It's hardly 'late breaking news' to say there’s a lot of change going on in financial advice. Much of it is driven by regulation but the deeper impacts are due to structural change impacting many other sectors of financial services.

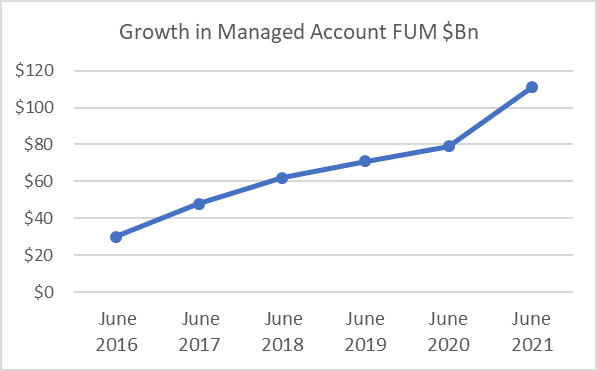

Managed Accounts are an important and growing part of the advice profession and IMAP’s survey of the managed account market shows a total Funds Under Management (FUM) as at 30 June 2021 of $111 billion, exceeding $100 billion for the first time.

Managed Accounts servicing more advisers

Managed Accounts are delivered through two main structures – Separately Managed Accounts or SMAs, essentially a single platform managed investment scheme, and Managed Discretionary Accounts or MDAs, an agreement-based service. The former is generally a product-based approach to the delivery of advice, the latter a service-based approach.

Either type of Managed Account is created by or on behalf of the advice profession as a way of delivering more or less customised portfolios in an efficient way. How customised is a function of the technology in use and the client circumstances.

Source: IMAP

IMAP has been collecting data on managed accounts of all types since 2017 and at $111 billion they are almost exactly the same size as the ETF market. This CAGR of 21% over the past three years, if maintained, will see Managed Accounts exceed $200 billion in 2024. Simple trend extrapolation is often a trap, but in an advised market that comfortably exceeds $1 trillion in assets, this seems credible.

We identify seven factors as driving this growth:

1. Professionalisation

Regulation, higher educational standards, the generational change of traditional advisers being replaced by younger, better educated women and men, many more independent investment consultants ... all these have led to the professionalisation of advice and portfolios built to meet client objectives with a higher probability of success.

Advice firms are adding resources to manage or ‘commission’ portfolios delivered through Managed Accounts which reflect particular approaches to investment markets. The investment consultants and research houses have been happy to meet this need and have brought far more rigour to the creation and management of portfolios than the old Approved Product List-based approach. This has allowed advisers to focus on the areas of expertise where they can personally add value for clients.

But professionalism isn’t simply about education standards and compliance. It’s also about operating advice businesses in an efficient manner with appropriate standards of governance, effective operating structure, sustainable revenue and cost models. Managed Accounts enable advisers to meet a continuing level of demand for advice at a time when the number of advisers is declining.

2. Wider investment choice

One of the key features of the investment landscape has been the expansion of investment options such as retail access to international shares, alternative funds or ETFs and other ETPs on the ASX and Chi-X.

The growth in the number and value of ETFs/ETPs, with the transactional advantages, transparency, superior reporting and often lower cost these products are able to offer compared to unlisted managed funds has seen them rapidly adopted into Managed Accounts.

IMAP estimates that Managed Accounts constitute 14% of FUM invested in ETFs in June 2021.

3. Technology

As in so many other areas, technology has transformed the capability of providers to easily create highly customised services. The platforms have been in a technology race to enable licensee-based portfolio management and lower cost technology is enabling the management of directly held assets in a way which simply wasn’t contemplated previously. Apart from the portfolio management capabilities, we’re seeing offshore listed assets directly held by retail clients and traded economically.

As an example of the impact of technology, Nucleus Wealth, the 2021 IMAP Innovation Award winner, offers highly-nuanced individualisation of ESG preferences through Managed Accounts in a way not available in pooled vehicles.

Cloud-based services and blockchain will only accelerate this drive.

4. Regulation

Traditional advice through Statement of Advice (SoAs) and Records of Advice (RoAs) is a cottage industry, inadequately systematised, delivered on a one-by-one basis to clients. It’s a recipe for compliance nightmares and breaches. The recent Westpac advice business corporate action remediation is costing around $100 million and grew out of apparently mishandling less than one corporate action on average per client per year for 14 years.

Managed Accounts enable a licensee to introduce a systematic approach to the management of portfolios, and ensure the clear allocation of responsibilities between advisers, platforms, providers and portfolio managers.

Best interest obligations are a frequently discussed topic in regard to Managed Accounts. Does ‘best interest’ have to mean cheaper? Actually, the correct question is “When is a process that is more structured than traditional advice, has clear objectives, is systematically managed, is more equitable, reduces implementation leakage and enables better reporting not in a client’s best interest?” This message is starting to become apparent to clearer-thinking advice firms.

5. Competitive pressure

Platforms, investment managers, research houses and advice licensees have all felt the pressure in the past few years from their respective client bases to create and support Managed Account offerings. It’s a dynamic market at work and the pressure to innovate isn’t likely to let up in the near future. It’s part of a virtuous circle of innovation where demand calls forth supply and supply creates demand.

6. ‘Retailisation’ of institutional capability

Driven by the factors we’ve set out above, the lines are blurring between retail, wholesale and institutional clients and capabilities. Examples include:

- A Managed Account presents the chance for a portfolio manager to offer investment managers mandates of tens or even hundreds of millions of dollars

- Use of assets listed on offshore exchanges and pooled structures such as UCITS in retail portfolios

- Consultants offer sophisticated capabilities such as dynamic risk management designed specifically to manage sequencing risk for retail clients

- Management of currency hedging for individual retail clients

- Institutional asset consultants are also active.

Capabilities which previously were available only to institutional investors or though pooled vehicles such as unit trusts are now increasingly deployed for individual accounts.

7. Price compression

All of these factors are leading to lower costs for retail clients. Advice licensees see a value add for their clients in their ability to use lower cost investment options such as ETFs and direct holdings and in putting pressure on the costs of other participants in the value chain through rebates and specific unit classes.

The price pressures on platforms have occurred for broader reasons, but Managed Accounts have contributed. As advisers feel their own margins are under pressure, expect this focus on driving down costs to continue. And as the costs associated with Managed Accounts fall relative to more expensive service delivery of individual advice through RoAs, expect this economic reality to compound.

The factors we have listed above aren’t temporary and are likely to intensify. Their prediction of a $200 billion market before 2025 doesn’t seem far-fetched.

Toby Potter is Chair of IMAP (Institute of Managed Account Professionals) and a Director of Philo Capital Advisers, an MDA Provider. This article is general information and does not consider the circumstances of any investor.