In conjunction with Graham Hand’s article, OK Boomer: fessing up that we’ve had it good, we asked both Boomers or Non-Boomers: Do you agree the Baby Boomer generation has been favoured?

[Note: This survey is now closed]

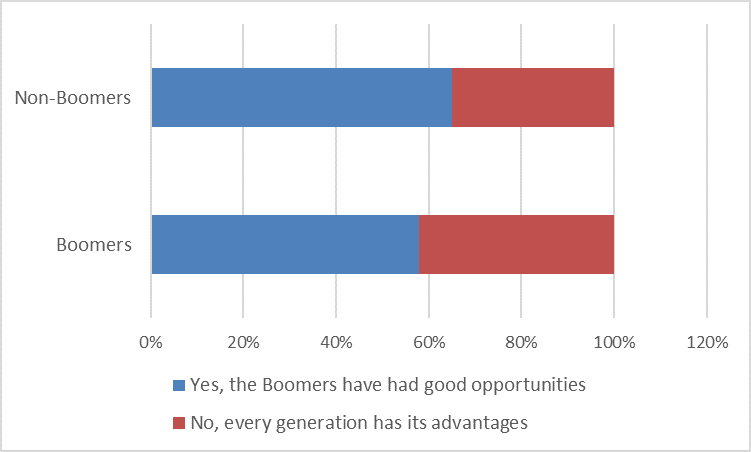

We've now had 2,400 people share their opinions and circumstances (up from 1,800 when the last update was posted). The overall percentages have remained similar: Boomers outweigh Non-Boomers among respondents (68% to 32%), and the responses on whether Boomers have 'had it good' show most people think it's a lucky generation.

Republishing comments in full

The original comments were heartfelt and passionate, including examples of personal struggles, as well as responses taking one side of the debate versus the other. These were published in this report.

The more recent comments are as enlightening.

Comments from Boomers

- We have been prepared to sacrifice to take advantage of the benefits. Our three children all own homes with reasonable equity in them now, because they have made sacrifices and not the bank of Mum and Dad. Similarly other extended family members have too. Some have chosen not to, and have little or no assets, but life style.

- I have been very fortunate; off the back of all of the advantages gifted to my generation. I am sometimes embarrassed when my peers congratulate themselves for having accumulated wealth. For many it was only a matter of being in the right place at the right time. It is so much harder now, at every level, for younger people to get to a situation of financial independence.

- Yes, but we also worked hard and paid our way (including the primary tax burden) for what we do have.

- Good and long lasting jobs were easier to come by.

- Came to a halt once one is over 50 and made redundant (i.e. too old to retrain!)

- There is a need to place this discussion in terms of the time and expectations from each of the generations. Yes the movement of the markets have favoured us however our entry expectations were affected by our parents and grandparents and the need to save and not expect everything placed on a platter. Yes we are to blame for giving our kids too much!

- BUT our work ethic in paid employment and now equal commitment to voluntary work sets us apart from the ‘me’ based millennials and makes our society better

- Some of my friends have not progressed well and some have. Like all generations it depends if you are in a situation to maximise what is on offer.

- We had to pay back BOTH the Whitlam AND Hawke/Keating deficits, AS WELL AS high interest rates when we first bought property in the 80s!!! FAR from being privileged we have had to cough up for bad government policy for most of our working lives!!!

- I recall paying 24% interest on loans where they were going up 1% a month. Bit different now but have no borrowings to take advantage.

- Boomers made immorality look moral and unethical behaviour look ethical.

- Millennials have a vast communication and information advantage but are intellectually squandered and spoilt by a social media pre-occupation upon trite. Pre-occupation and misinformed fears of a 4bn year old Earth failing are a displacement activity. Feel good emotions are over sought over sound life choices.

- And I backed mine up with a lot of bloody hard work and have been ever grateful for the opportunity to be able to do so.

- The current generation of 20 or 30 somethings has far more disposable income, far more choice of activities and interests, and far more freedom from social mores than I had at their age, but they lack the self-discipline to save and waste far too much of their time consuming social media.

- They have access to the bank of mum & dad because we both worked hard!

- I had 3 jobs to pay for my 1st house which cost $20400.00. Went without... did not buy anything until we saved for it. Still doing odd jobs at 73 and love it!

- Tax-free super pension has saved us plus a little help from inheritances which allowed us to pay 3 private school fees. Our 3 kids are likely to be downwardly mobile.

- I've worked long and hard for what I have; saved and invested. I have not taken any hand outs and refused to use social welfare all my life. Yes I've used the available 'system' just as the younger generations will do to their own benefit. In relative terms, it was just as hard for me to buy my first house as it is for my children. The difference is, they expect a free 'leg up' and they are doomed to future failure if they get it. The lessons learned from austerity build self-discipline and personal growth. Easy come easy go.

- Agree with everything in the article - free education, extremely favourable policies for investments and no impact of wars has made us the lucky generation.

- At the ages of 65 and 69 respectively, we have just purchased our first ever new car - Please tell me how long most younger generations want to wait for a new car? Neither of us got any free Uni education, we both had to go straight to work/apprenticeship. Are we comfortable now? Hell yes! Did we work bloody hard for it? Hell yes! We have moved 28 times in 48 years of marriage to keep in work - how many of your younger generations will do that I ask you?

- Yes, but we worked and saved hard. We also did without often to save more.

- The advantages are not equal in each age bracket. Those boomers who have adopted a prudential financial scheme obviously have benefited, but one can see advantages in all generations; it depends on how financially savvy you are.

- Opportunity was there to invest any money left over after tax and living. I reiterate it was what was left after paying tax. I invested well, did not have luxury holidays or cars, dining out (because I lived in a remote area) but I made sure compound interest would work for me. Every dollar saved then would yield 10 times in ten years. And it comes to pass that was true. Does it now?

- You live in an era that has its advantages & disadvantages & you make the most of the opportunities presented. We did not have a car at 17 nor live in a highly indebted mansion as soon as married. Sure we prospered but not without learning the necessities of frugality. I lived in an industrial town & saw men ride a bike some 15km+ to work 8 hrs in the steel industries in heat & extreme discomfort & 15+ kms home to do the same each & every day (public transport was minimal) you deny these people of minor privileges they have earnt. These were the same people who kept Australia from foreign invasion.

- We purchased land and built 40 years ago then sold recently for 16 times the price. We had 5 kids and put them through private school so averaged a holiday (2 weeks) every 9 years. Yes, we are doing OK but I have to add that "the harder we work the luckier we get".

- I have worked since 17. Paid my own way, no parent boost for me. My taxes have built the roads, hospitals and dams. No pension for me because I saved too much.

- You are one eyed and don't know what you are talking about.

- It's important to note that technology had not assisted us in our early years. The young have access to so much information which is always more for less and they get to have huge inheritances. I got nothing from my parents and will leave millions.

- Yes, but our parents had experienced the tough times and we were heavily influenced by their experience and advice. We were cautious when it came to borrowing, we saved for the ‘rainy day’, we didn’t spend what we didn’t have, we didn’t have to ‘have it now’ and we saw planning for our retirement years as a priority. This is stark contrast to what I see in the generations that followed.

- You conveniently leave out the bad. E.g. RBL's

- I want to answer Yes and No, your earlier comment on taking advantage of opportunities is critical. The younger generations will also learn how to grasp the opportunities.

- Our children have taken advantage of the circumstances that were offered to Gen-X and they have prospered both financially and personally. If you cannot make it in Australia, then don't move overseas as Australia is certainly the land of opportunity. Stop whinging!!!

- I think we are lucky generation. Less competitions and more job opportunities.

- your article deals with someone born at a particular time. I was born 1949… no free education as pre-Gough Whitlam.... no superannuation for the first 50% of my working life... i was in private enterprise... high tax on my super by Costello where taxed 30% not 15. We only bought what we could pay for... hence no mobile phones etc… we had to pay for most things before we bought them... the list goes on... your article looks back on an era with rose coloured glasses when in fact it was a much tougher era in many ways than today.

- We were lucky to be born at the right time.

- The article highlights, SYDNEY housing price changes (talk about using an 'outlier' to formulate an argument). Boomers did have the generous government benefits of child-care, first homeowners grants etc. University was free, but a much smaller % actually went to university. The high HECS debt crisis is as much about the social policies that encourage people that shouldn't actually attend a university or enroll in 'mickey mouse' degrees. Housing prices are higher now (agreed) largely a manifestation of central bank low interest rate policy and the absurd demand to want to live in the city. Housing prices outside of the capital cities is much more reasonable (supply and demand is distorted because the precious millennials won't contemplate an existence outside a big city), if it’s too dear move to where it's not. While housing is more expensive (on the times x average earnings) almost everything else is cheaper, white goods, clothes, electronics etc. It is disingenuous to just include housing when comparing cost of living. The simple question is 'are we worse off than the previous generation in terms of quality of life, education, health and leisure experiences' answer = NO. I was over 40 before I allocated money to overseas travel (pay off my mortgage first!). Millennials, often in their 20's are traveling overseas on a yearly basis (no wonder they can't afford their dream home in Sydney!!!)

- Free university education and cheap housing have been the foundations of our wealth. Most of us saved for our retirement and are enjoying it. Our children will eventually benefit if they have not done so already. I didn't realise that there is a tax advantage in taking all money out of superannuation shortly before death. That poses a moral dilemma. I doubt I will do it as I refuse to run down my super to go on the pension like a lot of people I know have done.

- Some good points in the article. Yes, boomers have had some good opportunities compared to generations before and after. However, it compares boomers in their later years to younger people who haven't had the time to build their assets. To buy my first (very modest) 2-bedroom house in Sydney in 1980 I had to save 40% of my salary for 5 years for a deposit. My wife did the same. All our furniture was second hand for about 15 years. Everything except houses was much more expensive (in real terms.) I drove secondhand bargains for 50 years before I lashed out on a new Commodore ute.

However, in our retirement years, my wife and I have subsidised our kids into their homes. They aren’t doing too badly compared to our younger days. All our friends are doing the same. In Britain, the boomers are paying the private school fees for 15% of pupils. The boomers are using their frugal habits, hard work and good luck to share with the next generation.

Next article please compare apples with apples ie total cost of living eg for the boomers in say 1975 vs nowadays. Yes, it's often tougher now, but not as much as the media makes out.

- We had to start with nothing and saved, not consumed ad infinitum as today’s generation does. We saved for a long-term future, I see today’s consumers simply selfishly spending in an 'I want scenario'.

- They have generally not been available to women, casual and lower paid workers. You also left out the impact of the Hawke Government's First Home Owners Grant which I think was $20000, and was 40% of my first home. That gave me a real leg-up.

- Free education - yes, missed out on first home owners grants, missed out on baby bonus. Started work when high unemployment rates existed. Lucky to have had a fixed interest rate for housing during the high interest rate years. So swings and round abouts!

- Every geneneration has to work and apply themselves; planning short, medium and long term goals within the constraints and changes occurring in social, economic and political fields. Till recently (the internet) for most, there has never been a 'free lunch'. Greater access to information, self education, knowledge and 'awareness' across these fields will continue the pace of change.

- There are always opportunities. However, we are wrong to have been charging HECS and its latest equivalent to young people. Our country is wealthy enough to pay for preschool, primary, secondary and tertiary education. Every additional year of education that we have on average across our country translates into an additional 3% of GDP. Further, many Boomers did not consider their retirement, the income they would need to live comfortably, and did not accumulate adequate superannuation, preferring to spend their income contemporaneously and did not exhibit delayed gratification. More fool them. However, now they are a burden on the public purse.

- Life was simpler, I was never out of a job and politically the past has been far more stable (Hawke/Keating & Howard/Costello). Mum & Dad did it far tougher and forged a special future for us to break-out '60s & 70s. Technology grew but was not all pervasive and finally surviving in a high inflation environment taught us more about debt.

- I was born toward the end of the artificial 'Boomer' period - the year I finished high school a recession hit. None of the cliché 'jobs for life' for me - it's been a precarious existence, exacerbated by being a woman - always last on, first off, because 'your husband can look after you'. Pity that's a fantasy.

- We had far fewer career choices and far fewer educational opportunities. We expected much much less in terms of our personal lifestyle no matter which decade of life we were in. Some Millennial frustration is due to unrealistic expectations. They want a 60 or 65 year old leisure-filled lifestyle complete with nice housing and glamorous experiences every day of their lives - from age 18 onwards. We sweated and toiled forty years for the same thing - going without, working late, moonlighting nights and weekends, visiting relatives instead of having an actual holiday. All this was to afford to give them an education, experiences and opportunities we never dreamed of allowing ourselves to have. This generosity has backfired - big time - especially for female Boomers whose kids are demanding inter vivos gifts of the measly assets they've finally been able to accumulate after those same kids left home.

- Unemployment hardly existed for us.

- Free university education, lower aspirations in buying first house, parents who lived through the depression and taught us to save money.

- I am a female with not a lot of super.

- No TV until early teens, personal computers only from 80s, internet only from 90s, mobile phones only from 2000s and smartphones/tablets only from 2010s with online investing about the same time. Many disadvantages compared to current generation who have the gig economy to fall back on.

- We have lived through a period where we have been lucky enough to be the beneficiaries of unprecedented wealth and prosperity. In addition, our world has been in comparison safe and peaceful. It reminds me of the Roman Empire they reached the peak then went into decline. I believed we have peaked.

- We were prepared to up sticks and migrate to where the money was.

- Super wasn’t really having an influence until the 1990s, so those born after the boomers experienced both property rises and benefits of super

- Not many. Can honestly say “I’ve worked all my life and now I’m owed something” In truth, we were born in a lucky place, we had mainly peace, we had good education and lots of job opportunities, we have good healthcare and many tax advantages, we are lucky!

- It has never been easy. To get ahead one needs to be focussed.

- Boomers made immorality respectable during their lifetime because they embraced unethical behaviors in all walks of life and institutionalized them. They are the first generation of 20th Century who will leave the next generations economically worse than them. This is how civilizations fall otherwise what was wrong with Egyptian, Mesopotamian, Roman civilizations before us.

- Every generation has placed a different value on the priorities of life. How many overseas trip did boomers take before buying their first home? I still have never bought a takeaway coffee in my life.

- No free tertiary education before mid-1970s. Mortgage interest rates above 17% in late 1980s & early 90s. No super for most until early 1990s & then only low contributions.

- I'm female. 58. I actually have zero superannuation. My husband at 65 only has 75k. We are trying now, very late, to somehow have more when he retires. When he retires what happens to me? The rules around the aged pension keep moving. I am no longer a "partner". I have to reach retirement age before I qualify. And I can't work but am not entitled to disability. We're stuffed. One bright thing, we own our home.

- Very favoured. More than any generation in history before or since. Unfortunately there are so many boomers who have an extraordinary sense of entitlement. It is very disappointing.

- And no, every generation has its advantages (my first electronic calculator cost 2 weeks' wages for a graduate engineer). John Howard and Peter Costello produced the first intergenerational report and then decided to make superannuation pensions tax free, AND, knowing how the Norwegians created a sovereign fund to save all the income from their resources boom, proceeded to create a small future fund and spent the rest on reducing the tax base in a totally unsustainable way (tax free pensions, reduced CGT, reduced income tax for the wealthy). But of course, the Coalition are the better economic managers. I benefit from this largesse but look forward to the day when the family home is means tested, CGT is taxed more fairly and superannuation pensions are taxed sufficiently to pay for the health care and aged pensions for our cohorts who weren't so lucky.

- The younger generation has the same opportunities as the boomer Generation. If the younger generation spends their whole life working, saving and investing, then they will also have assets when they are old. To say that young people must have the same net worth as older people is ridiculous, as the older generation has a lifetime of work behind them, which the younger generation does not. When the current younger generation has spent a lifetime working and is old, then the comparison with the current older generation will be valid.

The younger generation will likely have even better opportunities than their elders did with advances in all technologies likely to make their lives much easier and more prosperous than those that have gone before them.

The boomer generation has paid their dues with a lifetime of sacrifices, work, taxes, contributing to health funds and bringing up and paying for children. Now that it is time for the system to give something back to boomers, we have instead become targets for envy, victimization and robbery, not to mention the prospect of being neglected, abused and robbed by the aged care system. How are we supposed to pay for our aged, frail years if we are robbed of our life savings before then?

- I was born in 1950, endured a frugal upbringing and learned the value of saving and being careful. Our circumstances were not advantaged by the 'booms' of the 50s and 60s. I started work in 1968 and retired in 2018 and we are now in an extremely comfortable self-funded retirement, all achieved by careful and disciplined planning.

- And disadvantages. I'm 68, a typical Boomer. No free uni yet, couldn't get a scholarship so paid full price for a 4-year degree. Uni in the day, manual factory work at night, huge debt. Vietnam War and compulsory conscription. 1990 recession which meant 18% housing interest, too much for many including me with young kids who had to sell up for what they could get. As interest rates fell, unemployment went up. Early 1990s, 12% interest rates and 12.5% unemployment in Adelaide simultaneously.

GFC when you're 55 decimates your super in the final years of work before retirement - sequencing risk at its worst!

Adelaide house prices. Been in current home 9 years. In that time price has increased in total 13%, that's just over 1% per annum compounded. Unlike Melbourne/Sydney, no rags to riches here.

Wife age 66. Active discrimination at uni in the early 70s for being a Catholic! Yep, Adelaide Uni, one of the elite sandstones and definitely Church of England then. Studying double degree in Classical History and English to become a teacher - finds out that women are paid 67% of a male teacher’s rate for High School teaching. Chaining herself to Government House gates helps overturn that. Starts teaching at govt school. The Principal tells her that she should be a Primary School teacher, not a Year 11/12 teacher because she's female.

Promoted to Senior Teacher after 4 years due to the fairly new practice of promoting on merit, not seniority. Results in older male teachers ostracising her because she's taken their promotion. Harassment including heavy bookcase and filing cabinets in her office turned to the wall so she can't access them (she's only 5 foot 2 inches, 53 Kgs). Her office table is nailed to the ceiling! Sexual harassment by the vice principal pinning her to the wall in the staff room by putting his hands on the wall on either side of her head whilst the male staff who missed out on promotions laugh. Vice Principal also strongly believes that women should not be in management roles because they menstruate. Yes, it was a really easy life for a young, professional Boomer woman

- We are fortunate to have been brought up: taking responsibility for our actions and ourselves; without having social media; not getting offended by trivial matters; working hard to save for things rather than splurging on immediate gratification; and having a set of community based values - ie not telling older people to have a horrible day. In Darwinian terms there have been no serious pressures on younger generations which is making them soft and self-centered. A major world event may provide the required wake up call to realign Millennial thinking.

- Every generation has its opportunities, but ours were generally good. Those I know who are self-funded in retirement worked very hard to get there, often working past age 65. Because our parents saw difficult times, we were given a strong work ethic.

- New immigrants in the past have had to work hard (often two jobs) to advance - 'it don't come easy'

- But you've had to be prepared and willing to accept some risk and take these opportunities.

- My contemporaries (baby boomers) made their own luck for the most part and had a good work ethic. The main thing is to demonstrate strong family support within all generations, then there is no need for jealousy or retribution.

- Job security, low hard sell investment info (no Internet), stalwart stockmarket information, very resilient human mentalities, housing availabilities, home loans easy, less bombarding from all media sources that cause fear.

- You must work and have discipline to ensure you capitalise on the advantages.

- Don't forget, at one stage we were paying 18% for our home mortgage.

- My parents came to Oz immediately post-ww2 as refugees, with nothing, but worked very hard, so I am lucky.

- I have battled along as a single woman on a below average wage. I live in a cheap suburb and can't afford to retire. We need to stop calculating these formulas on wealthy couples. Millennials need to work and save and economize like we did - they are spoilt and expect a life of luxury.

- To take advantage of an opportunity, you must first recognize that one exists.

- We did without, saved and invested wisely. The younger generation want everything now. Let them do it tough like we did.

- We can compare and argue which generation had it better but the opportunities today are just different and more diverse. Having grown up in a third world country prior to coming to Australia I know what real hardship looks like and I don’t see too much of that. Work hard, save hard and the opportunities will abound.

- We have had a good life but also have made the most of opportunities. Not all baby boomers have been favoured. I agree, that every generation does have its advantages, it is what you make of opportunities and your outlook on life.

- Our time has been extraordinary. No wars, virtually no recessions etc. We have been very lucky. The future looks relatively bleak for Australia. Perhaps higher taxes for those who can afford them in retirement and death duties to properly fund the future of Australians is a reasonable recognition of our lucky times.

- Advantageous tax concessions have made many of us smug and secure. Relying so heavily on income tax is costing the economy in many ways and if I were young, I would be getting angry.

- Super didn't get introduced until we were well into our working lives, so I feel we are definitely behind the eight-ball vs our much younger cohorts - who get SGC from day 1 when they start a job!

- Each generation and then each individual has different experiences and gains individual skill sets. No one generation is ever favoured, opportunities presents for whoever wants to take them regardless of background or age.

- Everything should be viewed through the prism of relativity. There will always be pluses and minuses and it all boils down to the action or inaction of the individual.

- We had lower expectations. The consumer culture and digital age has spread expectations that make people dissatisfied with what they have in comparison to others. When I was younger we could only look over the fence, now people look at mega rich and privileged and expect to have similar lives. No point blaming the parents. One aspect where there could be a legitimate complaint is that boomer political power has skewed retirement taxation too much in favour of those with capital. I believe that a UBI (universal basic income) and then a progressive taxation system regardless of age would be fairer.

Comments from Non-Boomers (before and after)

- Born 1937... first car 22 years. first air.con home 30 years. No overseas trip before or after univ. No daily coffee or smashed avo. No $200 plus concerts. no $20 drinks at nightspots. GET REAL they are little darlings

- Please consider the social security rorts unemployment, ,job search, child minding paid maternity/paternity leave unknown in the past or certainly no were as generous as today. and the list goes on.

- I am a pre boomer (aged 74) I suspect that no millennial would think of living in our first house. Too small, no aircon, unmade road, no sewer and we could not afford a car.

- A very polarising debate and not helpful to our society. Look back through history and take a realistic look at life. Most of us are generally very fortunate - everyone has tough times. Get on with life and enjoy it.

- They have had it good but had to work hard particularly in their early years.

- The Boomers and the earlier generation did not sip lattes or eat smashed avocado. They rarely went to restaurants. Overseas holidays were unheard of. They were prepared to make sacrifices to achieve their goals. Only a few had the benefit of university education but if they wanted to work hard the opportunities were there.

- The pre-boomers survived the difficult period of the 1929 depression and the terrors, scarcities, destructions and displacements of populations during World War 1. Each generation has hardships and benefits. Post-boomers benefited in non-material ways and will gain from the wealth their parents were fortunate to accumulate.

- Technology changes opportunities. What the later generations are getting is life experiences developed by their parents.

- We (I'm pre-boomer) bought small houses, rode bikes, walked to the shops (corner stores, much more expensive). We didn't demand iPhones, iPads, Xbox, millions of toys, clothes to wear once and throw away. I went to UWA starting 1960. It was free. Gough might have made it free (unsustainably) for some, but benefactors made it free for me. My children are well post boomer. They've all done okay. Have their own houses, have families. Working and saving for what you need works every time. Cut your expectations to your ability to fulfil them.

- I am too old to have my wealth in super so I am still disadvantaged.

- All generations, if they invest and not spend, will have recessions, stock market falls, housing dips, so we all have our savings diluted at times, it's how you solve your own problems that count, but immigration has fuelled the housing cost escalation.

- Inflation and interest rates were higher and only the man worked in the family.

- I don't envy their good luck but would be happy if those who are well off as a result took some responsibility for all in the next generations -not only their own children and grandchildren but all those who are less fortunate than themselves.

- Media ownership. And communications individually will limit the advance of truthful knowledge.

- Promotion was based on age not ability. Most families had only one income.

- I have done all right, but I also got a free university education from R G Menzies. Plus the benefits of employer superannuation and the superannuation advantages discussed above. I've had it good also but I may not be that representative.

- Although born in 1944, I have experienced most of the boomer benefits mentioned in your article. I consider myself extremely fortunate for these and saw the financial logic in Labor’s withdrawal of franking credits even though I would be adversely affected. I did not vote Labor, however because of their refusal to end Adani, but otherwise was accepting of their rather brutal financial policy towards boomers.

- I think you have missed a major benefit is that a lot of boomers were on defined benefit super schemes - these offer very generous lifelong indexed pensions.

- Short-sighted governments failed. They should have encouraged all workers (especially middle income) to contribute to superannuation by not taxing contributions, on the understanding that superannuation would be taxed in retirement - they didn't need the taxes in the early 2000s but used them to buy middle income votes - they do need the taxes when the boomers retire. A civilised society has the obligation to support those who cannot or will not support themselves - but we do not have an obligation to prop up inheritances. The family home should be earmarked to repay any pensions paid before it reverts to the state.

- I am waiting for boomers to retire and for me to take over their jobs and properties.

- We shake our heads at the Greeks who refused to reform to save their national budget - yet we've been happy to build up a significant national debt of our own to support middle-class boomer welfare.

- Let gen Z etc earn their keep and wait in line. Age = wealth.

- High interest rates, availability of finance rationing up to late 1940s, limited tertiary positions up to 1970s, social services limited availability of assistance to aged parents impoverished by two world wars, and major depression. Young people had to provide for themselves, help aged parents, educate their children and pay off mortgages which in 1970s were over 10%. I paid 11.25% to ANZ subsequently reduced to 10.25%.

- Try working as hard as the previous generations and you may just learn to appreciate how good you have it now! Stop complaining like the spoilt brats that so many of you are! And no... you will not inherit my wealth! Get off your backside and create your own! Being of sound mind, I intend to spend the lot before I go!

- Born late 1944. Compulsory super only applied for approx 1/2 of many boomers working lives and much of that period at a low contribution rate. High interest rates on home loans for many years impacted heavily on family budget, they do not apply today and are unlikely to for many years. Many of my generation did not have to have expensive holidays or the latest tech device and upgrade every year. People born post WW2 are, I believe, more likely to have devoted time to parenting their offspring than many of today’s parents who expect the school/govt to provide all.

- Boomers are responsible for inter-generational theft that has ruined Australia and destroyed the prosperity of future generations

- High interest rates in the late 1980s, the 'recession we had to have' which was deep and very harmful financially, Vietnam War, Oil Shocks with lots of unemployment as a result. The GFC which decimated many baby boomers retirement savings, Superannuation accounts which did not enjoy the benefits of an entire working life span, unchecked smoking advertising and therefore lots of smoking leading to lung cancer, sun baking without sunscreen before we knew the risks, widespread asbestos in housing, not educated with technology, which had to be learned on the run in the workforce. The development of the Pill and HRT which both caused cancer in the early stages and where Baby Boomers were basically used as guinea pigs. Multiple child sex abuse cases that went uncheck for years, with victims still trying to get fair compensation. It certainly has not all been plain sailing for the BBs, but how soon society and the media forget.

- Boomers experienced 15% plus mortgage rates and virtually zero inheritance from their depression-era parents.

- Free education, houses near the CBD, free shares in floats like NRMA and life insurance companies, no brainer share floats like the CBA (what did you think was going to happen to the share price, duh?!), entitlement mentality of "eeeh I paid taxes all me life"... where should I stop?

- Hard work and financial wisdom always win.

- Huge asset growth caused by relaxed lending standards by banks and more double income households.

Leisa Bell is Assistant Editor at Firstlinks.