The unfortunate reality is that we are in the late stages of an incredibly long bull market in equities, but changes to the ‘growth’ component of a global equity allocation may prove appropriate for investors.

Four types of global equities

Traditionally, Australian investors have achieved growth exposure in their global portfolios by allocating to three buckets of global equities:

1. large cap growth

2. emerging markets

3. global small caps.

It’s not hard to see why. For the better part of the last decade, we have seen large companies - like the FAANG stocks – proving generally to be stellar performers, while emerging markets and global small caps have also performed well for many years.

However, no one was fully prepared for how the COVID-19 pandemic exposed the multitude of risks in global markets.

For those investors who were contemplating changes in global equity portfolios earlier this year but did not act, the recent rally could present a timely opportunity to make some changes to sub-allocations within global equities.

This is where we believe global small and mid-cap (SMID) stocks play an important growth role in diversified portfolios.

Investors have previously not been as aware of this fourth type of asset class as of others. A lack of analyst coverage and investor attention to global SMID stocks has meant that investors have been missing out on an asset class that exhibits strong potential growth opportunity, lower valuation risk than other growth assets and diversification opportunities.

They may not be named brands, like Apple, Facebook, or Google, but what these stocks do offer is an opportunity for investors to access them during their ‘sweet spot’ of the business cycle.

So is it too late to enter the global SMID space for investors?

Allocating to global SMID equities

Global SMID companies can improve the risk-return profile by playing a growth role in investor portfolios over the medium term. They have less valuation risk than large cap growth, less absolute risk than emerging markets and less liquidity risk than small caps alone.

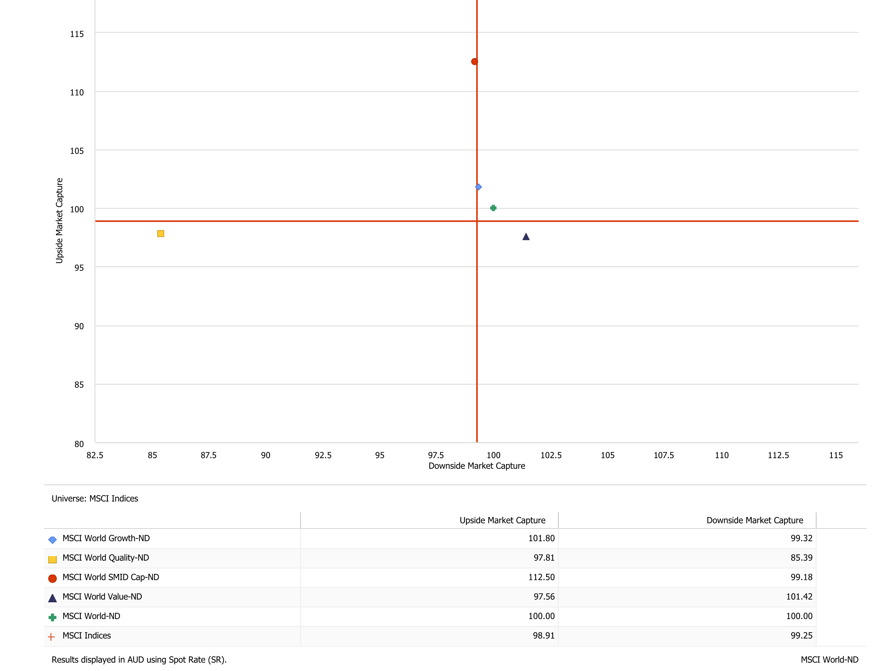

Further, global SMID companies have the best mix of upside and downside capture over 20 years when compared to other global market indices, as shown in Exhibit 1 below. This is an important metric when comparing returns and offers one way to measure expected performance during both market rallies and declines.

An upside capture ratio of greater than 100 indicates historical outperformance of the market during periods of positive returns (the MSCI World SMID Cap Index at 112.50), and a number less than 100 indicates relative underperformance.

Similarly, a downside capture ratio of greater than 100 would indicate a historical decline greater than the broader market during periods of stress, and a downside capture ratio of less than 100 (the MSCI World SMID Cap Index at 99.18), indicates that it historically has protected capital and declined less than the broader market during these negative periods.

Exhibit 1: Upside and Downside Capture (20 years)

Source: eVestment. MSCI Median is the median of the five indices shown in the chart. Period is for 20 years ending June 2020, run on a monthly basis. All results are in AUD terms and measured against MSCI World-ND.

The remarkable rebound in global equities following the dramatic losses in the first quarter of 2020 has caused many investors to question whether they have ‘missed the boat’ when it comes to investing in global stocks.

The simple answer is no. We believe the current environment makes a good case for an allocation to global SMID stocks.

Valuations have lagged but fundamentals are strong

When we look at global equities as a whole, valuations are not that high, considering the MSCI World Index as a proxy. The current forward price-to-earnings ratio (P/E) is about 20x earnings, or in other words, an earnings yield of about 5%. In the context of a 0% interest rate environment, a 5% earnings yield is reasonable. But within these valuations there is massive dispersion, particularly between large cap growth stocks and value stocks.

Within the global SMID space, there is far less dispersion. As much as stocks have been rebounded off their lows, global SMID stocks have effectively gone sideways over the last three years, lagging the MSCI World Index by 4.2% per annum. As an asset class, they are almost back to where they were in Q3 2017.

In terms of valuations, the MSCI World SMID Cap Index is currently trading on a 2020 P/E of 23.1x, compared to 30.5x for MSCI World Growth Index. As another ‘growth proxy’ in global equity markets, we would argue that a 24% valuation discount is compelling. The absolute P/E of 23.1 might not sound overly cheap in an absolute sense but 2020 earnings will be well below 2019 levels.

We also think investors should acknowledge how valuations have changed over the past five years. Global SMID stocks are currently trading at a 12% premium to the broader market which is in line with its 5-year average. Global large cap growth stocks on the other hand are trading on a 43% premium to the broader market versus its 5-year average of 23%.

This discounted valuation is an attractive proposition for investors seeking diversification potential compared to large cap stocks.

And while these stocks are not predicted to grow much this year, once we come out of the other side of COVID-19, the organic growth drivers of SMID stocks should come back. The combination of corporate cost-cutting, COVID-19-related stimulus and the reopening of global economies, positions global SMID companies for a strong rebound over the next two to three years.

Companies poised to win in a COVID-19 world

While many industries are suffering because of the COVID-19 pandemic, others have thrived in this environment, especially in the healthcare and consumer discretionary spaces.

The healthcare sector continues to boom, particularly towards research and development in pharmaceuticals and biotech industries. We believe dental orthodontics, which saw a negative impact in the short-term due to lockdowns, will present excellent earnings leverage in 2021.

Stocks that we are watching in the healthcare space include Align Technologies, Idexx Laboratories, and Danish medical devices maker Ambu.

Likewise, consumer discretionary has seen increased demand during COVID-19 as consumer behaviour changes materially. Opportunities include sectors such as home improvements, localised vacations and outdoor activities. However, overseas travel and the hospitality industry will continue to struggle.

Consumer discretionary stocks that we believe are poised to win include Tractor Supply, Pool Corp, O’Reilly Automotive, and YETI Holdings.

For investors looking to diversify their global large cap exposure, global SMID equities present investors with some strong opportunities in names we believe will do well over three to five years and beyond.

Ned Bell is Chief Investment Officer and Portfolio Manager at Bell Asset Management, a Channel Capital partner. Channel Capital is a sponsor of Firstlinks. This information is not advice or a recommendation in relation to purchasing or selling particular assets. It does not take into account particular investment objectives or needs.

For more articles and papers from Channel Capital and partners, click here.