From a financial advice and user perspective, it’s crucial to understand the impact of the coming drop in the 'aged care interest rate' or Maximum Permissible Interest Rate (MPIR). Advisers should look at a client’s personal circumstances, consider alternative scenarios and model not just the cost today but what it is likely to be in the future.

The MPIR is expected to drop to an all-time low of 4.10% from 1 July 2020. As with any change to government rates and thresholds, this change will create winners and losers. Unfortunately, the ‘losers’ are the low-means residents, people who are financially disadvantaged and receive government assistance with their accommodation cost whose lump sum could increase substantially. Ironically those who are not financially disadvantaged, known as ‘market price’ residents could be substantially better off if they pay by daily payment.

Let’s look at the impact the reduced MPIR will have on new and existing residents, explore what this means for an aged operator’s financial position and how advisers can deliver great advice to their clients.

1. Impact on new residents

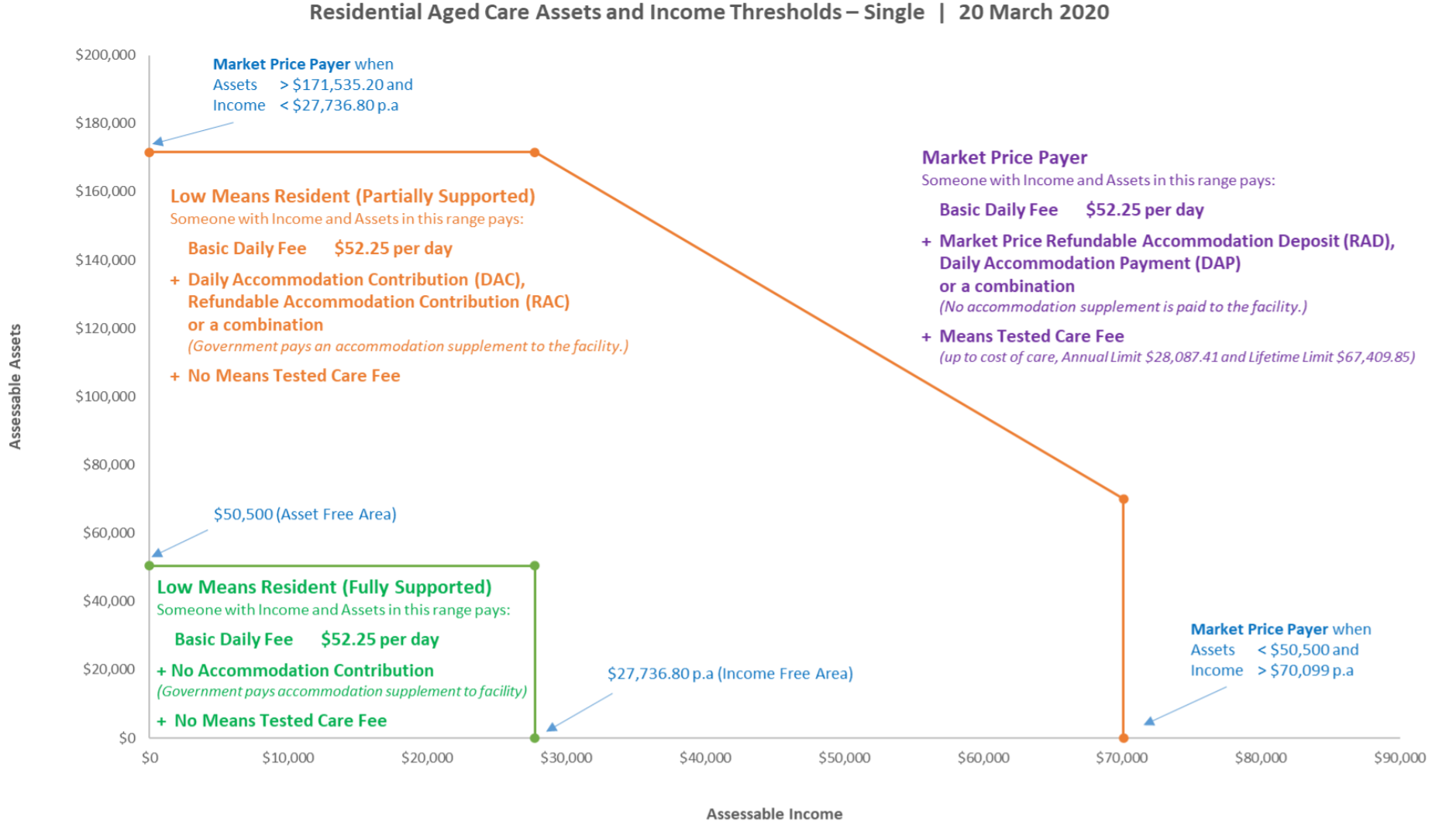

When someone moves into residential aged care, they are assessed based on their assets and income to determine whether they are classified as a ‘low means’ resident or a ‘market price’ resident. It should be noted that this means assessment is not compulsory, those who choose not to submit an assessment will be considered a market price resident. The diagram below shows how the combination of assets and income determine the resident’s classification.

2. Impact on low-means residents

Where the person’s assets and income are below the orange line their accommodation contribution is calculated at 17.5% of assets above $50,500 plus 50c per dollar in excess of $27,736.80/year. The income threshold for a member of a couple is slightly lower at $27,216.80/year. The result is divided by 364 to calculate the person’s DAC (Daily Accommodation Contribution). For people with assets and income below both the asset and income thresholds (inside the green line) their Daily Accommodation Contribution (DAC) is $0.

Source: Learn, Build, Deliver pro.agedcaregurus.com.au ACG Advice builder.

Low-means residents have the option of paying their accommodation contribution by daily payment, lump sum or a combination. The lump sum, known as the Refundable Accommodation Contribution or RAC, is calculated by dividing the daily accommodation contribution (annual) by the MPIR. In effect the daily accommodation contribution is the interest payable on that equivalent lump sum.

By nature of the formula the lump sum accommodation price for low means residents has an inverse relation to movements in MPIR, similar to bond pricing and yields. A decreasing interest rate (MPIR) will result in the equivalent lump sum increasing. Since the introduction of the Living Longer, Living Better (LLLB) reforms in 2014 the MPIR has reduced from 6.69% to 4.10% from July 2020. Changes to the MPIR don’t affect existing residents, the rate is set on the date of entry to the aged care home and doesn’t change while the resident lives there.

Changes to the resident’s financial position will cause their accommodation contribution to be recalculated, if their assets and/or income reduce then their contribution reduces. Likewise, if their assets and/or income increase (which is far more common) then their accommodation contribution increases (they can also be subject to a means tested care fee). But they are always classified as a low means resident while they live in that aged care home and the accommodation contribution they can pay is capped at the Government funding the facility can receive (known as the accommodation supplement).

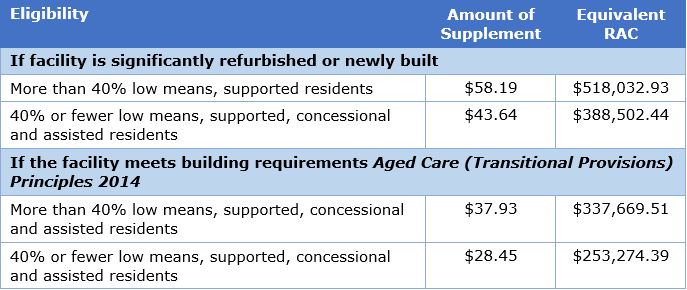

The amount of accommodation supplement the aged care home can receive is based on the standard of the accommodation and the ratio of low means residents to market price residents.

The table below shows the maximum funding an aged care home can receive based on their building standard and low means ratio.

Source: https://pro.agedcaregurus.com.au/ Resource library

3. Impact on market price payers

For market price payers who enter care after 1 July the reduction in MPIR won’t change their lump sum amount but their daily accommodation payment (DAP) will be less. For example, a market price Refundable Accommodation Deposit (RAD) of $400,000 today has an equivalent DAP of $53.59, after 1 July the DAP will be $44.93 a saving of $3,161/year.

Historical context and need for advice

When the LLLB reforms were introduced in July 2014 a RAD of $400,000 had an equivalent DAP of $73.32 per day in 2014 this has subsequently decreased to $44.93 per day from 1 July 2020, a huge saving of 63% to the resident and a substantial drop in income to the aged care home.

In contrast, low means residents in 2014 could pay a maximum DAC of $52.49/day and their equivalent lump sum was $286,380. From 1 July, while the maximum DAC has only increased to $58.19/day the equivalent lump sum will be a staggering $518,033.

Like all great advice, the advice needs to take into consideration the client’s personal financial needs and objectives.

There are many clients who may be on the borderline, while it may seem illogical, increasing their assessable assets to push them over the threshold to become a market price payer may be a good idea.

If the client is going to be a low means resident and they want to pay by lump sum, moving in now rather than after 1 July could mean the difference between paying $434,343 versus $518,033. Of course, the RAC is an exempt asset so paying more could actually be of benefit to their pension, paying the higher RAC could equate to an extra $6,500/year in age pension.

For other clients strategies to reduce their assessable assets could save them a great deal. Reducing the assessable assets by $20,000 could reduce the DAC by $9.62/day or $3,500/year – the reduction to the equivalent lump sum is $85,366.

The change to the MPIR could change the ratio of low means residents an aged care home chooses to keep. If the home meets the new (or refurbished) building standards but has a ratio less than 40% low means residents, the most they can receive is $43.64/day or $388,502 as a lump sum from a low means resident. But if the ratio reaches 40%, they can receive $58.19/day or $518,033 as a lump sum. This may be very attractive, especially if their market price is below $500,000 as the market price doesn’t cap what a low means resident can pay.

Changes to the home’s funding don’t just impact on what new residents can pay, they also impact on existing resident. A resident who moved in 2 years ago and is currently paying a DAC $43.64/day could find that their costs jump up to $58.19/day – as a lump sum the cost would increase by just over $92,000 from $276,059 to $368,100.

Many low-means residents think they can’t afford great advice, we think they can’t afford not to get it.

Jemma Briscoe is Head of Research and Technical Advice at Aged Care Gurus. This material is general information only and does not take into account your objectives, financial situation or needs. There is a free webinar on this topic on 14 July at 12.30.