No sooner have global markets digested the Brexit decision and the election of Donald Trump as US President (arguably ‘Brexit Mark 2’), another risk event now looms on the horizon: Italy’s constitutional referendum on 4 December. Should voters reject the referendum, it could lead to further weakness in the Euro and an extension of accommodative central bank policy – both of which could, perhaps perversely, aid European equities, at least on a currency-hedged basis. European concerns could also add to the Trump-related upward pressure on the US dollar.

Italy’s referendum: The growing risk of a ‘No’ vote

In a bid to make the passage of (often tough) economic reforms easier through the Italian Parliament, Prime Minister Matteo Renzi has proposed constitutional changes to effectively reduce the ‘blocking’ power of the upper house Senate. The referendum is scheduled to take place on Sunday 4 December, and Renzi has threatened to resign if the constitutional amendment is not passed.

At this stage, however, the polling suggests the ‘no’ vote is in the lead, not helped by the fact that major opposition parties, such as Berlusconi’s Forza Italia, the populist 5 Star Movement (run by a well known comedian!), and the right-wing Northern League party, don’t support the change. The actual measures proposed are quite complex, and in light of the anti-elite backlash that has been recently evident in the UK and the US, a ‘no’ vote seems likely.

Should the ‘no’ vote prevail, Italian political risks are likely to intensify. For starters, should Renzi resign as promised, it would usher in a caretaker government and bring forward national elections from 2018 to next year. Based on current polling, moreover, there is a strong risk that the 5 Star Movement could be the lead party in any post-election government. The 5 Star Movement’s current political aims include re-negotiation of Italy’s debt and a referendum on Euro-currency membership.

In fact, Italian risks are already being reflected in a widening in the yield spread between 10-year Italian and German government bonds.

Adding to the potential European turmoil, both the Netherlands and France have national elections in March and April/May respectively next year, with a growing risk that populist ‘anti-EU’ parties could take power in either country. Germany also holds its own national election in September 2017, where immigration issues are likely to figure prominently.

Implications for the Euro and equities

There is a growing risk that ‘Euro break-up’ fears could again wash through Europe in coming months, which would have negative implications for the Euro. A surge in political jitters, moreover, would make it even less likely that the European Central Bank will taper its quantitative easing programme anytime soon. Somewhat perversely, however, a weaker Euro and ongoing ECB stimulus could aid European equities, particularly in the export power-house of Germany.

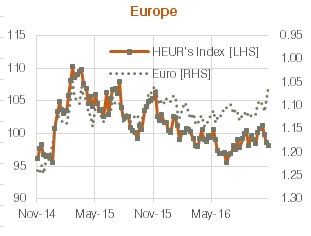

As seen in the chart below, the Index that the BetaShares WisdomTree Europe ETF – Currency Hedged (ASX:HEUR) aims to track outperformed against the main global share index the last time there was significant Euro weakness in the first months of 2015. Since mid-2016, there has again been some global outperformance by this Index, though this has been partly unwound in recent weeks despite continued declines in the Euro. It remains to be seen whether the benefits of Euro weakness on European equities outweighs the drag from heightened political risk as we head into 2017.

HEUR’s Index performance vs. MSCI All-Country World Index (currency hedged)

Source: Bloomberg. Past performance is not an indicator of future performance

Either way, given that European equities appear most likely to outperform in periods when the Euro is weak (based on the above chart), it would make sense to seek such exposure on a currency-hedged basis.

David Bassanese is Chief Economist at BetaShares. BetaShares is a sponsor of Cuffelinks, and offers risk-managed Exchange-Traded Funds listed on the ASX such as HEUR. It contains general information only and does not consider the investment circumstances of any individual.