Planning for retirement is daunting for many people. The stakes are high, and there is uncertainty around some important issues, like how long will you live? What makes this a particularly vexing issue is that hardly anyone likes talking or thinking about death, especially their own!

So, let’s be adults and tackle this ‘length of life’ issue head on.

How long are you expected to live?

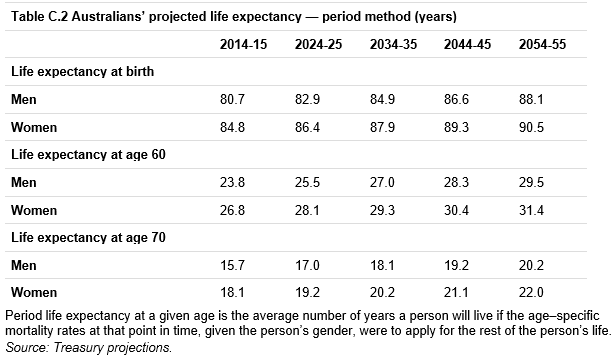

The Australian Federal Government provides updated life expectancy data for the Australian population each time it publishes its Intergenerational Report, which it last did in 2015. It shows that a man born today (that is, in 2015) is expected to live to 80.7 years of age and a woman is expected to live to 84.8 years of age. Whilst interesting, this full life expectancy statistic isn’t as helpful as you might think when planning for retirement. That’s because, if you are at retirement age now:

- You were born many decades ago and your full life expectancy is different from the numbers being quoted for new births today, and

- You have already outlived some of the people born around the same time as you.

What is a lot more helpful are the next set of numbers in the following table.

If a man is currently 60 years of age, he is expected to live another 23.8 years to 83.8 years of age and a woman is expected to live another 26.8 years to 86.8 years of age.

Similarly, if a man is currently 70 years of age, he is expected to live another 15.7 years to 85.7 years of age and a woman is expected to live another 18.1 years to 88.1 years of age.

Source: “2015 Intergenerational Report – Australia in 2055”, Australian Government, The Treasury, March 2015.

Living longer than the average

The Australian Bureau of Statistics ran a survey in 2014/15 about retirement intentions and found that the average intended retirement age was 65 years. Assuming reality matches these intentions, it means if a person retires at age 65 in 2017, a man will be expected to live until age 85 and a woman to age 87 years. That’s 20 and 22 years respectively living in retirement, which is a really long time.

And here’s the interesting part … that is just the average life expectancy: 50% of people will live beyond these ages, many into their 90s, and some (around 3-4% of the population) will live past 100 years of age.

There are a host of factors that impact how long you are likely to live. Here is a list of life expectancy calculators that can give you a better estimate of your own life expectancy.

Preparing for a long retirement

We can’t know exactly how long we will live, but there are a few things we can know.

We know that the age pension in 2017 (including supplements) is $23,096 per year for a single person and $34,819 for a couple. This may be enough to survive on if you already own your home, but most people would not consider it enough to thrive on. If you don’t own your own home, and don’t have much in the way of retirement savings, please, be really nice to your family, as you will probably need them later on.

Moreover, eligibility to receive the age pension is already income and assets tested, and given Australia’s aging population, the Federal Government is over time more likely to tighten the eligibility criteria and the level of the age pension than it is to be more generous and loosen them.

We also know that based on current life expectancy, you have a 50% chance of living into your mid/late 80s, which is 20-25 years in retirement. And you may well live beyond this average age and therefore will want to stretch your ability to generate additional income in retirement out to 35+ years.

What actions make a difference to your lifestyle in retirement?

There are only so many ways to build up that retirement nest egg to provide a higher and more sustainable income in retirement. Here are a few ideas:

Before you retire

- Save more: Spend less and save more. Making voluntary concessional and/or non-concessional superannuation contributions are not the only ways to save, but they are tax-advantaged ways of saving.

- Work longer: You will earn more income, make more superannuation contributions and give your retirement savings more time to grow before you start drawing down. This might not mean working full time for longer, but perhaps transitioning from full time work to part time work and then eventually into full retirement.

- Invest wisely: Depending on your time horizon or risk appetite, you might choose to invest more conservatively or more aggressively than you do currently. There is an inherent link between risk and return, so investing more aggressively is likely to deliver a more volatile and uncertain ride.

- Lower your cost of saving: Lowering your fees without sacrificing the integrity of your investment strategy might eke out a slightly better return. If you have multiple superannuation accounts, consider consolidating them to reduce fees.

- Get advice: There are hundreds of pages of government legislation around retiring, and thousands of pages of guidance notes, advice, etc. One of the big value-adds of financial advisers is they can navigate these rules and regulations with you. The decade or two prior to your retirement is an excellent time to engage a qualified financial planner to chart the course of your retirement.

When you retire

- Modify your lifestyle expectations to match your means: You might find that when you get to the point of retiring you have more or less assets than you expected. You should consider modifying your lifestyle expectations.

- Diversify your sources of income: Diversification still matters in retirement, and maybe it matters even more. But now you should not only think about diversification of investments, but also about a diversity of income sources. For example, you might draw an income partly from the age pension, partly from an Account Based Pension account, and partly from an annuity product.

Step up and plan

While preparing for retirement and discussing your own mortality may not be everyone’s idea of fun BBQ conversation, these are important issues to grapple with. And the earlier you do this, the more time and opportunity you will have to develop a plan that makes a difference to the level and sustainability of your lifestyle in retirement.

Michael Clancy is CEO of Qantas Super and the Co-Founder and Director of cloud-based wealth advice service, BigFuture. BigFuture has now made its retirement planning tool free to users, although you will need to register and log in. The tool allows users to see how much they are likely to own in retirement and test how much they can spend.