The Government’s proposal to introduce a $1.6 million cap on the total amount of superannuation benefits in pension phase limits the amount a person can accumulate in a tax-free environment. Whilst the average Australian could only dream of building a $1.6 million retirement fund, those that do will be required to move the excess funds out of pension phase. This overflow could be invested in a number of ways, and now would be a good time to talk to your financial adviser about the alternatives.

But let’s face it – super is still likely to be the best place to park large swathes of wealth, with generally considerable advantages to retaining excess funds in this environment. Concessional tax on earnings may not be better than no tax, but it sure is better than the marginal rate at the heavy end of the wealth spectrum.

Rolling the funds out of pension phase to an accumulation fund will generally not have any tax consequences on the withdrawal, and future earnings of the accumulation fund would be taxed at the concessional 15% rate. However, the tax consequences of subsequently withdrawing the excess out of super depends on factors such as age, condition of release and the underlying tax components of the benefits.

If you are retired and over the age of 60, withdrawing your benefits would be tax-free (unless you have an untaxed element in your taxable components, which would be taxed at 15% up to the untaxed plan cap of $1.395 million … but now we’re getting technical). If you are retired and under 60, you may consider sitting the fund in accumulation phase until you reach that magic age, as a lump sum withdrawal above $195,000 could see 15% of your taxable components going to the Tax Man. Declaring it as an income stream payment would not be any better while you are under the age of 60.

Example of past and possible future

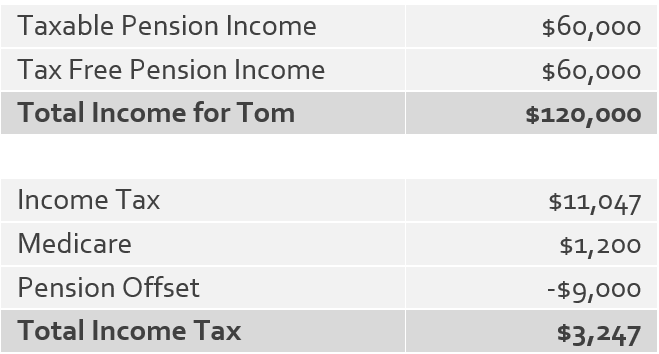

Tom is 56, retired and currently drawing $120,000 per annum as his minimum pension requirements from his $3 million fund. Half of his benefits consists of taxable components so Tom happily pays $3,247 in income tax on his pension payments knowing that this tax impost will only be for another four years.

Let’s say Mr Turnbull wins the election and all of Sco-Mo’s budget dreams come true.

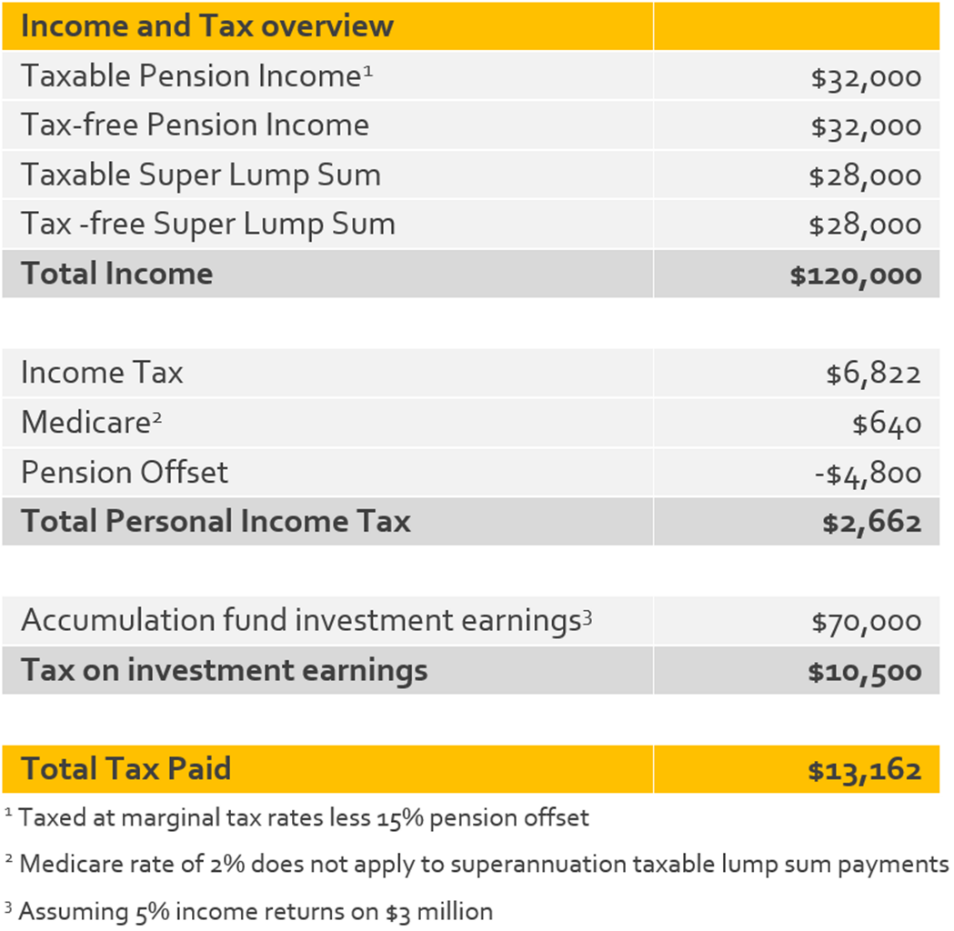

Tom still wants to live comfortably on $120,000 per annum post- 1 July 2017. He rolls out $1.4 million from his pension account and parks it in an accumulation fund after seeking advice. Being fully retired, he could nominate to take all of his income needs from his $1.6 million pension account, or he could continue drawing the minimum and augment his income with lump sum withdrawals from the accumulation fund (let’s keep it interesting and assume that he has fully utilised his low cap rates in the past).

Interestingly, Tom would pay less personal income tax under this strategy but the earnings in his $1.4 million accumulation fund are now subject to 15% tax. If the income generated in his accumulation account is 5%, the fund now pays $10,500 in tax on the investment earnings.

Should Tom roll back more into accumulation phase or perhaps pull it out from superannuation altogether? If he does, should he be planning for any future capital gains derived from the accumulation assets now while everything remains in pension phase and tax exempt? Asset transfers between pension and accumulation phase would generally keep the purchase cost information … food for thought.

And he could hold a significant sum (say $400,000 earning 5% income) in his personal name and pay little or no tax due to the tax-free threshold outside super, and any capital which would derive income above the tax-free threshold could remain concessionally-taxed in superannuation.

But what about the anti-detriment changes?

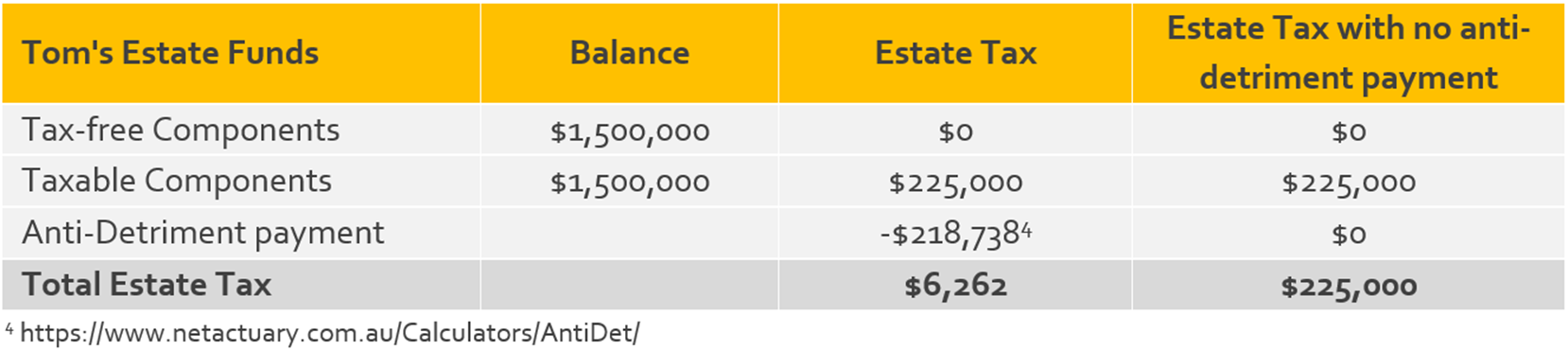

Tom has had a happy life and his adult daughter, Jessie, stands to inherit his wealth. Superannuation was taken into consideration as part of his wealth distribution and estate plan. Scott Morrison’s proposal to remove anti-detriment payments now means that Jessie’s inheritance would be heavily impacted.

Tom’s adviser shows him that superannuation may no longer be appropriate if his wealth distribution goal for Jessie remains a top priority. Given this significant impact, Tom could potentially look into holding some of his capital in his own name. With careful planning, his adviser can help him minimise the income tax payable over his lifetime.

Some other consequences to consider

There are several questions for the consultation papers when (and if) the budget proposals go through to legislation. Obviously the mechanics and administration changes would need to be carefully planned before 1 July 2017.

Many people will now need to park the plan for additional non-concessional contributions due to the proposed $500,000 life time cap, especially those who have made strong contributions from July 2007.

If you are not part of the $1.6 million club and have under $500,000 in super, there are a few options to consider.

If an impending bonus is going to tip you into the next tax bracket, or you’re planning to sell an investment property at retirement, it may be wise to hold back from further contributions (yes, stop that salary sacrificing arrangement) and subsequently make use of the catch-up concessional contributions provisions. This could serve to keep you in the lower tax bracket, and swell your fund balance considerably. And what if you make your large concessional contribution in June? You could then defer claiming the contribution until the following financial year, which effectively gives you up to six years of concessional caps to play with. Of course, you’d need over $150,000 in capital gains or other assessable income to make it worthwhile, but it’s a win nonetheless if you have the cash.

What other things should your adviser be considering in the next 13 months? Balance equalisation would be important; making use of the ability to split contributions with a spouse (beyond the age of 65), as well as making use of the spouse tax offset for partners earning under $37,000 (a proposed increase from $10,800). Of course, you would need to leave a buffer under the proposed non-concessional lifetime cap of $500,000 to make this worthwhile and trigger the $540 tax offset.

To summarise, there are a raft of strategic options to consider with the 2016 Budget proposals. The evolution of wealth creation will continue unabated, albeit in a new guise and with vastly different focus areas. Contribution splitting with a spouse will become the norm, whilst salary sacrificing and transition to retirements will be locked up in dusty museums for future generations to laugh and point at. Remember these are just proposals at this stage, and we are far from seeing the changes in their final form. Haste and complacency are your enemies in equal measure, but patience in planning your financial future will always be your friend.

The unintended consequence of Scott Morrison’s super 'reforms' is to make the provision of quality financial advice essential once again. Surely, Scott, this wasn't your intention?

Diana Chan is Head of Compliance at Stanford Brown. This article is general information and does not address the circumstances of any individual.