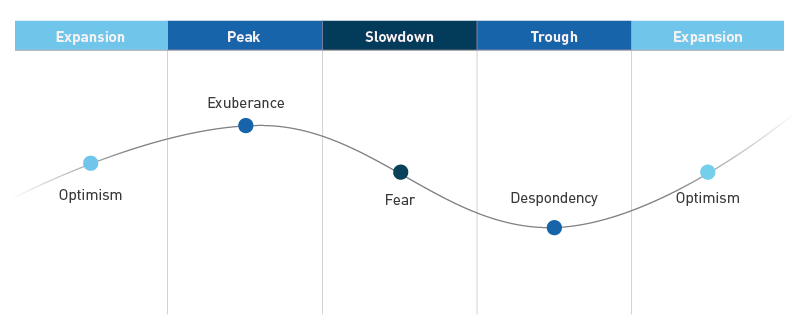

In our view, the commercial property market cycle includes four phases:

Peak: This phase features strong economic growth, rising property prices, and high investor confidence. Demand accelerates and vacancy rates drop well below normal levels. However, it can also lead to overvalued assets as sentiment moves ahead of underlying property performance and prices reach their zenith. Interest rates may also start to rise in this phase as the RBA seeks to take some ‘heat’ out of the economy.

Slowdown: In this phase, market dynamics shift, leading to weaker demand and softening prices. Construction, which typically picks up in the expansion phase, starts to create an oversupply and vacancy rates increase. Interest rates continue to rise, impacting jobs growth and slowing the economy. Sentiment worsens, perpetuating falling prices.

Trough: Characterised by low investor confidence and sometimes widespread despondency, this phase sees prices hitting their lowest point. However, it can also present opportunities for investors to buy undervalued assets at attractive prices. Towards the end of this phase, rate cuts often stimulate activity and lay the foundation for asset appreciation.

Expansion: During this phase, economic and financial conditions improve, boosting investor confidence and supporting asset prices. This is typically the longest phase, underpinned by moderate growth rather than the sentiment-driven extremes of the market peak and trough.

Property market cycles repeat over time, but each one is unique. This is because the intensity and duration of a cycle depends on a multitude of factors such as macroeconomic conditions, geopolitical events, investor sentiment, and unexpected occurrences like natural disasters or global pandemics. Sectors within a market and even different locations can be at different phases of the cycle at the same point in time.

Now that we have the basics covered, let’s take a look at the current property market.

The macro landscape

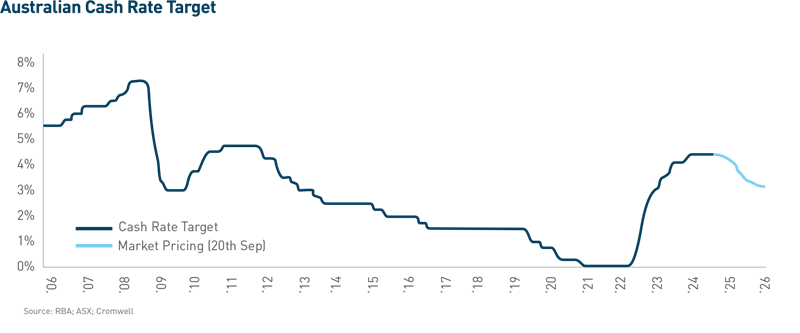

As mentioned above, macroeconomic conditions play a big role in property cycles. Recently, we’ve seen a significant increase in interest rates – 425 basis points in 18 months, which has significantly impacted commercial property prices. However, many believe that interest rates have peaked for this cycle. Other countries such as the US, Canada, New Zealand, and several across Europe, have already started lowering rates.

Australia’s inflation cycle took hold around six months later than peer markets and rate cuts are also expected to commence a bit later (around early next year). Cromwell expects lower interest rates will boost market confidence, stimulate transaction activity and support property prices.

Property pricing

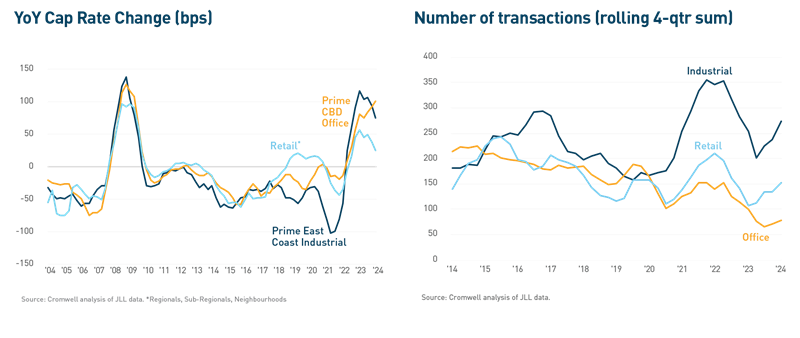

We’re starting to see signs that property prices may be stabilising. The pace of capitalisation (cap) rate expansion (a driver of declining property values) is slowing for retail and industrial properties, an indication that the cycle may be turning for these sectors. It is important to note that because the valuation cycle lags, waiting until market valuation cap rates have started to compress means the best buying (i.e. the bottom of the cycle) has actually already passed you by.

For office properties, cap rate expansion is yet to slow but should follow the example of retail and industrial, in part supported by the emerging cap rate differential to the other sectors, which will boost the relative attractiveness of office investment. Increased transaction activity is another sign that the market cycle might be turning.

Office fundamentals

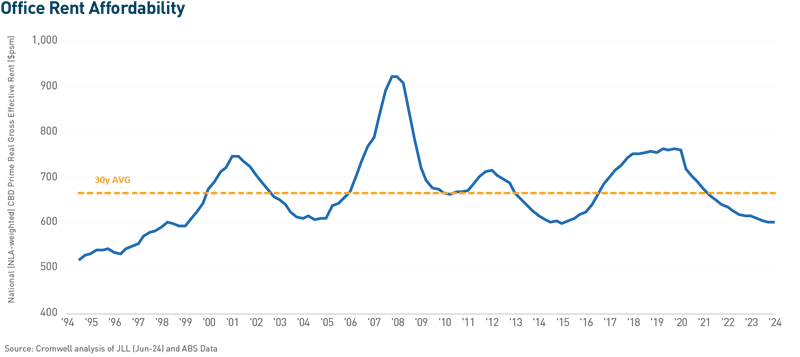

While the macroeconomic and capital cycles appear to be becoming more favourable, they would be of little consequence if office market fundamentals were too far out of sync. Despite some challenges, like high vacancy rates in Sydney and Melbourne, there are still reasons for investors to be optimistic about the office market.

Firstly, rents are at cyclical lows, similar to the levels seen after the early 90s office market blowup. With rents at low levels, occupiers aren’t under financial pressure to reduce their space or avoid expanding if they’re growing. This also means that cutting office space or rent isn’t the first option for saving costs. Companies understand that losing staff or having lower productivity due to a poor work environment is a bigger risk to their profits.

The other cyclical element of office fundamentals is the development pipeline (i.e. supply risk). This is relatively small, with the amount of national CBD stock expected to grow by only 0.9% per year from 2024 to 20281, compared to the 20-year average of 1.6% per year2. It’s not practical to build new offices unless they are already under construction or part of an infrastructure project, due to low rents and high construction costs affecting profitability.

It’s unlikely this dynamic will be resolved any time soon, with construction cost inflation expected to remain elevated3 and state infrastructure pipelines set to continue outcompeting for scarce resources and labour for at least several years. The lack of new development is good for the performance of existing buildings, helping to balance supply and demand and support rental growth.

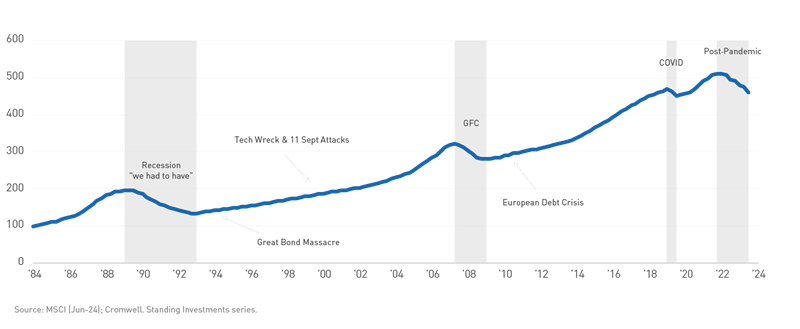

Commercial property asset value growth index

The long-term trend

Over the past 40 years, investing in Australian office, industrial, and retail properties has generally paid off, with property values growing steadily despite facing a number of downturns and crises. While looking at a shorter timeframe will accentuate cyclical ups and downs, the market has shown a long-term upward trend.

Adopting a long-term approach when investing in property means investors can benefit from this steady growth. This approach helps avoid the stress of predicting market movements. Sticking to a disciplined, long-term strategy based on solid fundamentals can help investors navigate market cycles, reduce risk, and build wealth over time.

Getting in on the ground floor

It’s hard to know exactly when any market will peak or bottom out, but there are signs that can give clues about the general position of the commercial property cycle – whether it’s falling, stabilising, rising, or peaking.

With rate cuts expected in 2025, financial markets believe the overall economic cycle is close to turning. Similar signs are appearing in commercial property, with slower cap rate expansion in some sectors and increased transaction activity. For office spaces, very low rents and limited supply are reasons for optimism and present a good buying opportunity.

For investors who have the courage and capital to buy now, the benefits can be significant. Attractive prices are available, with buyers able to take advantage of distressed sales and the gap between market fundamentals and sentiment. While choosing the right properties is still crucial for investment returns, getting in early and riding the market upswing can provide a strong advantage for investors. Those who have been patient and held onto their investments through this stage of the cycle are also likely to benefit.

1. Source: Cromwell (Jun-24)

2. Source: Cromwell analysis of JLL data (Jun-24)

3. Source: International construction market survey 2024 (Turner & Townsend)

Colin Mackay is a Research and Investment Strategy Manager for Cromwell Property Group. Cromwell Funds Management is a sponsor of Firstlinks. This article is not intended to provide investment or financial advice or to act as any sort of offer or disclosure document. It has been prepared without taking into account any investor’s objectives, financial situation or needs. Any potential investor should make their own independent enquiries, and talk to their professional advisers, before making investment decisions.

For more articles and papers from Cromwell, please click here.