Netflix’s operating profit increased from US$800 million in 2017 to ~US$10 billion in 2024. We see the potential for this to triple to US$30 billion over the next decade as streaming continues to take share of video viewership and Netflix leverages its leadership position and executes growth strategies to sustain its industry-leading scale.

Scale is critical for video streaming platforms whose largest expense is content, for which the marginal cost of viewership is close to zero. Platforms with greater scale can invest in high-budget, high-profile films and series, offer more diverse content by genre and region, and take more shots on goal in a hit-based industry where Squid Game and The Tiger King can achieve unexpected success.

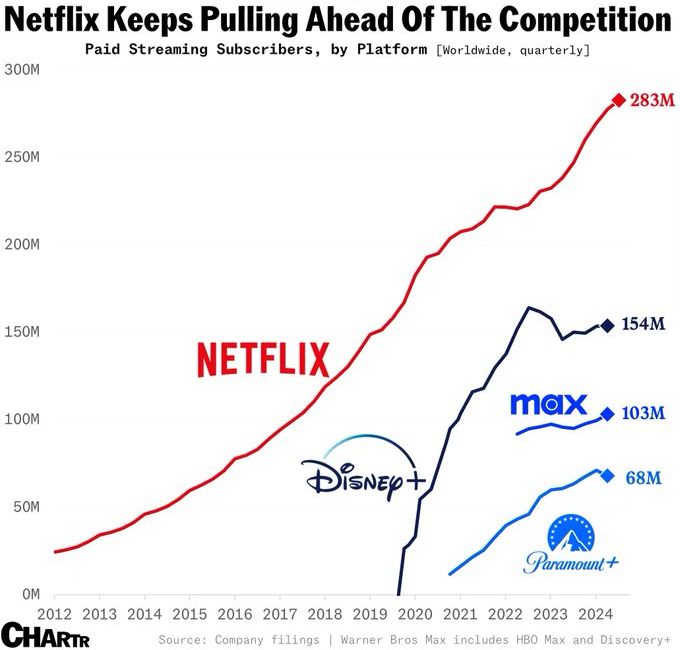

Measured across revenue, unique subscribers or engagement, Netflix has 2-4 times the global scale of streaming rivals1 including Disney and Warner Bros Discovery. Netflix’s scale advantage has been expanding as it continues to improve its offering and monetise password sharers while peers have lifted prices and pulled back on content and marketing spend in the pursuit of profitability. In 2024 Netflix added ~30 million subscribers vs ~15 million for each of Disney and Warner Bros Discovery’s HBO Max. Looking forward, we expect Netflix to drive further scale through the strategic expansion of its content budget and growth in its ad-supported offering.

Netflix spends ~US$17 billion a year on content, a figure we expect to grow by ~US$1 billion a year. We expect a growing proportion of this budget will be allocated to content franchises, event television and local content.

Being a relative newcomer to the media industry, Netflix owns a limited amount of recognisable IP or content franchises. However, as a small proportion of Netflix’s original content breaks through each year, Netflix can increase its annual spend on established IP or returning seasons of popular shows like Bridgerton, Stranger Things, Emily in Paris and Night Agent that offer proven engagement, and schedule their release to minimise subscriber churn. Netflix’s fostering of IP and content franchises is also a prerequisite should it seek to operate entertainment parks in the future, a large source of profits for Disney and Universal Studios.

While not without its critics, the Tyson vs Paul boxing event garnered over 100 million views globally, demonstrating Netflix’s unique ability to aggregate live viewership across a large and diverse subscriber base. This unique ability is attractive to partners like sports leagues and celebrities seeking to grow their own audiences. As a result, partners are open to creating such events by carving out special packages and less focused on extracting the maximum near-term economics. For example, Netflix’s NFL Christmas Gameday was a win for the NFL in terms of showcasing it to a younger and more global audience, and a win for Netflix in terms of growing mindshare with older male audiences in the US where it under indexes. We expect Netflix to invest in more win-win event television to deliver targeted subscriber growth and reduce churn.

Local content is another area where we expect to see disproportionate investment by Netflix in the years ahead. Netflix expanded into international markets well ahead of Hollywood peers and has used that head start to understand the taste of local audiences, build local content development capabilities where costs are often much lower, and establish itself as one of a handful of relevant streaming services alongside local competitors in many markets. This positioning and increasing investment will be critical to sustaining Netflix’s subscriber growth and scale advantage vs peers in the years ahead given the relative maturity of English-speaking markets like the US, the UK and Australia.

Another driver of subscriber and revenue scale for Netflix is its ad-supported tier. The introduction of the lower-priced ad tier in 2023 meaningfully expanded Netflix’s addressable customer base and has been a key contributor to recent subscriber growth with the ad tier accounting for ~50% of sign-ups in markets where it is available and growing to represent 10% of all subscribers. While having been a drag in 2024, Netflix’s ad tier will be an important driver of per-member revenue growth in the coming years through higher engagement, better advertising capabilities and increases in ad load from a very low base.

Source: Morningstar.com

Despite a favourable view of Netflix’s long-term earnings potential as it continues to scale, there are risks to this outlook and profits rarely progress in straight lines. Key risks for Netflix include subscriber growth moderating more than expected as the tailwind from the reduction in password sharing fades, a closing of the gap by competitors due to sustained strong execution and the release of highly popular content, and the recent strengthening of the USD that affects revenue and margins.

1Excludes YouTube, which has comparable viewership but is predominantly user-generated content and less scalable due to revenue share agreements with creators.

Sources: Company filings

Ryan Joyce, CFA is a Portfolio Manager and Sector Head of Financials and Technology at Magellan Group, a sponsor of Firstlinks. This article has been issued by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 (‘Magellan’) and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs.

For more articles and papers from Magellan, please click here.