The management fee on a managed fund is often the focus of analysis especially in the context of low-cost investing. But, for an investor entering and exiting funds, especially in a short period of time, the spread between the buying and selling price is equally important but often ignored.

There may be significant differences between the buy and sell prices, and the impact on performance is more notable in a low return environment. The costs of transacting in the fund are taken into account when the buying and selling prices are calculated and investors wear the cost.

Calculation of spreads

All investing comes with a cost, as both on-market and off-market transactions have different buying and selling prices, including direct share investing. In the case of funds, the difference between the buying and selling price is called the spread, often expressed as a percentage of the fund's net asset value (NAV). The manager of a managed fund covers the costs of trading and other transaction costs such as government taxes, brokerage and bank fees by setting different prices for entering or exiting the fund.

A fund may set the buy or sell prices at 0.25% either side of the NAV. This gives a 0.5% price spread, a material impact if an investor enters and exits a fund in a short period.

The price spread ensures investors are treated equally so that new investors joining the fund or those existing investors leaving the fund contribute towards the transaction costs. Investors that stay invested are not subjected to the financial cost of other investors' transactions. In fact, investors staying in a fund long term usually benefit from people coming and going, because applications and redemptions in the same period may net out but the buy/sell spread is still paid and goes into the fund.

The spreads can change without notice due to changes in transaction costs, which can include the impact of adverse market conditions or improving market conditions. Vanguard changed its spreads in 2013, with the following reason: “…reductions to buy and sell spreads across 21 wholesale and retail fund offerings reflecting changing conditions in various markets, greater liquidity in the domestic bond market, reduced volatility in global fixed income markets and improved efficiencies in trade execution”.

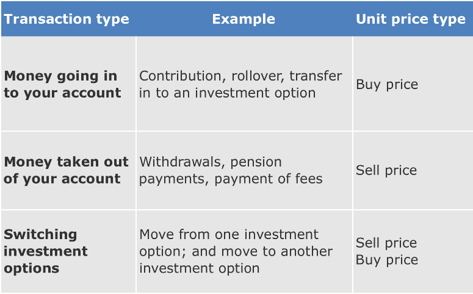

Common transactions in a fund that attract a spread

All transactions into and out of a fund attract one side of the spread, such as:

Source: REST Super Product Disclosure Statement

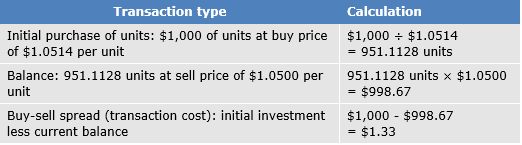

Initial contribution to fund attracting a spread

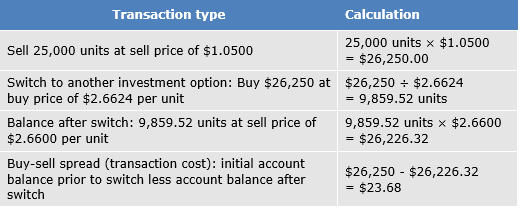

Switching between investment options attracting spreads

Source: REST Super Product Disclosure Statement

Spreads can vary for the same asset class

According to the ASX’s mFunds website, of the 176 managed funds available, the buy/sell spread can range from 0% to 2.2%. The spread is wider for funds investing in Asian and Emerging Markets and Australian Small Caps, while Fixed Interest funds have lower spreads. Some funds may invest in the same market such as Australian Equity but the spreads can vary, in this case from 0.33% up to 1.72% with a weighted average spread of 0.55%. The differences are likely to be due to factors such as how actively the fund trades, the number of stocks held, and the benchmark (small caps usually have wider spreads).

While management fees are quoted in per annum terms, such that a 1.2% fee is 0.1% a month, the spread is paid on entry and exit. If a 0.5% spread in paid within say three months, that equates to 2% per annum. For investors switching over short periods, the spread may cost more than the management fee.

ETF spreads are usually tighter

Exchange Traded Funds (ETFs) generally have tighter spreads compared with unlisted managed funds. The buy/sell spreads for ETFs are not set by the product provider (such as Vanguard or BetaShares) or even by individual market makers that create them and quote them. The spreads depend on the competition between market makers: if spreads are too wide, the market maker will lose business to other market makers.

An example of the difference in spreads between ETFs and unlisted funds is the unlisted managed fund Vanguard Australian Share Index Fund (for retail investors). It has a buy/sell spread of 0.16%, while Vanguard Australian Share Index ETF (ASX: VAS) usually has a spread of around 0.06%. But spreads on ETFs are not static and can widen during the trading day. This can happen especially at the open and close of the market due to volatility as market participants (market makers or authorised participants) are more actively creating and redeeming the units on behalf of the ETF provider.

The size of ETF spreads may also be impacted by the liquidity of the underlying individual securities that make up the ETF. ETFs that invest predominantly in large caps will most likely have tighter spreads than ETFs that invest in small caps or more obscure illiquid securities. The spread difference can be dependent on the ease with which new units can be created or redeemed by market makers.

Check the buy/sell prices

Costs including management fees and transaction fees are a major factor in a fund's net investment performance. Transaction costs directly impact investors up front by paying for the fund's cost of transacting.

Of course, there are buying and selling costs such as brokerage involved in directly investing in shares, and it may be a similar cost if the buy/sell spread on a managed fund has been set realistically. Nobody avoids transaction costs as they are a cost of investing regardless of the manner of investment.

Beating the market is difficult, and outperforming over the longer term can be made harder by higher costs from wider spreads.

Rosemary Steinfort is a Research Coordinator at Cuffelinks.