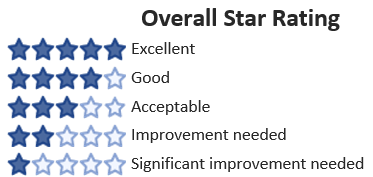

In December 2022 the Federal Government introduced star ratings for aged care homes with the aim of providing simple, reliable information about the quality of care. The introduction of the star rating system was a recommendation of the Royal Commission into Aged Care Quality and Safety which said that the system was needed to provide senior Australian’s and their families the ability to easily assess and compare aged care services based on measurable information.

A recent report by Dr Rodney Jilek titled “The Failure of the Aged Care Star Ratings” indicates that instead of providing the transparency older people need to compare and choose an aged care home, the star ratings may actually lead them to choose a home that is delivering poor care.

How the Star Ratings are determined

The star-rating system draws on data from the National Aged Care Mandatory Quality Indicator Program, consumer experience reports and provider compliance with and performance against the Aged Care Quality Standards as assessed by the Aged Care Quality and Safety Commission.

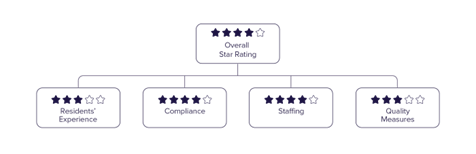

The star ratings are based on 4 domains.

- Quality – has the lowest weighting in the overall stars making up 15% of the rating. The quality measure uses data on five care quality indicators that operators provide to the government on a quarterly basis under the National Aged Care Quality Indicator Program.

- Staffing – has a weighting of 22% towards the total star rating. It uses data reported by the provider on the average number of care minutes each resident receives per day and how many of those minutes are with a registered nurse.

- Compliance – makes up 30% of the overall rating and is based on audits and non-compliance decisions made by the Aged Care Quality and Safety Commission.

- Resident Experience – has the greatest weighting contributing 33% to the overall rating. To measure resident experience the government will contract a third party to interview at least 10% of residents face-to-face about their experience at their aged care home. The interviews will be conducted annually.

Source: Department of Health and Aged Care

The failure of the ratings

The report, by Dr Jilek, compared the 501 aged care homes on the Government’s non-compliance register over 12 months from November 2022 with the star ratings those homes had received. “We targeted the homes on the non-compliance register mainly because they are supposed to be the worst in the country – they’re all non-compliant – so you would reasonably expect that they would represent the lowest ratings. What we found was that the majority of homes (300) were awarded 3 stars, which under the guidelines means that the home is providing “an acceptable quality of care”. 68 of the homes had a 5-star rating for compliance and 81 had 4-star compliance ratings, ratings that (according to the guidelines) are impossible to achieve for homes that have been deemed non-complaint.

The report gives an example of an aged care home that was assessed as non-compliant in 2020, and over the past 3 and a half years has had sanctions imposed and been required to engage external advisers. The home has remained non-compliant for three and a half years and yet has an overall rating of 3 stars, with 4 stars for compliance.

In another example, an aged care home that has 3 stars overall and 3 stars for compliance has a chequered history of compliance spanning 20 years. In 2020 the home failed 7 of the 8 standards, in 2022 the home again failed 7 out of 8 standards. Despite the history, and the fact that the home remained non-compliant, the Aged Care Quality and Safety re-accredited the home for a further 2 years.

The report concluded that the star rating system does not meet its stated objectives of improving transparency, ease of search, facility comparison or to monitor and improve the quality of aged care.

Dr Jilek describes the resident experience measure as “completely useless”, and says that “only 10% of residents are surveyed and the care provider can control the outcome by cherry picking the residents”. He says that it is hard to have certainty around the staffing and quality measures because they are based on unvetted provider supplied data, with no validation or check measure to ensure that it is correct. The only measure being independently reviewed is the compliance measure, which is the role of the Aged Care Quality and Safety Commission, and they are giving homes 5 stars for compliance when they have determined that they are non-compliant.

The best research you can do

Undertaking research, such as that carried out by Dr Jilek, outside of the star ratings can be very difficult. While the list of aged care homes on the non-compliance register has a search function, it uses the name that the Aged Care Quality and Safety Commission has for the home (which is often different to the name you know the home by), the variation can be small or it can be significant, but any variation to the record will result in no listing appearing.

If you are investigating an aged care home for yourself or a loved one the best way to do your research is to have a respite stay. Respite is designed to give carers a much-needed break but it is also a great way to “try before you buy”. Respite enables you to stay in an aged care home for up to a total of 63 days (9 weeks) per year. That time could be spent in one home or spread across a number of homes, which can be useful if you are unsure which home you are interested in.

A short stay of a few weeks is normally enough time for you to work out whether you like the activities, the other residents, the food and most importantly the care. Respite is also very affordable as there are no accommodation payments and no means tested fees. You simply pay the basic daily fee, set at 85% of the Age Pension, currently $61 per day plus any extra or additional service fees for things like hairdressing, wine and entertainment.

Respite is government funded so in order to get access you will need to have your care needs assessed by the Aged Care Assessment Team (normally just referred to as ACAT). The starting point is to contact My Aged Care either through their website or by telephone.

Having a simple, reliable measure of the quality of care an aged care home provides is crucial in working out whether or not you are going to get good value. Until you can have confidence in the star ratings, it’s best to do your own research.

Rachel Lane is the Principal of Aged Care Gurus where she oversees a national network of advisers dedicated to providing quality advice on retirement living and aged care. She is also the co-author of a number of books with Noel Whittaker including best-seller 'Aged Care, Who Cares?' and 'Downsizing Made Simple'.