The Good

In February 2017, Home Care Packages underwent major reform, giving consumers the ability to choose their home care provider, direct funds to the services they want and need, and wield the ultimate consumer power – the ability to move from one provider to another.

Without a doubt, the best thing about Home Care Packages is that they enable people to stay in their own home and community, whether that is a family home, an apartment, a caravan park, a retirement community, a granny flat, or other living arrangement.

For the most part, Home Care Packages are affordable. The Basic Daily Fee is set at 17.5% of the age pension, or $10 per day. The need to contribute beyond this amount is based on the person’s income with the fee calculated at 50c per dollar in excess of the threshold and capped at $10,627 per year. For people of limited means (or good negotiating skills), the Basic Daily Fee can be negotiated with the provider.

(For more details on the fees applicable to Home Care, see ‘Home is where the care is’).

The Bad

With the increase in choice and control comes an increase in responsibility to understand the fees and charges that apply, potentially negotiate some of them, and pick a provider. While this may seem fair and reasonable, the fee schedules can be mind-boggling with call out fees, different rates for the same service at different times of the week or day, and minimum periods. The fees and charges vary from one provider to the next, and for consumers who want to compare one provider with another, it can be an almost impossible task.

In addition to the cost of their ongoing care, consumers need to be aware of and factor in the cost of an exit fee if they move from one provider to another. Many providers don’t charge exit fees. Some providers, however, charge an amount that covers the cost of the administration involved usually around $500, while at least one has an exit fee in excess of $4,000.

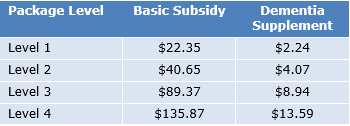

The funding provided through a Home Care Package is based on the level of the package the consumer receives, as shown in the table below.

Home Care Subsidy Daily Rates (1 July 2017 – 30 June 2018)

Additional supplements are paid for people with special care needs such as oxygen and enteral feeding.

Home Care Funding is simply an allocation of monies, but the money may not cover the cost of care. In many cases, people find that they need to ‘top up’ their package with private care.

The Ugly

Unfortunately, many consumers still view Home Care as a ‘slippery slope into a nursing home’ and delay accessing services. The expectation is they will get it when they really need it. The reality is that demand is increasing and the number of people waiting for a package is greater than those receiving one.

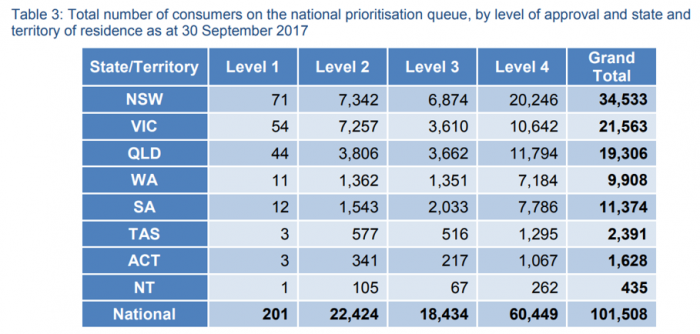

Between March and September 2017, the average number of approvals jumped from 401 to 497 per day. The majority of approvals are for people with higher care needs (Levels 3 and 4).

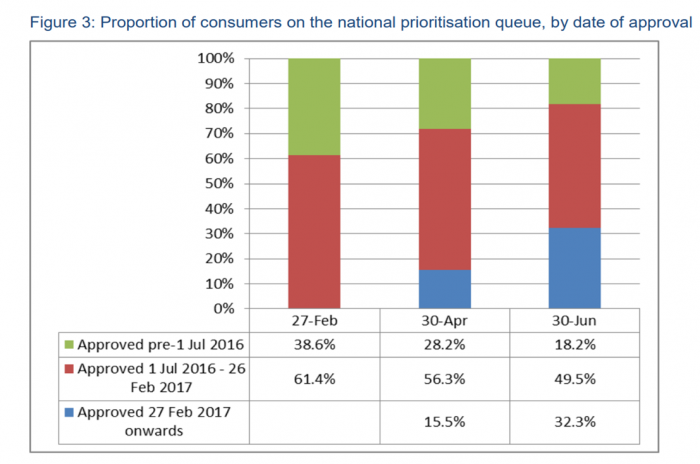

These approvals are adding to the growing number of people on the national prioritisation queue, which was up from 88,904 on 30 June 2017 to 101,508 on 30 September 2017.

Of the 101,000 in the queue, around 41,000 have an interim package which is below their assessed care needs. The other 60,000 are waiting with no interim package at all.

While 101,000 people are waiting, only 72,000 are actually getting a package and the queue is growing (data from the Reference Home Care Packages Program Report, Department of Health).

The bottom line is that the wheels turn but in some cases, they turn very slowly. Consumers can expect to wait for the ACAT assessment (to determine eligibility and package level), wait for the approval, and then wait for the Home Care Package. At the end of it all, maybe a Home Care Package lower than the assessed need may be made available.

The role of the adviser has never been so broad or so valuable. Crunching the numbers on the contribution to the Home Care Package is possibly the least valuable component. The real value is in the knowledge the adviser has of the system and helping the client navigate the various aspects and to come out the other end with access to the care they need that is also affordable.

Rachel Lane is the Principal of Aged Care Gurus and has co-authored a number of books including ‘Aged Care, Who Cares?’ with Noel Whittaker. This article is general information only.