The healthcare and social assistance sector is an essential and growing industry, accounting for 8% of the Australian economy[1]. It is expected to see the biggest increase in share of government funding from 2022-23 to 2062-63, with government health spending per capita forecast to grow by 2.0% p.a. on an inflation-adjusted basis[2]. However, it’s not all smooth sailing, as evidenced by recent news of private hospital closures[3]. This article outlines the tailwinds and characteristics which continue to underpin healthcare’s compelling investment proposition and explains why we believe medical centres are the specific property exposure investors should prioritise.

Demographics

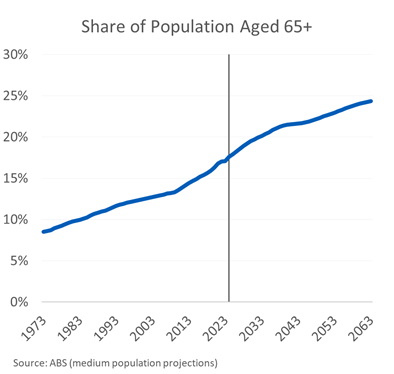

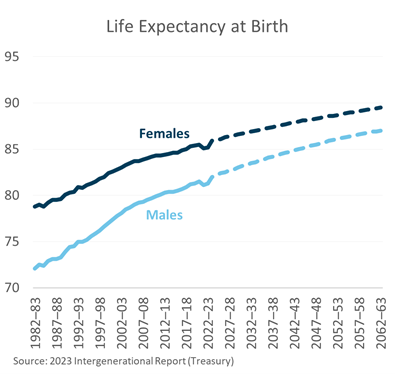

Growth in Australian healthcare is underpinned by several long-term demographic trends, which are spurring demand for care services. Firstly, Australia is forecast to experience the strongest population growth across developed economies over the next decade[4]. On top of broad-based population growth, there is an even more pronounced ‘population bulge’ now sitting in the 65+ age bracket due to the post-war baby boom. Life expectancy is also rising, up from 78 years (men) and 83 years (women) two decades ago to 81 and 85 today, with the rising trend expected to continue2. These factors mean the number of people aged 65+ will more than double and the number aged 85+ will more than triple over the next 40 years. As we live longer, the proportion of our lives lived in ‘full’ health is slowly declining, meaning a longer period of time where health services and care are needed per person.

Increasing disease prevalence

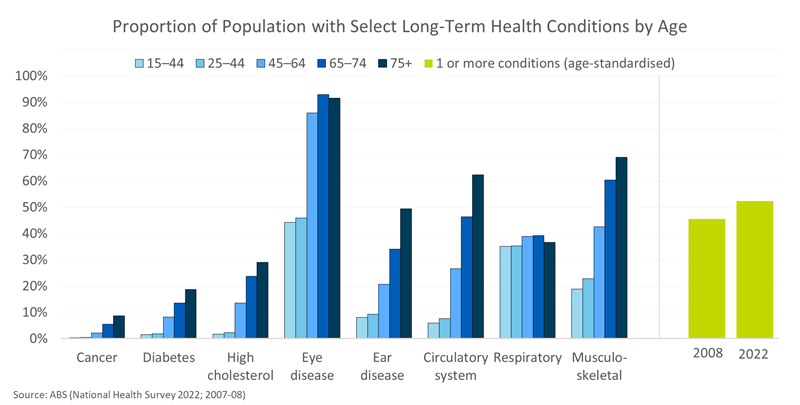

Naturally, an ageing population also means rising disease incidence and complexity. People aged 65+ currently account for 40% of government health spending despite being only 16% of the population2, with 95% of those aged 65+ having two or more chronic health conditions, compared to 59% of those aged 15-44[5]. This is being exacerbated by lifestyle factors, such as poor diets and lack of exercise, and improved medical detection and diagnostics, which are seeing the rates of disease incidence also increase on an age-standardised basis5.

Recession resilient

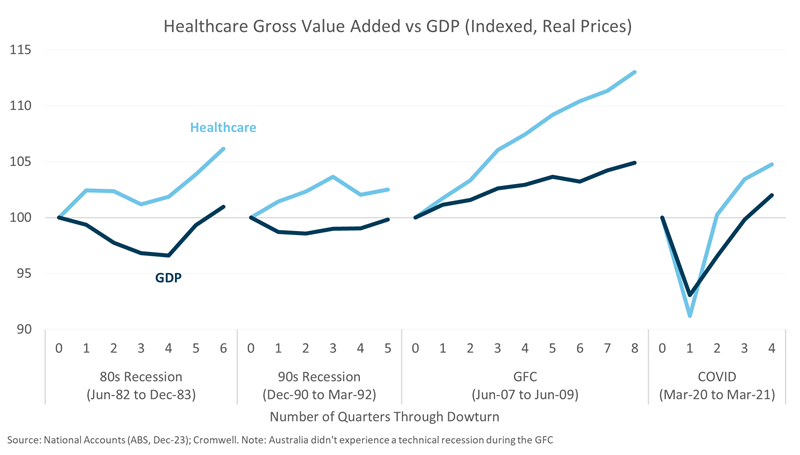

Healthcare is a defensive, necessity service resilient to changing economic conditions. Unlike other industries that rely on consumer demand or business cycles, healthcare is driven by the constant and growing need for essential health services, meaning healthcare activity expands more consistently and experiences fewer downturns. This has historically been the case even during periods of recession or global economic disruption. In fact, the healthcare sector recorded its weakest performance during the COVID-19 pandemic when most health services were shut down, but still experienced a sharper recovery than the broader economy.

Another key factor that supports the stability and resilience of the healthcare sector is reliable government funding. The state and federal governments fund over 70% of health expenditure in Australia[6], providing a consistent primary source of funding not exposed to economic, consumer or business sector fluctuations.

The resilient and consistent nature of underlying demand and funding are in turn positive drivers of healthcare property performance.

Getting the right exposure

Healthcare property encompasses a range of asset types such as hospitals, medical centres, and aged care. While demand tailwinds are strong and the overall sector provides attractive stability and diversification benefits, the careful selection of sub-sector is still crucial. There are several reasons why we believe medical centres offer the most favourable outlook and are the optimal healthcare property exposure for investors.

A necessary care model

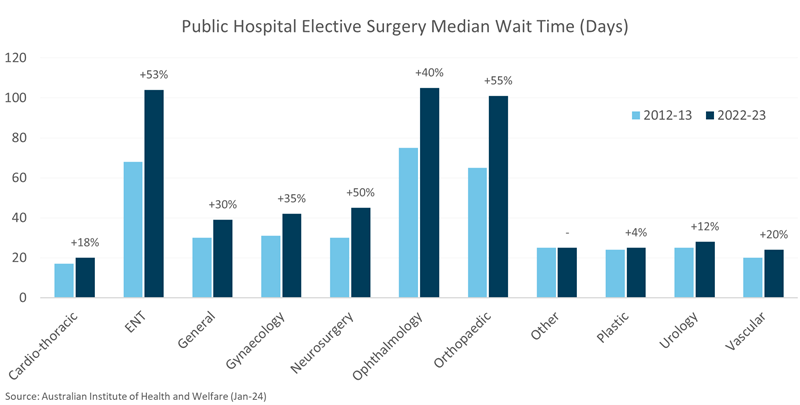

The supply of health services is struggling to keep up with demand, resulting in higher costs and longer wait times. There are inadequate financial and labour to improve care standards or wait times under the status quo – a more efficient and cost-effective system is required.

Part of the required shift includes moving treatment out of hospitals and towards GPs and other primary or secondary care facilities. Focusing on primary and out-of-hospital care can result in better health outcomes[7], reduced risk of infection and improved patient comfort, convenience, and satisfaction[8],[9]. From a funding perspective, out-of-hospital care can be cheaper due to lower overheads compared to when a hospital bed is occupied8.

Avoidable emergency department presentations are clogging the hospital system, with an estimated 1.9 million preventable patient days per annum from those aged 65+ alone[10]. It would be more appropriate to provide this care in an efficient, fit-for-purpose medical centre environment, saving costs and freeing up hospital resources for actual emergency care and complex cases.

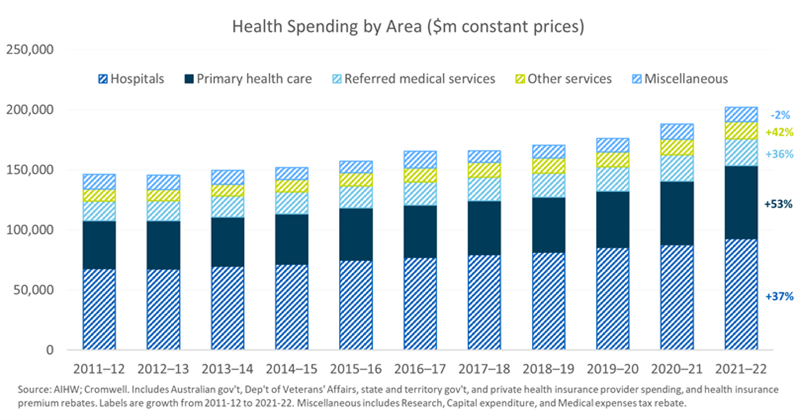

The shift from hospital to non-hospital care is already underway, evidenced by growth in primary healthcare spending outpacing spending on hospitals, as well as government policies putting greater emphasis on primary care and preventive health. For example, a $99 million Federal Government initiative to connect frequent hospital users with a GP to reduce the likelihood of hospital re-admission; $79 million to support the use of allied health services for multidisciplinary care in underserviced communities; and $3.5 billion to triple GP bulk billing incentives[11].

Attractive investment characteristics

In addition to demand and funding tailwinds, medical centres offer attractive investment characteristics:

- High-quality cashflow from a reliable tenant base

- Inflation hedging, via CPI-linked or fixed rental escalations

- Long leases, sometimes on a triple net basis

- Higher rates of lease renewal compared to traditional office[12]

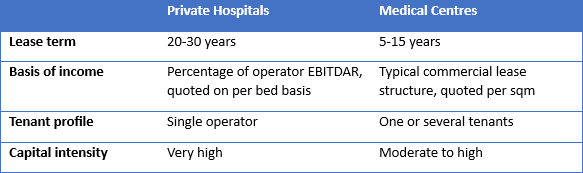

Compared to private hospitals, medical centres may be preferred due to deriving income from a typical commercial lease structure, rather than a percentage of operator EBITDAR. Land also typically comprises a greater proportion of asset value, which can provide downside protection and aid long-term development or change of use potential.

An increasingly important part of the healthcare landscape

Medical centres are an increasingly important part of the essential and growing healthcare industry, representing efficient and fit-for-purpose facilities that can help alleviate the capacity constraints of hospitals and improve the sustainability of the health system.

We believe medical centres’ alignment with demand trends and Government healthcare spending priorities, together with attractive investment characteristics such as CPI-linked income and defensive land holdings, puts them in a favourable position compared to other healthcare property investments.

Colin Mackay is a Research and Investment Strategy Manager for Cromwell Property Group. Cromwell Funds Management is a sponsor of Firstlinks. This article is not intended to provide investment or financial advice or to act as any sort of offer or disclosure document. It has been prepared without taking into account any investor’s objectives, financial situation or needs. Any potential investor should make their own independent enquiries, and talk to their professional advisers, before making investment decisions.

For more articles and papers from Cromwell, please click here.

[1] National Accounts, ABS (Dec-23)

[2] Intergenerational Report 2023, Commonwealth of Australia (Aug-23)

[3] Ramsay Health Care warns of hospital closures as costs blow out, AFR (Feb 29th, 2024)

[4] 10-year average growth from 2024-33 based on UN median population projections for ‘More Developed Regions’ excl. Holy See

[5] National Health Survey 2022, ABS (Dec-23)

[6] Health expenditure Australia 2021-22, AIHW (Oct-23)

[7] How much of Australia’s health expenditure is allocated to general practice and primary healthcare?, M. Wright; R. Versteeg; K Gool (Sep-21)

[8] Out-of-hospital models of care in the private health system, Australian Medical Association (Oct-23)

[9] There’s no place like home: reforming out-of-hospital care, Private Healthcare Australia (May-23)

[10] Health is the best investment: shifting from a sickcare system to a healthcare system, Australian Medical Association (Jun-23)

[11] Federal Budget 2023-24, Treasury (2023)

[12] Exploring Australian healthcare opportunities, JLL (Jun-22)