When speaking with fellow investors and finance professionals, I am surprised by how often I am told that hedge funds are more risky than equities. This article offers thoughts on why I think this belief is largely incorrect.

It is not possible to say categorically that hedge funds are more risky than equities or not, because the hedge fund universe is heterogeneous and different funds run different levels of risk that could be above or below that of equities. In my experience however, the majority of hedge funds run levels of risk that are far below that of equities, using most definitions of risk.

What risk is being measured?

It is also important to define ‘risk’ and how it can be measured. Most risk measures are based on historical returns and don’t say much about the actual risk that was taken to produce the observed return. A one dimensional number based on historical performance (such as return or volatility) only takes account of the single outcome instead of the range of possible outcomes that could have occurred. To put it another way, an asset that generated a positive return was not necessarily less risky than another asset that generated a negative return over the same period.

We prefer to take a multi-dimensional view of risk and find it counter-productive to reduce risk to a single number. The main risk faced by investors is the permanent impairment of capital and this is what we aim to protect against. Although it is beyond the scope of this short article, hedge funds are subject to a different set of risks (as a result of using leverage and shorting for example), which are not easily comparable to long-only managers. That said, just because a hedge fund uses leverage or sells short doesn’t automatically make it riskier than equities. In most cases the managers use these techniques to reduce rather than increase risk.

The perception of large hedge fund losses is almost certainly due to negative press coverage of a very limited number of failures or frauds. These extreme examples were typically avoided by the more astute hedge funds and are not consistent with our history of investing in hedge funds. Of course, if an investor had too high a percentage of their portfolio in any vehicle that failed it would be devastating, but to extrapolate that specific experience to the entire universe is like refusing to invest in equities because HIH Insurance failed.

This article compares the performance of the Ibbotson Alpha Strategies Trust, which is an actual portfolio of hedge funds (Hedge Fund Portfolio) after all fees, against the S&P/ASX 200 Accumulation Index (ASX 200) which is fee-free and outperforms the average long-only manager. This removes the impact of survivorship bias and other factors that are often cited as providing an artificial boost to the hedge fund indices, and also gives a slight boost to the equity portfolio.

Different methods of examining losing periods

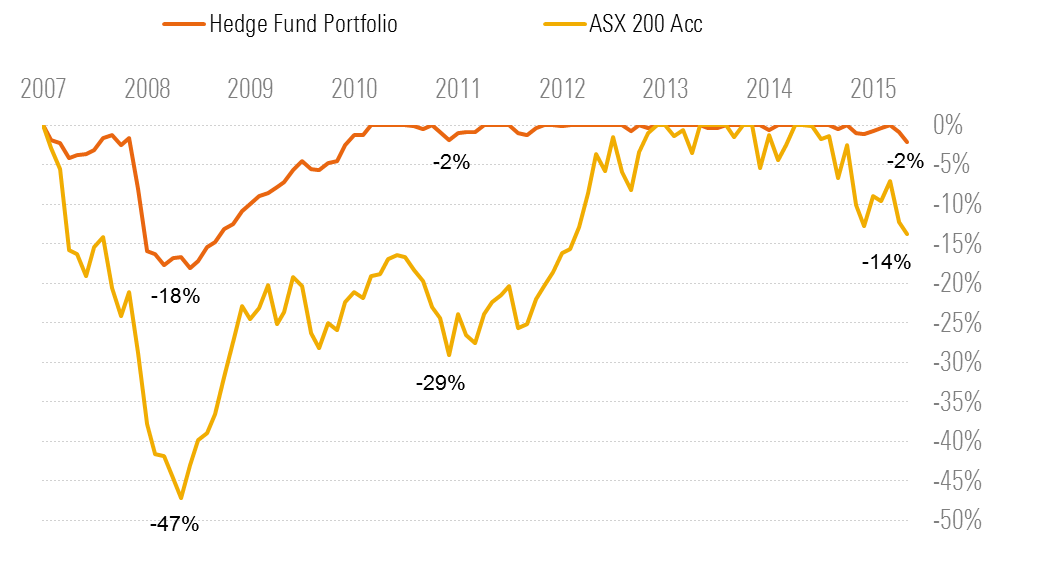

Figure 1 is a drawdown chart, which shows the total losses sustained by the Hedge Fund Portfolio and the ASX 200 since the launch of the Hedge Fund Portfolio in late 2007. During the GFC, the Hedge Fund Portfolio lost a little over 18% whilst the ASX 200 lost 47%. If you consider capital loss as a measure of risk, the Hedge Fund Portfolio has been substantially less risky than the ASX 200 during all losing periods for the ASX 200.

Figure 1: Drawdowns for the Hedge Fund Portfolio and ASX 200 since October 2007

Minimising capital losses is crucial for any investor. It leaves a larger pool of capital to generate future returns. From the GFC low, the Hedge Fund Portfolio recovered its losses in 21 months whilst the ASX 200 took almost three times as long, 55 months, despite the ASX 200 having a far higher average return over the period (and the ASX 200 Price Index remains more than 20% below its 2007 high after more than eight years). If you consider time to recover your losses as an important risk, the Hedge Fund Portfolio was substantially less risky than the ASX 200.

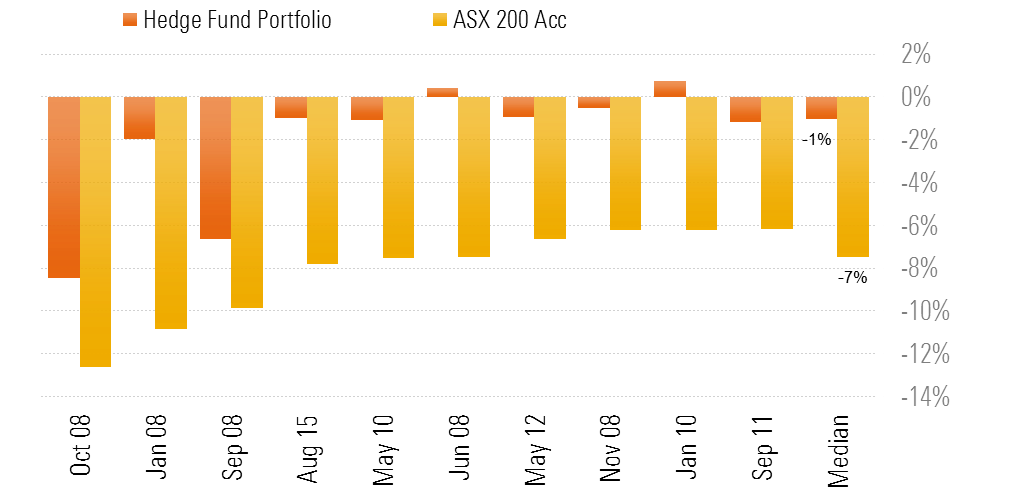

Figure 2 looks at performance during difficult periods in another way, by comparing the performance of the Hedge Fund Portfolio to the ASX 200 during the 10 worst months for the ASX 200 since late 2007. The graph shows that the median loss for the ASX 200 over this time period was 7% whilst the median loss for the Hedge Fund Portfolio was around 1%.

Figure 2. Performance of the Hedge Fund Portfolio and the ASX 200 during the 10 most difficult months for the ASX 200

Returns and volatility since 2007

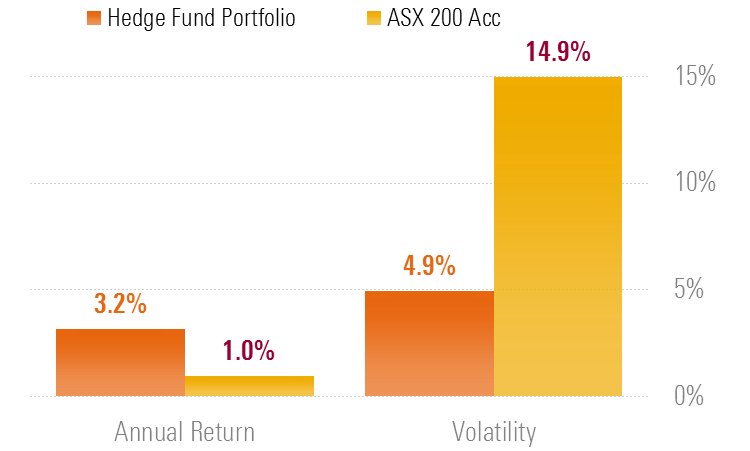

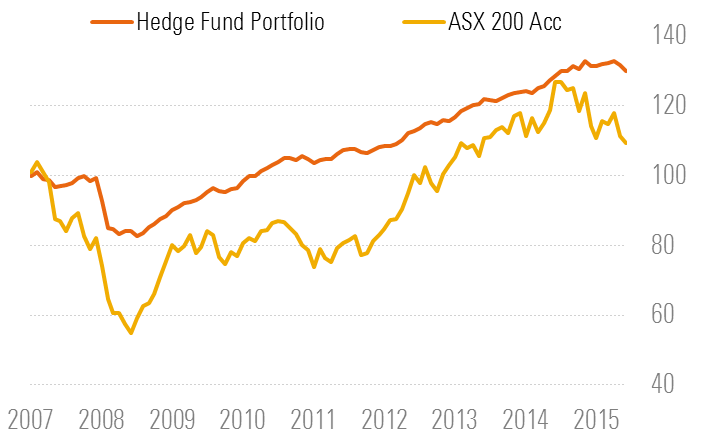

Although we don’t think that realised volatility is a very useful measure of risk in isolation, it has gained widespread acceptance. Figure 3 shows the Hedge Fund Portfolio has returned more than three times as much as the ASX 200 with one third of the volatility. On the basis of realised volatility, the Hedge Fund Portfolio has been a substantially less risky investment than the ASX 200. Figure 4 shows the value of $100 invested in late 2007, with the Hedge Fund Portfolio far more consistent.

Another observation is that the goal of fee minimisation without taking account of the actual investment outcome is narrow-minded. An investment in a low-fee ASX 200 tracker has experienced lower and more volatile returns.

Figure 3: Return and Volatility

Figure 4: Value of $100 invested at inception

The purpose of this article is to counter the commonly held belief that ‘hedge funds’ are riskier than ‘equities’. Although we believe the key risk that investors face is the permanent impairment of capital, we included a number of popular risk proxies including drawdown, performance during difficult months and volatility. We believe investors and financial advisers should consider the role and benefits that an allocation to hedge funds can play in a diversified investment portfolio.

Craig Stanford is Head of Alternative Investments with Morningstar Investment Management Australia Limited. The information provided is for general use only. Morningstar warns that (a) Morningstar has not considered any individual person’s objectives, financial situation or particular needs, and (b) individuals should seek advice and consider whether the advice is appropriate in light of their goals, objectives and current situation.