It’s one of Australia’s oldest listed investment companies, yet few investors have heard of it.

While household Listed Investment Company (LIC) names such as Australian Foundation Investment Company and Argo Investments grab the limelight, low key is how Whitefield Ltd (ASX:WHF) prefers it.

Late last week, Whitefield took the time to celebrate its 100th birthday in a closing bell ceremony at the Australian Stock Exchange in Sydney.

Whitefield MD Angus Gluskie at the 100th birthday celebrations in Sydney. Picture: Supplied

The secrets to Whitefield’s longevity

Whitefield is a specialist LIC. It only invests in industrials stocks and excludes the resources sector from its portfolio. The company invests in about 160 companies in the ASX 200 industrials index.

The industrials exposure seeks to give investors a benefit from exposure to the long-term growth of the Australian economy, the historically lower volatility of companies operating in non-resource industries and has the incidental benefit of lowering exposure to fossil fuel producers and emitters.

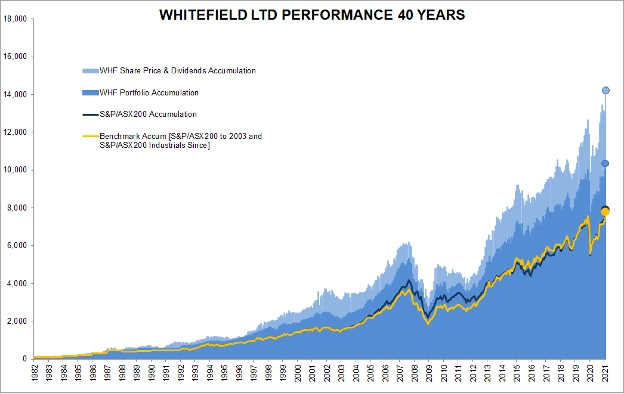

Over the past 40 years, the company has returned close to 14% per annum, including the benefit of franking credits.

So what are the keys to Whitefield’s longevity?

Managing Director Angus Gluskie puts it down to some simple principles:

“We believe there are three important contributors to durability: 1) having a sound investment strategy, that invests sensibly across a high diversity portfolio that targets consistent small increments of outperformance. 2) Alignment of interest between managers and shareholders. 3) A listed investment company structure, which encourages long term planning.”

Born in the ‘roaring ‘20s’

It’s ironic that the publicity-shy Whitefield was born during the roaring '20s’.

A.S. White was a young man then when, after the death of his father, he was put in charge of the financial operations of his family’s baking and milling business, the stock exchange listed Gartrell White.

By 1923, A.S. had built an accounting practice, created one of the nation’s first workers’ compensation insurers and listed a financing company.

In March of that year, he launched Whitefield as an investment company with a 5,000-pound public share issue. The company found an enthusiastic following and after several capital raisings, Whitefield’s issued capital swiftly increased to 300,000 pounds.

Initially, the company invested in mortgages, taking advantage of a resurgent housing market during the 1920s. But with the Great Depression, and then price controls on house prices and rents during World War Two, Whitefield pivoted to investing in companies that would benefit from growth in the broad industrial economy.

That’s how the investment strategy evolved towards owning a diversified portfolio of Australian shares for long term wealth creation. By the 1950s, Whitefield had 300 stocks in its portfolio.

While the investment strategy has broadly stayed the same since that time, Angus Gluskie says the tools of the investment trade have changed dramatically.

Whereas once, the company used manual mathematical calculations and handwritten records, now everything is computerised. That’s allowed the firm to use quantitative tools to assess stocks and develop proprietary assessments of quality, earnings, and growth.

Remaining a LIC is central to long-term success

Gluskie says the benefits of being an LIC far outweigh any negatives. While investors are free to sell Whitefield shares on the stock exchange, he says most see the company as a closed-end long term investment vehicle.

The stability of this investor money has allowed Whitefield to think about investments in decades rather than years or months.

I can attest to the stability of the investor base having met Margaret Dobbin at the ASX event, who’d been an investor in Whitefield since 1955.

It’s also no accident that there’s been little turnover in management since the company’s founding. Only five people have had the role of either Chair or CEO. The tenures of each, across the combined roles, has been between 30 and 50 years.

How does Whitefield stack up against other LICs?

With a market capitalisation of $603 million, Whitefield is a small-to-mid cap company in the LIC space. It's one of the few LICs that currently trades at a premium (2.1%) to its net tangible assets (NTA). Its share price versus NTA fluctuates more than some of the larger LICs, though less so than smaller peers.

Over the past one, three and five years, Whitefield has lagged many similar-sized or larger LICs due to the outperformance of commodities during these periods and Whitefield doesn't have any exposure to this sector.

Yet over the past decade, the company's investment portfolio performance (NTA growth of 8% p.a.) has been more than credible. Whitefield also offers a 100% fully franked dividend and the current net dividend yield of 4% compares favourably with other LICs.

And the company has maintained or increased its dividend in every year since the introduction of the dividend imputation system in the 1980s.

What does the future hold for Whitefield?

Whitefield has been a tremendous success story, though past performance is no guarantee of future performance.

Gluskie says the company’s history provides a guide for what works best for investor outcomes. Using investment experience, integrity, and innovation, Gluskie believes Whitefield can continue to thrive for another 100 years.

* Note that you can find detailed reports on LICs including Whitefield in Firstlinks' education centre.

James Gruber is an Assistant Editor for Firstlinks and Morningstar.com.au. This article is general information and does not consider the circumtances of any person.