President Donald Trump warned us in his State of the Union address in February 2019 to resist the pull of socialism, while Senator Bernie Sanders told us in his campaign announcement that his ideas are now markedly more mainstream than they were in 2016. You can't pick up a publication without reading an assessment of the Democratic presidential candidates' shift to ‘the left’. It seems an idea has become a trend in a short period of time.

Some may argue this is a logical evolution in a two-party political system characterised by growing divisiveness. Recent election outcomes markedly favored one party, so perhaps it shouldn't be a surprise to see the electorate move in an equally radical but opposite direction. Welcome to global politics in a polarised world.

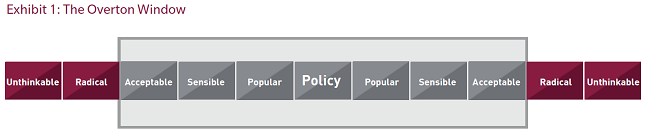

The window of political discourse

This is a good example of the Overton Window, also known as the window of discourse. It describes how the level of acceptance for a political idea can shift over time as the ‘window’ grows in response to changes in public perception. Ideas and public policy once viewed as extreme can become acceptable to politicians and the public, often in response to increasingly-radical competing views.

political outcomes

The political movement toward the left in the United States and elsewhere is in part a response to growing differences in income and wealth. While undoubtedly a global theme, it's particularly pronounced in the United States. Policy ideas promoted to compete with those of the current US administration are often presented through a lens of Pareto Efficiency, i.e., when it's impossible to make one party better off without making someone worse off. A zero-sum game in other words. In this paradigm, allocating resources in favor of one group is only possible at the expense of another group.

This point is exemplified by the proposed increase in tax rates on higher earnings or a wealth tax to finance Medicare for all and universal college tuition. While the intention of these policies is clearly to redistribute income and wealth, it's worth asking whether they'll have unintended consequences with broader ramifications. Might policies such as these also impact government debt balances and economic growth?

Proponents of redistribution policies argue for greater equality and more money in the hands of those most in need — also the group most likely to spend any additional income, which would foster economic growth. Detractors argue policies of this nature sacrifice prosperity and create investment uncertainty that constrains growth. Wealth and income may be divided differently, but the pie may, in fact, shrink in this scenario. There are more opinions on this subject than I can enumerate and I'll let elections decide the outcome.

Investment consequences of redistribution policies

That said, regardless of your views in this debate, there are undoubtedly potential outcomes and investment implications to be considered if this redistribution trend becomes policy. Higher tax rates will likely push investors into a tax-advantaged asset class. Increased public spending could find its way into state and local budgets, improving credit quality and benefiting projects with municipal financing. Infrastructure investment opportunities and utilities are also likely to benefit in this scenario.

What happens to interest rate exposure is a key question. Higher debt balances may exacerbate the structural challenges that characterise the US economy today: stagnant growth and disinflation. This scenario benefits duration and fixed assets, and has been a factor in our ‘low-for-longer’ rate investment thesis. However, high debt balances can be destabilising for an economy from a macroeconomic perspective, while rising debt-service may crowd out investment alternatives. Challenges to credit quality of this nature are often met with higher risk premiums and, consequently, also higher interest rates. In this situation, income redistribution might improve the economy, prompting a more aggressive Federal Reserve Bank. These outcomes would argue for less interest-rate exposure.

In a piece of this nature, I run the risk of over-generalising. Nothing is simple in the complex investment environment today. There are many cooks jockeying for a place in the public policy kitchen, and more and more ingredients being stirred into the pot. Headlines frequently reflect the heat of the current divisive climate, but seldom the substance of the issues.

Predicting political outcomes

Our goal at MFS is to invest in the framework of a long-term investment horizon rooted in an assessment of fundamentals and valuation. Political outcomes are challenging to predict. I'm not convinced that forecasting binary political results creates a competitive advantage for managers. Instead, we need to understand the investment implications of a variety of outcomes and create a probability matrix that maps all of them.

This is the kind of environment in which active investment management with a longer-time horizon should thrive. It's easy to get caught up in the short-term ebb and flow of eye-catching headlines. It's more challenging to invest for the long term, but this is typically the horizon needed for valuation to intersect with fundamentals — and the generation of more consistent risk-adjusted investment returns.

William Adams, CFA, is the Chief Investment Officer, Global Fixed Income at MFS Investment Management. The comments, opinions and analysis are for general information purposes only and are not investment advice or a complete analysis of every material fact regarding any investment. Comments, opinions and analysis are rendered as of the date given and may change without notice due to market conditions and other factors. This article is issued in Australia by MFS International Australia Pty Ltd (ABN 68 607 579 537, AFSL 485343), a sponsor of Cuffelinks.

For more articles and papers from MFS, please click here.