Investing in unpopular stocks is a great way to make money for investors but a disciplined process is required to find uncomfortable opportunities. This is especially true in smaller companies, which have underperformed their large cap peers in 2022 and into 2023 against a backdrop of rising interest rates and a bleak economic outlook. We’ve seen this movie before. Small caps are more exposed to the economy, have less diversified businesses, and are less liquid than large caps. When the outlook starts to deteriorate, investors rush out of small caps and into large, liquid defensive stocks.

However, this underperformance has historically created an attractive entry point, as smaller companies deliver their strongest absolute and relative performance over larger companies when the economic outlook starts to improve. Small caps are now trading on a material discount to their historical relative valuations versus large caps.

The stockmarket is going through a phase when global investors are attracted to the ‘new world’ of large tech, growth companies. To find unpopular opportunities, a different framework for thinking is required. We hear a lot about new world assets, but in reality, it means higher expectations and greater potential to disappoint.

Uncomfortable opportunities in real assets

In fact, ‘old world’ assets are becoming more attractive because the barriers to building new things are getting higher. Anyone who has attempted an investment development such as residential or commercial property or a major project will know it is taking longer and it is much more expensive. There are more political constraints and fewer trades people. Interest rates are higher and competition among brands for a customer base is intense, and there’s less funding available for new businesses. Money was free a few years ago but now there’s a cost.

Newcrest Mining and Origin Energy are examples of good assets that have received attractive takeover bids in the past few months, Newcrest at a 30% premium and Origin at a 53% premium. Investors often focus on the ‘buy or build’ decision, and our view is that as the barriers go up to building new things, many existing assets become more valuable to buy rather than build.

Two old world companies the market is underestimating

Incitec Pivot (ASX:IPL) is not a household name but it's been unpopular in recent years, with the share price down from $4 to $3 in the last year. There are reasons for this, such as falling fertiliser prices, poor plant reliability and then the CEO stepped down. This is a company that turns gas into fertiliser or explosives, and when their plants don't work efficiently, they don’t make money. So it is a company that is out of favour and herein lies the opportunity. Its assets have value.

Its US fertiliser business is worth about $1.8 billion and Australian fertiliser business is about $1.4 billion, but the explosives business is what really matters. It’s valued at about $5.2 billion. The market probably understands that but underappreciates that this is radically-simplified business. In fact, they have sold the US business and there will be $1.8 billion cash on the balance sheet. They are looking at demerging or selling the Australian fertiliser business. We will be left with a pure play explosives business.

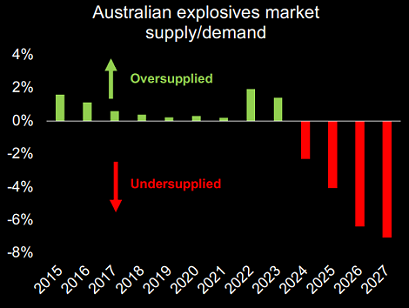

Consider the opportunity. One of the things miners must do is move material, and they need a lot of ammonium nitrate or explosives. In 2016, a huge ammonium nitrate plant was built in Western Australia. The green bars in the chart below show the market was over supplied with explosives for close to a decade. This is the type of original research we do.

How many explosives plants have been built in Australia since 2016? Zero. Miners such as BHP have been on a capex holiday and they are now increasing production, which means they are increasing movement of material. We see a large shortfall in the amount of explosives available in the Australian market. It can’t be covered by imports because explosives do not travel well, and the largest exporter of explosives was Russia with nearly half of global supply. We think this is a great time to be buying into the explosive business after 10 years of underperformance.

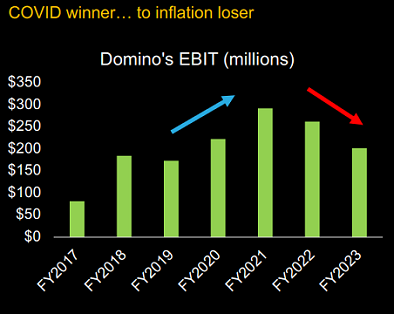

The second stock with some old-world characteristics is Domino’s Pizza (ASX:DMP). It was a major Covid winner in the lockdowns, but then it became a huge inflation loser. Inflation ravaged Domino's, it was among the most-impacted companies in the ASX200 from inflation. Food costs went up. Labour costs went up. Then they tried to push prices up but in a very clunky way. They added a Domino's Service Fee, the DSF they called it. It was a variable charge, like the surcharge on Uber during busy times. They had never had one before and customers started leaving. So Domino's was massively hit by inflation and issued seven profit downgrades in two years. It was a terrible time.

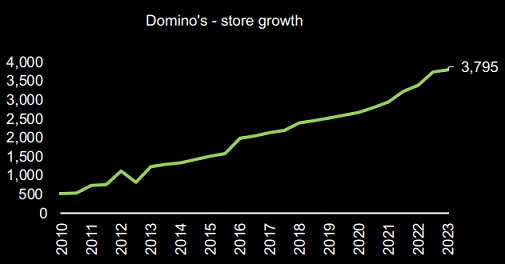

It’s out of favour but what is the opportunity? Domino’s makes money when they sell more pizza, and they sell more pizza by rolling out stores. And look at the following chart. They've gone from 500 stores in 2010 to 3,800 today. Even in the toughest time last year, they increased their stores by 6%. They have a very simple model with a delivery focus. It's small format so it's cheap to roll out new stores, in Australia today for about $500,000. They typically pay back in about four years, so for franchisees, this is a great investment.

We believe Domino's will revert to profit growth. They've committed to no more price increases based on what they can see, which will be more stable for customers. With store growth of about 7% per annum, and each store does a little better by about 3% per year. So it’s a business that can grow revenue at 10% a year and its earnings even higher. The inflation headwinds have created an opportunity and now they need to make the case for investing in the company.

That’s what we call an uncomfortable opportunity.

Finding comfort in the discomfort

The key takeaway is that many old world assets may be more attractive when the market is focusing more on the new world. Incitec Pivot, Domino’s, Newcrest and Origin are not large cap tech companies, and investors are overlooking them.

As Insitec Pivot becomes a simplified, pure play explosives business, and Domino's recovers from its inflation shocks, we believe both companies will move from discomfort to comfort.

Blake Henricks is Deputy Managing Director and Portfolio manager at Firetrail Investments. Firetrail is affiliated with Pinnacle Investment Management, a sponsor of Firstlinks. This article is general information and does not consider the circumstances of any investor.

For more articles and papers in Firstlinks from Pinnacle and its affiliates, click here.