The Retirement Income Review (RIR) noted that many retirees leave large bequests and they would have enjoyed a higher standard of living in retirement if only they had spent some of their capital, not just the income from their investments. Planning cash flow in retirement is extremely difficult because of the uncertainties about expenditure, doubts about investment returns and unpredictability about how long we are going to live.

How long before the tank is empty?

For some retirees, investment returns exceed withdrawals, their savings nest egg continues to accumulate, and they need never fear outliving their savings.

For many others, retirement savings can be compared with a rain water tank. Cash flows in from investment income and the sale of assets and cash flows out to pay a regular income stream as well as lump sums. Just like a rain water tank, if the cash outflow is greater than the cash inflow, sooner or later the tank is empty. The critical question then is; “How long before the retirement savings are exhausted?” The advice is typically; “It depends…” It depends on so many uncertainties that many retirees become extremely cautious.

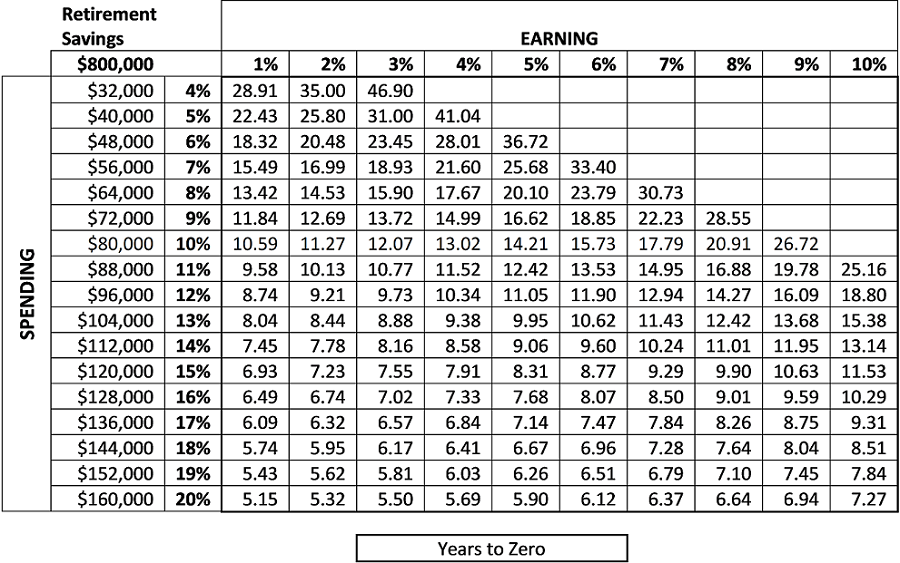

Rather than simply hoping for the best, the table below provides some guidance for that planning. It shows the number of years it takes for a starting amount of savings to reduce to zero if the percentage withdrawn is greater than the percentage income earned.

To make the spending percentages meaningful, I have included a nominal capital value of retirement savings. Please note the starting capital amount is irrelevant in determining how long it will last. What matters, as always, is the earning rate and the withdrawal rate.

Spending more than you earn

Assume Sue has $800,000 in savings and she needs an annual income of $64,000 (8%). Assume also these retirement savings are invested and earning 6%. Therefore, Sue needs to liquidate $16,000 of capital in the first year to pay the shortfall in income and her savings balance progressively declines. According to this table, reading across the rows and down the columns, it will take 23.79 years until those retirement savings are reduced to zero.

If Sue could reduce her spending to 7%, her savings will last for 33.4 years.

The table shows that if Sue spends 8% of her savings annually and earns only 1% per year, from a term deposit for example, her savings will be exhausted in only 13.42 years. It begs the question why term deposits remain so popular with retirees.

This table assumes constant withdrawal and earning rates over the whole time period, and it assumes no fees, taxes or inflation. The table is not a prediction but it can be instructive.

The real world has fees, taxes and inflation

The table can also illustrate the effects of fees. Using the example above, if the adviser (or other) fee is 1%, the actual spending is 9% annually. According to the table, the savings are then exhausted after only 18.85 years, not 23.79 years. The fee of 1% has truncated the income stream by almost five years. That is the true cost of an annual fee of just 1%. Any tax imposed has the same effect.

With inflation, withdrawals need to progressively increase to maintain spending power. Modelling inflation is not possible because the table assumes uniform withdrawals, but if inflation is a constant 3% (which is near the RBA’s preferred rate) prices will double in 24 years. In that scenario, the example savings will be depleted long before that time.

It is clear that retirees must minimise fees and taxes and retirement income must at least keep pace with inflation.

It is important to note that superannuation pensions mandate minimum withdrawals that increase with age regardless of inflation. For example, at age 80 the minimum withdrawal is 7%. As the table shows, larger withdrawals including lump sums accelerate the rate at which the retirement savings reach zero. Superannuation pensions have been designed to be exhausted by progressively removing assets from this tax concessional area.

Age pension as a safety net

In reality, the balance of capital is unlikely to reach zero because in Australia we have the safety net of the age pension. A couple who own their home with $800,000 in financial assets would actually be entitled to an annual part-pension of $6,258. Their combined income (investments plus age pension) is $54,258. If this couple were to decrease their capital by $100,000, under the current assets test, their combined pension would increase by $7,800 to $14,058. The taxpayer has replaced the $6,000 (6%) formerly earned from that $100,000 with an increased pension of $7,800 (7.8%). Their combined income is now $56,058.

When their assets fall to $401,500 this couple gain the full age pension of $37,340 so their combined income is $61,430. The age pension places a safety net under all retirees, thereby reducing the need to liquidate capital.

The challenge of financial independence

For retirees who aspire to financial independence, the task is complex. Without careful planning, retirees are likely to outlive their savings. We know that 50% of males currently aged 65 will survive beyond age 84, but around 5% of that group will survive beyond age 97. Similarly, 50% of females currently aged 65, will survive beyond age 88, but around 5% of that group will survive beyond age 100. Some individuals will survive even longer.

Therefore, if independent retirees wish to plan their retirement with a 95% certainty that they will not outlive their money, they need to plan for a retirement of at least 30 years.

That means, according to the table, they cannot spend much more than their investment earnings – ever! For them that is a different message to that offered by the RIR and their standard of living in retirement is a function of the investment returns they achieve.

There is a direct relationship between risk and investment return, but independent retirees also need to balance market risk against the longevity risk that they will outlive their savings. Therefore, those who adopt low-risk, low-return investments may be sacrificing their long-term financial security due to their short-term concern about market volatility. Yet, such conservative investment portfolios are typically considered normal and appropriate and may explain why so many retirees exhaust their own resources prematurely.

Postscript. You can generate the table yourself by using the (NPER) financial function of Microsoft Excel which calculates the number of periods for the final balance to reach zero by computing the interaction between the earning rate and the spending rate. Or you can just take my word for it.

Jon Kalkman is a former director of the Australian Investors Association. This article is for general information purposes only and does not consider the circumstances of any investor.