t protect a portfolio against negative returns, it does reduce the impact of poorly performing asset classes.

Keep costs low

All else being equal, investments with consistently low management fees and transaction costs can provide a head start in achieving competitive returns. Management fees create a drag on returns that can make it more difficult for a fund manager to add value. Factors such as high portfolio turnover within a fund can also lower its tax efficiency and drive up transaction costs.

The bottom line is—lower fees mean you get to keep more of your returns, which can help you earn more over time.

Click to enlarge

Our perspective on diversification

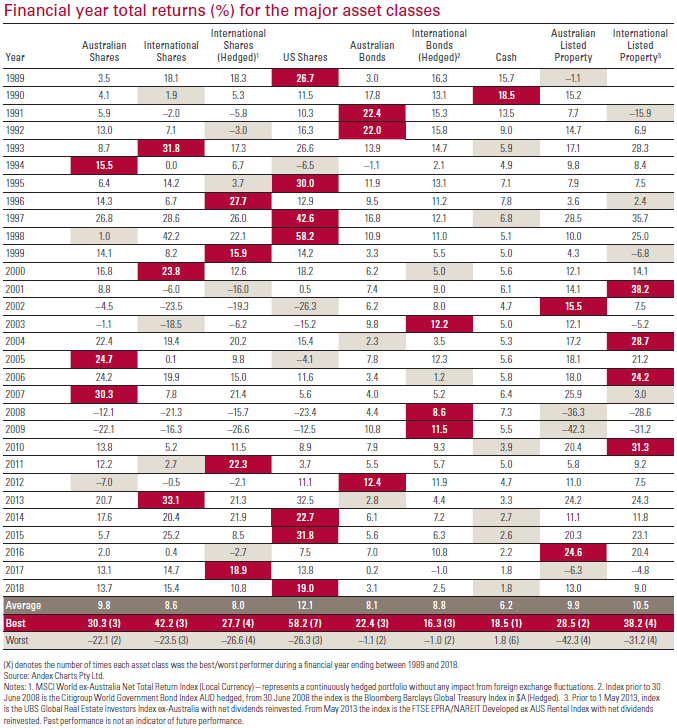

The table below shows the performance of various asset classes over the past 30 years.

When deciding where to invest their money, it is important investors understand that the best and worst performing asset classes will often vary from one year to the next. Having a diversified mix of investments across multiple asset classes can help smooth out returns over time.

The table also reinforces the importance of sticking to an investment strategy and focusing on the long term.

For example, the declining returns from international shares (hedged) in the 2016 financial year may have swayed investors to move out of this asset class in search of better returns elsewhere. In taking this option, investors would then have missed out on the 18.9% return in the 2017 financial year.

Vanguard’s Interactive Index Chart: tell the story your way

Build your own customised version of the Index Chart with 45-years of investment performance of major asset classes as well as key economic, social, political and demographic changes at vanguard.com.au/indexchart.

Robin Bowerman is Principal and Head of Corporate Affairs at Vanguard Australia, a sponsor of Cuffelinks. This article is general information and does not consider the circumstances of any individual.

For more articles and papers from Vanguard Investments Australia, please click here.