Although financial markets are averse to uncertainty, there has been a remarkable lack of volatility recently. Is this the calm before the storm?

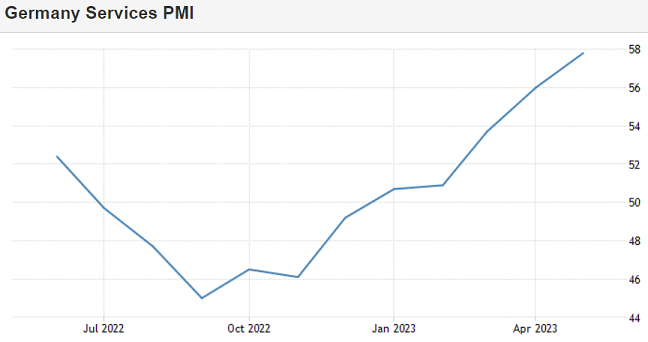

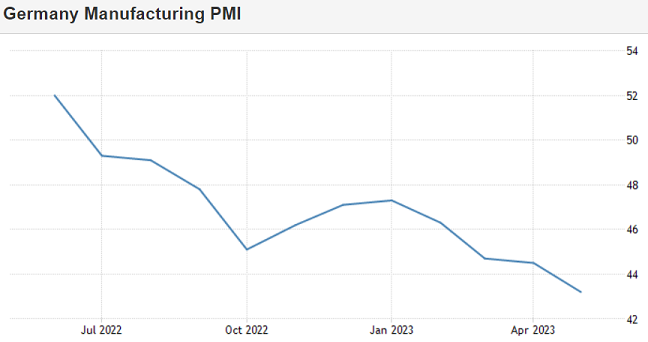

Take the stark divergence between services and manufacturing Purchasing Manager Indexes (PMIs). This trend is present globally, but nowhere is the divergence larger than in Germany, a historic bellwether for the global economy. In May, the German Services PMI rose to a strong 57.8 whilst the Manufacturing PMI declined further to a lowly 42.9, with a reading above 50 indicating an expansion and below 50 a contraction.

Source: tradingeconomics.com

In normal cycles, Manufacturing PMIs are a good leading indicator of what will happen to the broader economy. But it’s fair to question if this is a good indicator this cycle, given the magnitude of the divergence and desynchronisation. One read is that the manufacturing weakness is just a hangover from the pull forward of goods demand during COVID, and therefore, merely a rebalance in the composition rather than a broader slowing in the economy. Another read is that services strength will soon roll over as the lagged effect of monetary policy works its way through the system.

The path of inflation and the impact on interest rates will likely provide the answer to this question.

The current interest rate hiking cycle has been one of the steepest on record. Yet despite this, a question remains whether the economy has become less sensitive to interest rate increases. On the surface, households and corporates have been able to navigate the pressures relatively well with growth sustaining and retail sales is slowing but not collapsing. But there are signs of cracks. The Silicon Valley Bank collapse and Credit Suisse takeover were a clear signal that the hiking cycle has exposed some frailties in the system.

Further rate rises will amplify the pain

In Australia, the real pain of interest rates is yet to be felt. Westpac commented in May that only 8 of the 11 interest rates increases had been passed onto borrowers thus far. On top of this, we are right at the precipice of the fixed rate cliff where the majority of borrowers lucky enough to lock in 2% mortgage rates will reset to 5-6%. With the last couple of interest rate rises, the cacophony of complaints has grown noticeably louder indicating the pain threshold has been reached. Further rate rises will only amplify this pain.

Whether the RBA is done raising rates for this cycle will come down to the usual suspects: inflation and employment. Whilst growth has slowed from the dizzying pace of 2021, employment continues to hang in there at record levels. As immigration returns there is likely to be some easing in employment markets. Some companies are telling us that positions they have had open for 18 months have all been filled in the last few months and that poaching of staff by competitors has also dried up.

On the inflation front, it looks increasingly clear that headline inflation has peaked in the US and Australia is following with a lag. But it is the core or underlying inflation that remains a problem. It is the services element of the economy, the non-discretionary items like haircuts, dentist, and childcare, which remains stubbornly high. This is translating directly into wage growth and risks fuelling a wage-inflation spiral. The recent Federal budget will only add to these pressures with large handouts to the people that need it and will spend it.

Putting this together, it means that even if we are close to the peak in interest rates, they are unlikely to be cut quickly. Unless economic conditions become dramatically worse.

Consumer staples are attractive

Either way, the consumer is likely to be under sustained pressure. Whilst some consumer discretionary stocks might be pricing in a consumer recession, many of them have not seen the downgrades to earnings that would be expected before there can be comfort that the cycle has bottomed. Especially considering the huge pull-forward of goods demand that occurred during COVID. Do you really need another coffee machine or big screen TV now?

Consumer staples are far more attractive in the current environment. Everybody needs food and drink. If you've got to go to the hospital, you've got to go to the hospital, even more so now considering the number of surgeries that were postponed over COVID. Insurance is another non-negotiable, especially in light of the amount of natural disasters Australia has seen recently. So, people will spend on these essentials regardless of inflation.

Despite this uncertainty, Australia is well placed in the global context. Firstly, the RBA has been more cautious than their Central Bank peers in raising rates, such that Australia has the lowest real interest rates amongst the major economies. Secondly, growth should continue to outpace the global averages supported by our linkages with a reopening China and abundance of natural resources. Thirdly, the Australian banking system is arguably the strongest globally, and unlikely to see significant contagion from events in the US or Europe. This is critical in periods of slower growth as weak banks lend less and further constrain growth. Finally, Government policies are generally expansionary with strong immigration inflows a key highlight.

The importance of immigration should not be under-estimated. Australia’s 29 year run without a recession is the stuff of legend, even able to navigate the Global Financial Crisis without falling into recession - on aggregate. However, what many don’t realise is that Australia did experience a technical recession in 2009 on a GDP per capita basis. It was only the growth in population from immigration that saved us.

Small caps look cheap

Contrary to this supportive growth backdrop, the ASX 200 has been one of the worst performing equity markets year to date. This has left the Australian market looking good value, trading in line or below historic average multiples. Small caps look particularly compelling, having underperformed their large cap peers by 15% over the last two years, and having the tendency to perform well in a cyclical recovery. The value is also being recognised by corporates, with the amount of takeover activity picking up recently over a wide variety of sectors, from utilities to resources and consumer.

So, while there is great value to be had in certainty, opportunities to take advantage of the robust growth in Australia are emerging which we expect will help set up the market when the cycle turns.

Casey McLean is a Portfolio Manager for the Fidelity Australian Opportunities Fund. Fidelity International is a sponsor of Firstlinks.

This article is issued by FIL Responsible Entity (Australia) Limited ABN 33 148 059 009, AFSL 409340 (‘Fidelity Australia’), a member of the FIL Limited group of companies commonly known as Fidelity International. For more information about Fidelity Australia please visit www.fidelity.com.au. This article is provided for general information purposes only and is not intended to constitute advice of any kind. To the maximum extent permitted by law, no responsibility or liability is accepted for any errors or omissions or misstatements contained in this media release.

© 2023 FIL Responsible Entity (Australia) Limited. Fidelity, Fidelity International, the Fidelity International logo and F symbol are trademarks of FIL Limited.

For more articles and papers from Fidelity, please click here.