An ancient Latin adage advises 'if you want peace, prepare for war'. This is useful advice for current market conditions.

This may seem a surprising comment considering the recent performance of global equities. After all, indexes are up, and volatility is down. Never mind that a handful of tech giants like Apple and Microsoft are driving the headline positive numbers while most shares are having a harder time.

And there has been good news. It has gone quiet in the global banking sector after the debacles in US regional banks and the demise of Credit Suisse. This offers comfort to anyone who has been in markets long enough to know that stress in the financial sector is often the first sign of real trouble.

But even if they are not ringing as loudly as they were, we still hear alarm bells warning of potential difficulties on a broader front. While the banking sector has so far avoided systemic problems, at the very least these events should inhibit economic activity.

Already cautious loan officers have further tightened their standards. Consumers are also likely to adjust their behaviour increasing saving and cutting spending. Corporates too will inevitably look more closely at their liquidity and raise the required return of any potential investments.

Regardless of recent performance, our view is that we are in the ‘risk averse’ stage of the current equity market cycle. Therefore, the balance of probabilities is heavily weighted towards falling indices and negative returns, and we believe this will continue to play out through to mid-2024.

There are several data points that we believe support our concerns, including:

1. Government deficit and corporate profitability

Around the world, the COVID-19 pandemic triggered increases in government deficits. While the resultant growth in the stock of debt remains huge, deficit spending itself will provide no further sugar rush to business profits. For example, in the US, the deficit is currently set to remain at between 5-6% of US gross domestic product (GDP) rather than ballooning as it did during the pandemic.

Furthermore, business profits should no longer benefit from consumers spending their way out of lockdowns. In the US the savings rate has fallen to 4.7%, from the extraordinary 33.8% during the beginning of the pandemic. If anything, savings rates may well rise from here.

2. Labour costs

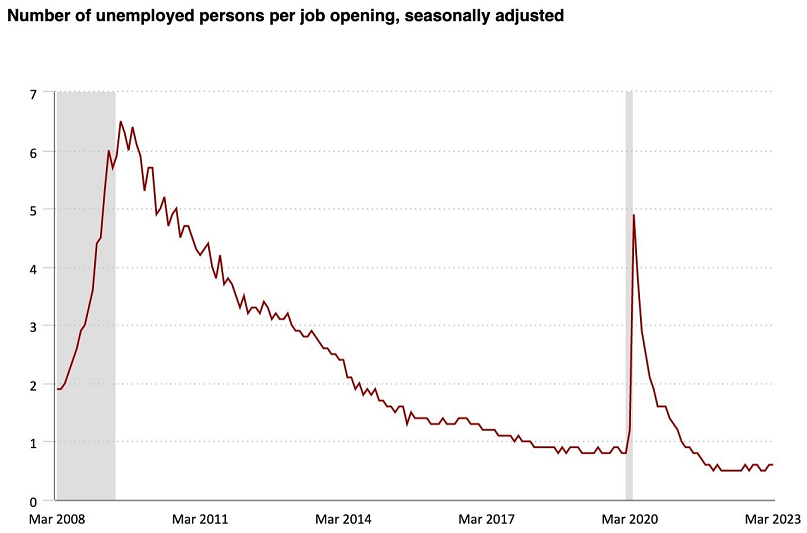

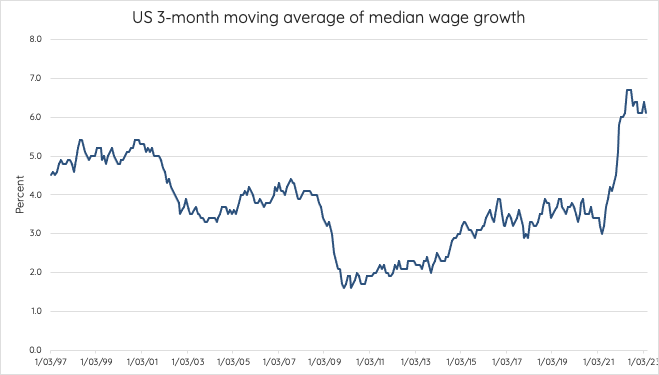

According to the US Bureau of Labor’s statistics, there are currently twice as many job openings as there are people to fill them. This is as high as it has been at any time since the GFC (Global Financial Crisis). The consequences of worker shortages are showing up in median wage growth which has accelerated since the start of 2021.

Source: US Bureau of Labour Statistics

Source: Federal Reserve Bank of Atlanta

3. Interest rates

Up until 2022, the falling cost of corporate debt helped boost businesses’ margins. But since central banks started increasing rates, interest costs have grown and compressed margins. Meanwhile, it is difficult to envisage a situation where interest rates will meaningfully fall.

4. Taxation rates

In the US, the government is considering raising the marginal tax rate on US-derived profits which will turn what has been a tailwind in recent years into a headwind.

5. Earnings per share (EPS)

According to Bloomberg, current year S&P 500 EPS estimates peaked in June last year at $248 with the latest at $220. Looking at leading indicators, EPS could easily fall to below $200, perhaps materially below. If that seems unlikely, do not forget that the 2019 pre-pandemic high was just $164. Reversion to that level would put an S&P 500 index at 4000 on an eyewatering PE (Price Earnings) of 24 times.

Considering this, three areas for investors to look at to help manage risk are:

- Valuation – while the debate around value versus growth is perennial, what is inarguable is that buying a dollar for 80 cents means there is 25% upside available to a value investor that a growth investor often misses. This is not to say that value investing is like shelling peas, but that it does offer an added source of potential return.

- Income – remember the importance of income. In terms of the two components of total return, the bull market that ran throughout the last decade trained global equity investors to focus on capital growth more than income. But income always plays a positive part, while the same cannot be said of capital growth.

- Discipline – take steps to avoid behavioural biases that are repeatedly the cause of investment errors. Examples are recency bias (favouring what has just happened) or confirmation bias (sifting for data that support an already formed view). Swerving such pitfalls is difficult, but a disciplined process that is aware of the dangers helps.

We live in a probabilistic world, which can include rolling hills and caressing breezes, so there is always a chance that our caution proves to be unwarranted. But our advice is to protect capital, because what matters is losing as little as possible when times are bad to have as much working for you when things get better.

To this end, investors should prize income, excellent value, short duration, and rapid payback periods. They should avoid high beta shares, those with prices that can be largely or more than fully explained by overall market moves, and they should avoid financial leverage. We believe this remains a time to play defence.

Hugh Selby-Smith is Co-Chief Investment Officer of Talaria Capital. Talaria’s listed funds are Global Equity (TLRA) and Global Equity Currency Hedged (TLRH). This article is general information and does not consider the circumstances of any investor.