With the RBA cutting the cash rate for a second time this year in May and the expectation for further rate cuts to come, is now the time to be investing in small caps?

The rate cut in May combined with the pause on tariffs by the Trump administration saw markets rally in May with the S&P/ASX Small Ordinaries Accumulation Index outperforming large caps. The index increased 5.8% in May with a number of small and mid-cap managers outperforming the market. While Small Industrials were up in May, it was Small Resources that drove the performance of the Small Ordinaries Index with the S&P/ASX Small Resources Accumulation Index up 10.1%.

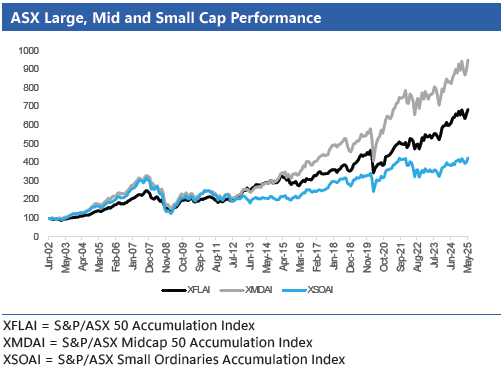

Small caps have lagged large and mid-caps for quite some time now as is highlighted by the below chart. If we were to take a look at the period since May 2022, which is when the RBA started its rate increase cycle, large caps have been the best performers followed by mid-caps, and small caps have lagged.

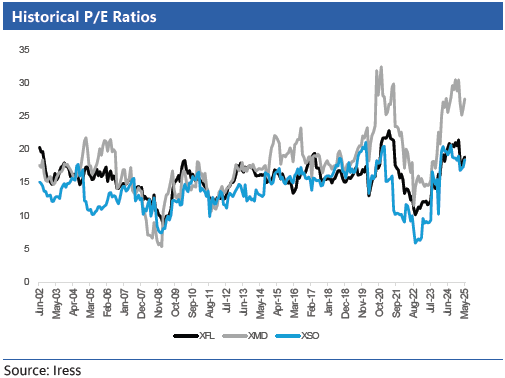

Small caps have been trading at lower multiples for much of this period as is shown by the historical P/E ratios for large, mid and small caps. However, the P/E ratio of small caps has recovered and was only slightly below large caps as at 31 May 2025. We note that there is significant dispersion in the P/E ratios amongst both large and small cap stocks. Mid Cap multiples have expanded the most since 2022, contributing to the outperformance of this segment of the market.

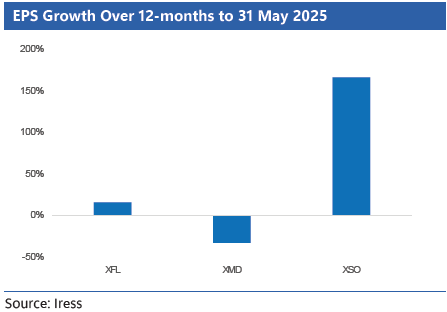

When looking at the EPS trends for each of the market segments, small cap EPS has improved the most over the last 12 months after being hit the hardest in 2023. This compares to mid-caps, the EPS of which has declined over the last 12 months. Further interest rate cuts may see this trend continue which may propel the performance of small caps.

Trade ideas

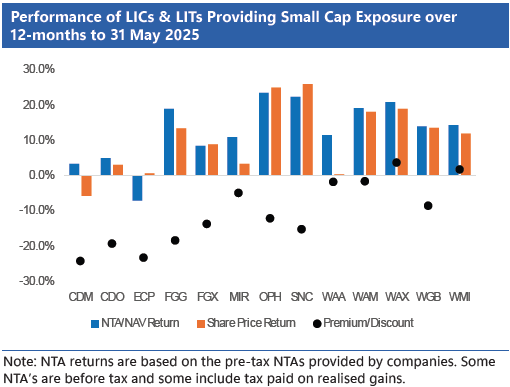

Below we take a look at LICs and LITs rated by our firm that provide exposure to small caps and may be worth further consideration from investors. We would expect relative outperformance of small caps to have a positive impact on discounts as demand for this segment of the market increases.

The below does not constitute investment advice. We are simply providing ideas for further consideration by investors. Investors should consult with their investment adviser when considering investments to ensure they fit the risk and return requirements to meet the needs and objectives of individual investors.

The below chart shows the performance of the IIR rated LICs and LITs that provide exposure to small caps over the 12 months to 31 May 2025 and the premium/discount as at 31 May 2025. We have included LICs and LITs that provide exposure to domestic and global small caps with small caps underperforming large caps globally in recent years.

There have been some standout performers over the 12 month to 31 May 2025 from the LICs and LITs included in the above chart. The NTA/ NAV return of 7 of the 13 LICs and LITs outperformed the S&P/ASX 200 Accumulation Index over the period and 9 of the 13 LICs and LITs outperformed the S&P/ASX Small Ordinaries Accumulation Index. We take a look at some of the LICs and LITs in more detail below.

Future Generation Global Limited (ASX: FGG)

FGG provides exposure to a portfolio of global funds managed by a range of asset managers. The Managers have a range of investments styles including long only, absolute return and quantitative. While FGG is exposed to an all-cap portfolio, the portfolio has historically been overweight mid and small caps.

FGG is a philanthropic vehicle whereby the managers forego management and performance fees and FGG donates 1% of the average NTA in a financial year to a selection of charitable causes. In addition to donating to charity, investors reap the benefits of any fee savings in excess 1%.

FGG’s NTA performed strongly over the 12 months to 31 May 2025 returning 19.0%. While shareholder returns also increased, they lagged the NTA over the period. This has resulted in FGG trading at a material discount as at 31 May 2025.

The discount provides exposure to a portfolio that has an overweight exposure to global mid and small caps. The underweight exposure to large and mega cap stocks has been a drag on the relative performance of the portfolio in recent years, however the relative returns are expected to improve in the event mid and small caps outperform. The diversified exposure by manager and investment style has resulted in the portfolio having lower volatility than the broader global equity market. This may appeal to those investors seeking some capital preservation given the expectation of market volatility to continue in the second half of this year.

Future Generation Australia Limited (ASX: FGX)

Like FGG, FGX is also a philanthropic vehicle whereby the managers forego management and performance fees and FGG donates 1% of the average NTA in a financial year to a selection of charitable causes. In addition to donating to charity, investors reap the benefits of any fee savings in excess 1%.

FGG provides exposure to a portfolio of managers focused on the domestic market. FGX has also historically had an overweight exposure to mid and small caps which has been a contributor to the underperformance to the broader domestic market over the 12 months to 31 May 2025, however since inception the NTA has had periods of strong returns relative to the broader market.

FGX is trading at an elevated discount providing attractive opportunities for investors to take advantage of improved relative performance in the event mid and small cap stocks outperform with the portfolio historically delivering returns with a lower volatility than the broader market.

Mirrabooka Investments Limited (ASX: MIR)

MIR provides exposure to a portfolio of ASX ex-50 stocks. The Company completed a 1-for-7 Entitlement Offer in June, raising ~$85 million. The Offer was oversubscribed with shares under the Offer issued at $3.06. The Offer price represented the average pre-tax NTA from 4 April to 2 May 2025. The rebound by the market in May saw the Offer price become very attractive, providing shareholders the ability to acquire shares at a discount to the share price and NTA.

MIR is currently trading at levels around NTA and at times at a slight discount providing investors the opportunity to gain exposure to a portfolio that has outperformed its benchmark over the long term and consistently performed strongly relative to its peers. There have been limited opportunities in the last decade to invest around par with the Company trading at material premiums for prolonged periods of time.

Ophir High Conviction Fund (ASX: OPH)

OPH delivered the best NAV/NTA performance over the 12-months to 31 May 2025 with NAV increasing 23.5%. Unitholder returns were also strong, slightly outperforming the NAV return, increasing 25%. The portfolio has been volatile to start the year which is often the case with concentrated portfolios. The portfolio delivered an uplift in May 2025 of 11.5%, contributing to the strong 12 month figure.

Despite the unit price increasing more than the NAV over the 12-month period, the Trust continues to trade at an elevated discount. We view discounts as attractive investment opportunities for investors seeking exposure to a Manager that has outperformed the market over the long-term.

Sandon Capital Limited (ASX: SNC)

The SNC portfolio performed strongly in the 12 months to 31 May 2025, being the second best performer of the LICs and LITs in the above chart.

SNC provides a highly differentiated exposure to the market with a deep value focus and activist approach. SNC’s portfolio has a low beta compared to the domestic market and has historically delivered the capital preservation in down markets you would expect from a deep value strategy. Given the nature of the strategy, an investment in SNC is for patient, long-term investors.

Buying at elevated discounts has been fruitful for some investors with investors taking advantage of the extreme discounts during the COVID market benefiting from a narrowing of the discount. The Company does have limited liquidity and this is a consideration for investors, however is an investment worth considering for those looking to diversify their portfolio from the potential heightened market volatility.

WAM Global Limited (ASX: WGB)

WGB provides exposure to a portfolio of global undervalued growth stocks. While the Company invests in large caps, the portfolio is typically overweight mid and small caps. This overweight exposure has been a contributor to the portfolio lagging the broader global market.

Given the overweight exposure to mid and small caps, the rotation into this segment of the market is expected to bode well for the WGB portfolio. Improved relative performance is expected to have a positive impact on the discount, which has narrowed in 2025 to date and as such may be worth further consideration for those investors with a bullish outlook for the smaller-end of the global market.

Concluding Remarks

The RBA already cutting rates twice in 2025 and further rate cuts forecast on the back of moderating inflation is expected to be a catalyst for small cap stocks. Improved relative performance may see increased demand for this market segment which is expected to have a positive impact on discounts and presents an opportunity for investors to enhance their returns through a narrowing of discounts.

Investors should make sure to do their due diligence and make sure a manager’s investment style and mandate fits within their risk and return requirements. While small cap stocks may be a beneficiary of rate cuts, there is also expected to be heightened market volatility as growth in the global economy slows and uncertainty surrounds policies implemented by the Trump administration.

Claire Aitchison is Head of Equities & Funds Research at Independent Investment Research. This article is general information and does not consider the circumstances of any investor.

For a copy of the full report, see the Firstlinks Education Centre or this link.