Transurban (ASX: TCL) was one of Australia’s great corporate success stories – until it was hit by a triple-whammy of Covid lockdowns, inflation, and public/political backlashes.

Do the new CEO and chairperson have the political cunning and connections to revive Transurban’s once-golden yellow brick road?

Here’s my take on Transurban for long-term investment.

Golden start

From an initial value of $500 million when formed and floated in 1996, TCL’s market value grew 100-fold to $50 billion by 2019 (pre-Covid), putting it into the top-10 list of largest ASX stocks, and making it the world’s largest ‘infrastructure’ stock. It was a volatile ride due to high levels of debt but returns beat the overall market handsomely.

But that golden ride ended nearly five years ago. Since its pre-Covid peak, TCL has lagged the market badly. The post-Covid ‘work from home’ revolution has reduced traffic volumes, inflation has raised the costs of road tolls for drivers, eaten into consumer spending, and increased interest rates on the company’s heavy debt load.

In addition, the company now faces a crisis that strikes at the core of its recipe for success – monopoly power and political favours.

Click for larger image

Secret sauce

Throughout history, most corporate success stories were the result of the extraordinary drive and ambition of a visionary entrepreneur, but the initial founder-driven momentum rarely continued after the founder’s departure.

TCL was different – the ‘big idea’ was not a new technology or product. The big idea was that cash-strapped governments could outsource the construction and operation of roads and tunnels to commercial companies and allow them to charge tolls, and the governments would support the venture by providing political favours in a variety of forms including deliberately routing traffic to the toll-roads, and promising protection from competition. TCL led this new trend in Australia and has dominated ever since.

Some of these ‘Public-Private Partnerships’ have been successful, but others have been financial disasters – and TCL has been smart enough to pick up some of the failures at bargain prices.

Monopoly

Every business owner’s dream is to have a monopoly in its chosen market. Monopolies can exploit ‘pricing power’ – the ability to raise prices where customers have little or no alternatives, allowing the business to extract out-sized profits. As road tolls are generally set by governments and restricted by inflation, TCL’s growth has come mainly from acquisitions of additional roads, plus extensions and expansions of roads it already owned.

Avoiding the ‘four horsemen’ of doom

In Australia, corporate success has generally not been about coming up with a brilliant world-beating idea. For Australian companies, survival and success has mostly been about avoiding the ‘four horsemen of the apocalypse’ – avoiding the four ‘dumb things’ that blow up most companies: rapid growth, aggressive international expansion, excessive debt, and ego/hubris.

1. Growth – modest and careful

On the growth front, Transurban has stuck to its core business – toll roads, and it has eliminated competition by running an almost complete monopoly on toll roads in the three largest cities in Australia – Melbourne, Sydney, and Brisbane.

Because of this monopoly, it has not had to deal with competition, which is usually the big risk to profitability with rapid expansion. It has even been able to extract extraordinary favourable deals from governments – including the right to tax-payer-funded compensation if new competing roads are built. In what other industry go you get that?!

2. International expansion

The second big risk – international expansion – has been well controlled. TCL has resisted the usual temptation to expand rapidly into foreign markets. It expanded into Washington (USA) in 2007 and into Quebec (Canada) in 2018, but these were relatively small, careful steps. These together make up just 10% of revenues and profits, leaving plenty of room for careful and selective expansion in future.

3. Debt

The third big destroyer of companies is debt – and this is where TCL has been running closest to the edge. Although the tolls are regulated by governments, the volume of road traffic is highly cyclical. High levels of debt dramatically increase the volatility of profitability – rising during economic booms but declining in slow-downs.

The 2020 covid lockdowns virtually emptied roads instantly in Australia and around the world, and TCL was hit hard.

The company has always carried high levels of debt. It was formed initially to build and operate Melbourne’s CityLink motorway. The total cost of $1.8 billion was financed by $455 million in capital raised from the public in the 1996 float, plus $1.3 billion in debt. This was a debt/equity ratio of 2.8 (72% leverage ratio), which is very high.

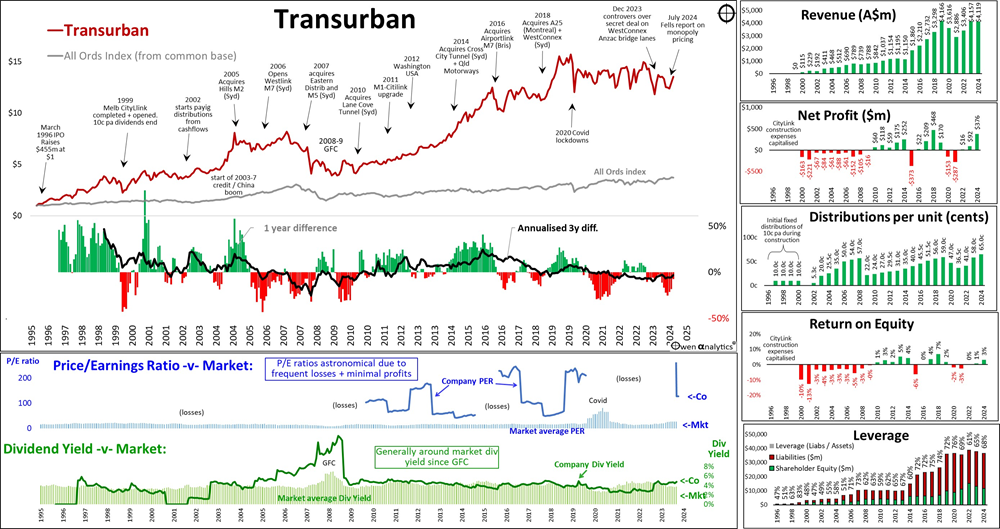

The bottom-right chart shows the level of TCL’s equity and debt each year. Around 70% to 80% of the asset values have been financed by debt. The big jumps in asset values from the major acquisitions are accompanied by large jumps in debt levels. The problem is that asset values are reliant on rubbery assumptions like estimates of future revenues and subjective discount rates, but debt is debt, and harder to fudge.

Continually high debt ratios have allowed TCL to grow without overly diluting shareholders, but it has meant frequent accounting losses and a volatile share price.

4. Ego

On the ‘fourth horseman’- ego and hubris, TCL has managed the roles of CEOs and Chairperson well - with stability and technical expertise rather than aggressive, ego-driven expansionists. More on this below.

Profitability and pricing

TCL rarely posts accounting profits, and its free cash flows are also mostly negative, thanks to large outgoings for maintenance, capex, expansions, and acquisitions (tip: never accept published ‘free cash flows’ numbers at face value). Returns on equity have been low single digits, averaging around zero.

Despite big swings in profitability, the company was able to maintain rising distributions in the boom years 2002-8, but distributions were cut savagely in the GFC, rose steadily in from 2009-19, only to be cut savagely again in the 2020-1 Covid lockdown crisis.

Distributions (2024) per share are finally back up to where they were sixteen years ago (2008) – and that’s before inflation. Between 2008 and 2024, inflation has reduced the real purchasing power of distributions by one third.

It's a case of the 'Telstra disease' - shareholders cling on to the illusion of 'stable dividends' but forget that they are losing real purchasing power after inflation, big time.

Price/earnings ratios have been either astronomically high or non-existent, due to frequent losses and minimal profits. Likewise for pricing to free cash flows.

On the other hand, distribution yields for TCL have been more or less similar to broad market dividend yields since around 2010. This is on the rich (expensive) side given TCL’s very low profits and returns on equity, high debt load, cyclicality of revenues, regulatory risks, and little/patchy franking.

CEOs competent technocrats

The CEOs have all been career employee professionals, not visionary entrepreneurs. Founding CEO, Kim Edwards (1996-2008), was a Melbourne engineer with deep local and international experience running big construction projects including ports, offices and hotels. He was the driving force behind the company’s success in Melbourne, then Sydney, and then in the US.

After developing world-first E-tag technology for the Washington toll roads, he did not fall into the usual trap of aggressively trying to blanket the world in a mad rush. (Are you listening Domino’s, Xero, Appen?)

When Edwards retired as CEO, he was followed by Chris Lynch (2008-12) – ex-BHP CFO, and Alcoa. Given the timing of his reign, his top priority was debt management in the GFC. Next came Scott Charlton from 2012, after a long career with construction giants LendLease and Leighton.

In late 2023, Charlton handed over the CEO role to his CFO Michelle Jablko, who was previously ex-ANZ CFO, and originally a lawyer at Allens. Unlike past CEOs, the new CEO has no hands-on experience in construction or engineering, nor in companies involving construction and management of huge engineering projects. One would have thought this would be a mandatory requirement for a CEO. Strange call.

Chair

TCLs’ chairpersons have been solid, stable, unexciting, but mostly highly competent and well connected. Political connections and clout are the key. The skill set needed here includes securing political favours and dealing with capital markets on both the debt and equity side, as the acquisitions and road extensions and expansions have been financed by combinations of debt and capital raisings, and negotiating political favours.

First in the chair was Laurie Cox (1996-2007) – former chairman of the ASX, long-time Potter Warburg broker, and supremely connected with governments of all flavours. He was followed by former banker David Ryan (2007-10), and then Lindsay Maxsted (2010 to 2022) – career KPMG partner/CEO (Maxted also chaired Westpac until he was unceremoniously booted out over the disastrous Hayne Royal Commission findings against Westpac).

Maxted was replaced with rookie chairperson Craig Drummond - ex-CEO of Medibank, after a career with NAB, Bank of America, and JB Were. The combination of relatively new, relatively inexperienced CEO and chairperson is a real issue.

Is the game up?

The game (milking monopoly power based on political favours) might be up for Transurban. You can only push monopoly power so far before it triggers a backlash from the public, and therefore populist politicians.

(As an aside - we have a holiday house in the Blue Mountains outside Sydney. A two-way trip up there costs about $30 in petrol and another $30 in TCL road tolls – Ouch! However, I feel for ordinary folk who pay $50-100 or more per week in road tolls just to get to work and back! I have a niece who is an aged/disability care worker who has to travel all over Sydney as part of her job. Road tolls are her second largest expense after rent. Sydney is the most tolled city in the world, and it was only a matter of time before we saw a widespread backlash from hundreds of thousands of ordinary workers who simply cannot afford the cost of the tolls.)

In December 2023, a controversy erupted over secret deals for preferential access to lanes on Sydney’s Anzac Bridge favouring Transurban when the NSW government’s new WestConnex tunnel system opened, causing traffic chaos and anger across Sydney’s inner west. It was just the most recent in a long line of scandals highlighting political favours that included closing and/or redirecting perfectly good lanes on public roads to push traffic into TCL toll roads.

In July 2024, a report by powerful former national competition regulator Allan Fells detailed inequities in Transurban’s monopoly pricing, and recommended a raft of radical changes including wholesale renegotiation of tolls, a new regulator, toll caps, and a range of other interventionist measures.

This is probably not something that will disappear quickly, as it is consistent with the new global populist trend toward government intervention, re-regulation, and re-distribution of wealth and power from capital back to labour.

The new CEO and Chair may be very competent and able in their respective fields in their past careers, but neither have experience in building and/or running major engineering projects, nor in political rent-seeking and clandestine deal-making, nor overcoming public / populist backlashes.

Do they have political cunning and connections to revive Transurban’s once-golden yellow brick road?

You decide!

NB - I have been a shareholder in TCL over the years, but not at present. Readers should not read anything into my current or past holdings as they may not have the same financial goals, needs, or circumstances as I had or have. As always, my analysis is fact-based and intended to be as dispassionate as possible, regardless of whether or not I am a buyer, a seller, or holder. This quick, initial snapshot is no substitute for more detailed research required before making any investment decisions.

Ashley Owen, CFA is Founder and Principal of OwenAnalytics. Ashley is a well-known Australian market commentator with over 40 years’ experience. This article is for general information purposes only and does not consider the circumstances of any individual. You can subscribe to OwenAnalytics Newsletter here. Original article is here: Transurban – end of the gravy train for monopoly toll road powerhouse?.