Cash has often been a source of confusion for investors. Some people do not consider it an investment class in its own right but more as a ‘balancing’ or ‘residual’ item after all other investments have been made. However, there are compelling reasons why cash should be considered a core portfolio allocation item.

Investors who see holding cash as a missed opportunity in other investments may deliberately minimise the allocation. In poor markets, this mentality creates problems, because cash cannot fulfill its role to support the portfolio and act as a bastion of certainty.

To understand cash’s true value, investments should be measured on a risk-adjusted basis, which puts the cash return in a much more favourable light.

There are four interconnected reasons why all investors should consider cash as core.

1. A new dimension of uncertainty and volatility has entered markets

Markets are now more prone to moves that are extremely difficult to anticipate or forecast. Price discontinuity and volatility is partly due to four dynamics at play in markets:

- Globalisation: Financial markets are now more influenced by the financial and trade interconnections. These markets are continuously being affected by factors operating in other parts of the world. For example, China has evolved quickly in recent years as the number two economy in the world with a profound economic influence in our region. Our economic and financial models need recalibration but we simply have not had enough time to understand China’s influence on global trends or Australian financial markets with much precision.

- Changes in the political and geopolitical spheres: New forces and trends are emerging with direct flow-through effects to the way markets behave, including the way government finances and central bank monetary settings are managed. Two examples are: first, the emergence of ‘populism’ with new reactive politics from both the left and the right sides; and secondly, demographic and cross-generational trends where baby boomers vie with the millennials in an economic and wealth battle. This will accelerate as the baby boomers move into retirement and the sheer number of millennials and the older Gen X out-vote the baby boomers.

- Growth of large institutions and their use of algorithms: The use of complex, ‘opaque’, mathematics-based algorithms by large funds means markets can move indiscriminately, quickly, and even violently if certain market price levels are reached. Algorithms can be ‘correlation-based’ whereby price levels in several markets need to be simultaneously breached before trading action is invoked. Price movement may trigger further algorithm-based trading. The volume of trading potentially released can overwhelm markets and cause significant dislocation.

- Uncertainty and illiquidity: Price volatility increasingly occurs in unpredicted ‘jumps’ and is a major source of illiquidity and even severe dysfunctionality in markets. Illiquidity exacerbates problems for investors looking to exit securities and needs to be assessed in any investment model.

Potential illiquidity and uncertainty can be risk-managed via a designated percentage of portfolio assets in cash, with the percentage in cash increasing if there is a perceived risk to these price jumps. This cash component needs to be considered a core volatility and uncertainty management tool.

2. Cash is both certain and available

Being certain and available provides real value to a portfolio, yet these attributes are often not measured or given their true importance in risk-adjusted returns. All markets trade essentially as a premium to the risk-free government rate. The premium reflects the extra return required to hold an investment, to compensate for the additional risk. This extra return or premium is seen in capital asset pricing models, which calculate the cost or return on capital deployed, by reference to a premium to the risk-free government rate.

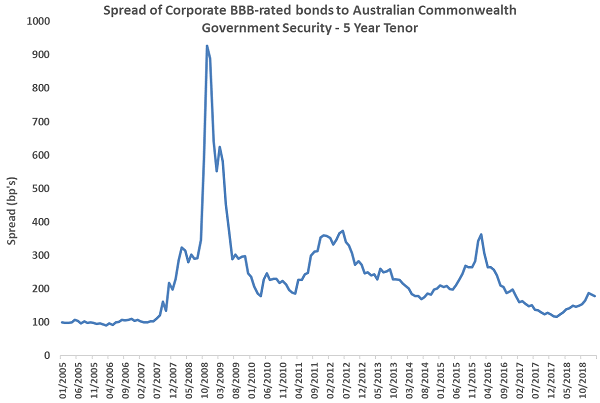

The chart below shows one measure of risk premium, being the premium of five-year bonds issued by BBB-rated companies over the Australian Government bond yield, as compiled by the Reserve Bank of Australia. It shows how the spread was bid very low pre-GFC, spiked violently during GFC, and now has settled back to again to a low level.

core portfolio allocation

Premia are low currently because of the long rally in equities and bonds. While still low in property markets, premia are higher now than in 2018. Premia are also low due to structurally-low inflation and interest rates, which means investors have been prepared to bid up the prices of risk-assets to abnormally high levels.

3. Equity markets can turn quickly

Equity markets are reasonably buoyant at the moment, but can turn quickly, making cash (and liquidity) important. Cash returning only 2.0-2.5% may be considered a lame or even unworthy investment, however if the equity market falls 10%, this cash return will look stupendous. Diversification across different markets may not help a portfolio during a significant market fall, as markets often become more correlated during extreme events.

4. The emergence of cash-plus and cash-enhanced funds

Cash-plus and cash-enhanced funds allow investors to earn a higher return on a risk-adjusted basis compared to traditional cash investments. This means cash holdings can be ‘put to work’ more effectively and earn a decent return. Again, applying the risk-adjusted return methodology, these funds generally contain more risk that traditional cash at bank, hence they may allocate only a portion of their ‘cash’ to the cash-plus fund sector.

Cash can be king

‘Cash is king’ is often the plaintive cry when markets have already moved. While cash may not always be king, it should not be relegated in status to the ‘poor cousin’ especially in today’s markets with new dimensions and sources of price volatility. Cash holdings should be held as a legitimate, wise and prudent form of ballast in a diversified investment portfolio. Cash-plus and cash-enhanced funds provide a ready way for funds to enhance other traditional forms of cash investments.

Matthew Lemke is the Fund Manager of the Prime Value Cash Plus Fund. Matthew has worked in the securities market for over 35 years. This article is for educational purposes and is not a substitute for tailored financial advice.