As an investor’s investment horizon lengthens, however, a diversified portfolio of U.S. equities becomes progressively less risky than bonds, assuming that the stocks are purchased at a sensible multiple of earnings relative to then-prevailing interest rates.

It is a terrible mistake for investors with long-term horizons – among them, pension funds, college endowments and savings-minded individuals – to measure their investment “risk” by their portfolio’s ratio of bonds to stocks. Often, high-grade bonds in an investment portfolio increase its risk."

Warren Buffett, 2017 letter to Berkshire Hathaway shareholders, published 24 February 2018.

I noticed with sadness that an article promoting ‘life cycle’ investing was published in Cuffelinks last week, pushing this asset allocation technique as a sensible retirement alternative.

In 2015 Glenn Stevens, the then Reserve Bank Governor, pointed out the huge cost required today to produce a reasonable level of income and, more importantly, generate a sustainable income for longer retirements.

“In a low interest rate world, the problems of providing retirement incomes will become ever more prominent. The very low level of yields on fixed income assets means that it is very expensive today to purchase a secure stream of future income, which is what someone who is retiring is usually seeking. And there are more of such people, living longer.

The retiree can of course respond to this by holding more of her portfolio in dividend-paying stocks – accepting more risk. She may hope for a dividend stream that is fairly stable from year to year but that tends to grow over time.”

Glenn Stevens, ‘The Long Run’, address to the Australian Business Economists, 24 November 2015

Put simply, from the heady days of the late 80's/early 90’s where a $1 million dollar bank deposit would have produced around $140,000 income a year, on this same amount we have seen the income fall to around $30,000 in 2018. I refer to this as the 'cash crash'. If the sharemarket fell by 80%, can you imagine the outcry?

Challenging the definition of ‘risk’

Investing is about survival and we are living a lot longer in retirement than most people imagine or plan for. The greatest danger is locking into artificially low rates of return for long periods, such as with bonds, term deposits or annuities. I am reminded of the Law of Unintended Consequence when seeking the 'security' of cash instruments.

Stevens also reinforced my theme when talking about people facing retirement today when he said; "They have to accept a lot more risk to generate the expected flow of future income they want". I accept that he is using the traditional measure of risk and is referring to the volatility of capital. I, however, will not accept that volatility of capital is a satisfactory measure of risk provided one is a long-term 'investor'.

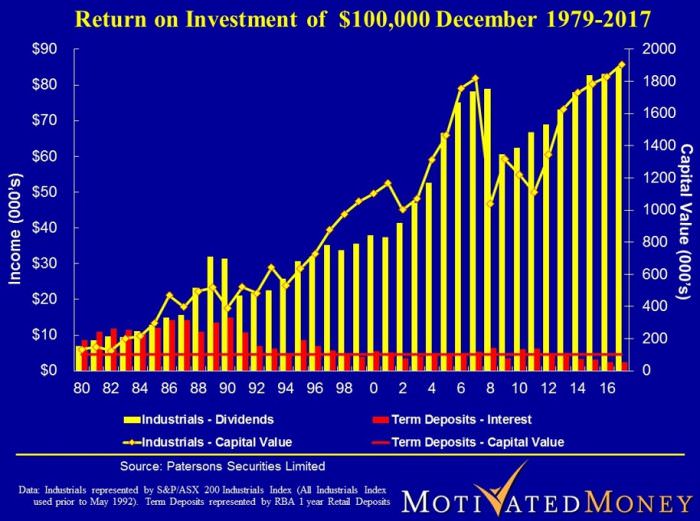

On the basis that a picture is worth a thousand words, the 'mothership' (as I call it) chart below, comparing cash deposits with industrial shares over 37 years, hopefully speaks for itself. This example shows $100,000 invested in both industrial shares and term deposits in 1979, with all income from both investments spent and not reinvested. After receiving interest payments every year, a term deposit is still $100,000 after 37 years whilst shares, in addition to the income received, are now worth $1.9 million. I must add, as with the interest, no dividends have been reinvested during this period.

This is why I prefer the safety and security of the sharemarket to risky assets like term deposits. I can live with short-term volatility over 40 years. It is my friend during accumulation phase as I inevitably buy more when the market is cheap and less when it is expensive. In retirement, I want income and for me, the volatility in the value becomes a non-issue.

The life cycle investing argument

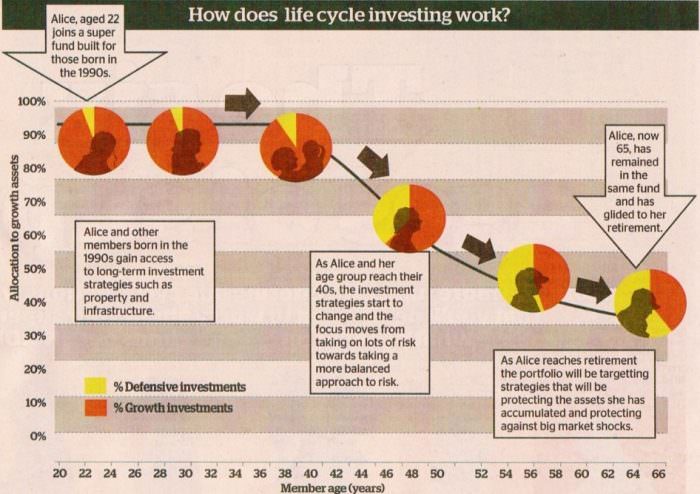

In the same vein as the Cuffelinks article on life cycle investing, an article titled, 'Your super can grow old gracefully' in the Sydney Morning Herald in 2015 caught my eye. The chart below from the article explains graphically how an investor can automatically be transitioned from 'risky' growth assets into more conservative investments as they approach and then enter retirement. It is posited as a sensible and conservative approach.

Source: Sydney Morning Herald, 5 March 2015

Proponents of this strategy explain that this will ensure the security of your financial future. Thankfully, the authors of the article raised legitimate concerns but what annoys me about this simplistic approach is that it intimates an 'account value' without splitting it into the two components of capital and income.

It should be clear from the two charts above that theirs is the antithesis of mine. According to the second chart, as one grows older, investments will be shifted away from the yellow in my chart and more into the red so that by the time retirement comes, having invested for 40 or so years, the retirement future is now jeopardised. In addition, the entire account balance in the life cycle fund will be substantially less than mine as ‘they’ will have been selling shareholdings over the years and switching to cash.

To give you a sense of the compounding effect during the accumulation phase of life, if I had reinvested the interest and the dividends, the account balances would be $1.3 million for cash and $12 million for shares over the 37 years. Let’s take it a step further. You are now about to retire, and the account balances above can be used to produce an income. So, looking at the chart above, in retirement, your starting point for cash remains the $1.3 million whilst your starting point for shares will be $12 million.

The thought of this life cycle model being applied to our adult children strikes fear into my heart. If 'Alice' had stayed in the yellow, as per my chart, for all of her working lifetime, her eventual retirement pot would have been substantially greater than the outcome as proposed in the shifting asset allocation of the second chart. She, like my wife and I, would have no need for cash as a buffer to smother the volatility. The opportunity cost of the life cycle strategy will be huge. It’s the opportunity cost that no one talks about and the largely irrelevant volatility. When one hits retirement, one simply stops the reinvestment and turns on the dividend stream from a substantial asset base as a pension.

Why sell off the best compounding asset?

Commentators are always banging on about compounding, the ‘8th wonder of the world’. So why do the supporters of life cycle investing undervalue it in the latter stages of the accumulation phase of our lives? They are going to guarantee that as you progress through your working life, the strongest compounding (income-producing) asset will be sold off to buy something that will produce the lowest income stream.

The irony is that we are only now beginning to recognise the longevity risk, and retirements stretching out to equal our working lifespan. With most of your retirement fund in 'defensive' investments for 30-40 years, the experience of the last 37 years, as displayed in my 'mothership' slide, being applied to your retirement years should hopefully ring warning bells.

There is nothing conservative or defensive about term deposits or bonds, in fact, quite the opposite. In the longevity stakes they rank as the riskiest asset you can hold. Why must we cling to the outdated concept promulgated as ‘modern portfolio theory’ from the 1940’s? Volatility does not measure risk, it merely indicates the high level of liquidity.

Personally, I refuse to expose my family to these risky deposits, preferring instead the boring predictability of shares.

Peter Thornhill is a financial commentator, public speaker and Principal of Motivated Money. This article is general in nature and does not constitute or convey specific or professional advice. Formal financial advice should be sought before acting in any of the areas discussed. Share markets can be volatile in the short term and investors holding a portfolio of shares will need to tolerate short-term losses and focus on a long-term horizon.