Weekend market update: the S&P/ASX200 fell heavily on Friday to drive a 1.6% loss for the week due mainly to worries about the virus impact in Victoria. The US S&P500 was far stronger, up another 0.8% on Friday with NASDAQ leading the way, up 1.5%. The market quickly shrugged off the huge fall in US June quarter GDP, down 9.5% quarter on quarter. Many parts of the world are experiencing rising virus cases again, and European stocks fell 3.6% with Japan down 4.6% over the week.

***

Differences of opinion create a market. Technology stock buyers have been the big winners recently but there are plenty of sellers as it's not difficult to make a compelling argument for and against the sector.

The doubters say speculative money flowing into tech has pushed values well beyond fundamentals, with the NASDAQ tech index up about 17% this year and 21% per annum over three years. The S&P500 is down 1% this year and up 9% per annum over three years. We have never seen NASDAQ dominate trading volumes versus the New York Stock Exchange as much as now.

In many presentations over recent years, I have said that every portfolio can justify an investment in the leading technology stocks. I remember when BetaShares launched its NASDAQ100 ETF (ASX:NDQ) in May 2015 at $10, it was an ideal vehicle for Australian investors to gain easy and inexpensive access to the best US companies. It now trades at $24.80. However, just three stocks - Apple, Amazon and Microsoft - now comprise over one-third of the NASDAQ index. As they are worth more than the GDP of Germany, the case is not as strong as before with much future success built in. The threat of regulation over their near-monopoly positions is greater than ever.

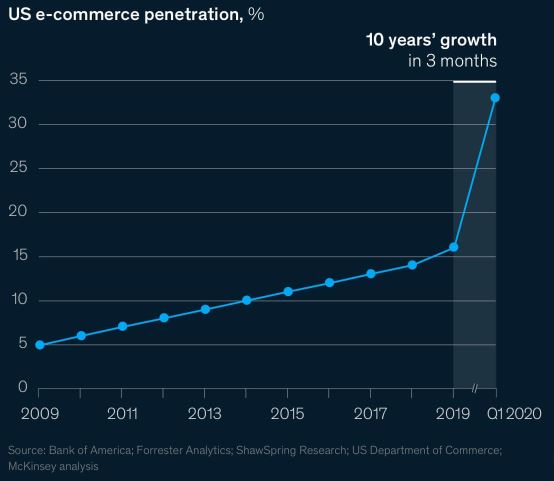

The main case for tech at these levels is that the future growth which would have taken years without COVID-19 has been compressed. Indeed, as shown below, e-commerce has achieved 10 years of growth in only three months, so future value has been brought forward into the current prices which makes them easier to justify.

As Arvind Krishna, CEO of IBM said recently:

“The trend we see in the market is clear. Clients want to modernise apps, move more workloads to the cloud and automate IT tasks. They want to infuse AI into their workflows and secure their IT infrastructure to fend off growing cybersecurity threats. As a result, we are seeing an increased opportunity of large transformational projects.”

On the other side, an equally salient argument is made this week by Roger Montgomery, who has seen plenty of booms and busts in his three decades of investing. This is one party he doesn't even want to attend, never mind leaving early before the champagne runs out.

Then in an interview with Gofran Chowdhury, he describes how his clients have changed their investment patterns in recent months, with caution that the full impact of COVID-19 is yet to hit.

Sean Fenton and James Delaney see major company beneficiaries from the pandemic, and their process allows them to go long the expected winners relative to the expected losers. Low interest rates also benefit growth stocks.

There's a popular view that the generations are 'at war', many against the Baby Boomers, with the pandemic creating new tensions. Emma Davidson investigates whether we have more to connect us than separate us.

Rarely has gold generated so many headlines as it touches US$2,000 amid rising global geoplitical and economic risks. Jordan Eliseo asks whether we should consider gold as a growth or defensive asset in a diverse portfolio.

Large superannuation funds are predominantly active share investors, priding themselves on their investment prowess over passive alternatives. Donald Hellyer dives into the numbers to see if the confidence is warranted.

COVID-19 has wreaked havoc on many sectors but greenhouse gas emissions have fallen. Lise Moret says society has an opportunity to build on improvements and create a greener future.

These are difficult times to build the bond part of a portfolio, especially when the Australian Government yesterday issued $15 billion (with demand for $37 billion) of 30-year bonds at a yield of only 1.94%. The 10-year rate is about 0.8%. It's all part of funding the large budget deficits, an unavoidable necessity to support the economy, and at least it is being done at low rates. The Port of Brisbane recently launched a deal with $2.75 billion of bids for a $500 million issue. There's a lot of cash chasing low rate, high quality bonds, and with headline inflation negative in the June quarter, investors know rates are not rising anytime soon.

To assist in portfolio construction in these tough conditions, this week's White Paper from Vanguard is its latest Asset Allocation Report, showing investors are incorporating caution into their outlooks.

Graham Hand, Managing Editor

A full PDF version of this week’s newsletter articles will be loaded into this editorial on our website by midday.

Latest updates

PDF version of Firstlinks Newsletter

Latest ETF Quarterly Report from Vanguard

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website