The world of investing can be confusing and scary at times. Fortunately, the basics of investing are timeless and some investors (often the best) have a knack of encapsulating these in a sentence or two that is insightful and easy to understand.

In recent years I’ve written several insights highlighting investment quotes I find particularly useful. Here are some more of my favourites.

The market

“Stock price movements actually begin to reflect new developments before its generally recognised they have taken place.” Arthur Zeikel

This goes to the nub of how share markets work – they are forward looking. Regularly I have seen share markets bottom and start moving higher even when the fundamental news is still terrible, only to see the news improve and vice versa. This is why many often get wrong footed – selling at bear market depths because the fundamental news is so bad and buying at the height of a bull market because the news is so good.

“It’s a basic fact of life that many things everybody knows turn out to be wrong.” Jim Rogers

This can’t apply to everything – eg if it’s raining outside then it is. But when it comes to investing this quote highlights how perverse it can be because when everyone is saying the same thing – like economic conditions are so bad shares can’t recover - then maybe the share market has already factored it in, the crowd has sold and the cycle will soon turn up.

“That men and women do not learn very much from the lessons of history is the most important of all the lessons of history.” Aldous Huxley

Which is partly why investment cycles perpetuate no matter how much regulators try and guard against a return to the behaviour which gave us the last boom and bust. The key for investors is to have an historical perspective, partly so they can filter the noise from what matters but also to help guard against being sucked up in periods of euphoria or pessimism.

“Cash is a fact, profit is an opinion.” Alfred Rappaport

This is one reason why dividends are great – providing they are not being paid for out of debt, they reflect that companies are actually generating cash and so can afford to pay the dividend.

Contrarian investing

“Even the intelligent investor is going to need considerable willpower to keep from following the crowd.” Ben Graham

When times are good the crowd is happy and fully invested. But it gets to a point where everyone who wants to buy has. This leaves the market vulnerable to bad news because there is no one left to buy. Similarly, after a sharp fall the crowd gets negative, sells their investments to the point that everyone who wants to sell has and so the market sets up for a rally when some good, or less bad, news comes along. So the point of maximum risk is when most are euphoric, and the point of maximum opportunity is when most are pessimistic. But for many investors trying to sell when the market is booming and all around you are euphoric is tough. As is trying to buy after the market has crashed and everyone is pessimistic.

Having a goal and a plan

“Compound interest is the eighth wonder of the world. He who understands it, earns it…he who doesn’t, pays it.” Albert Einstein

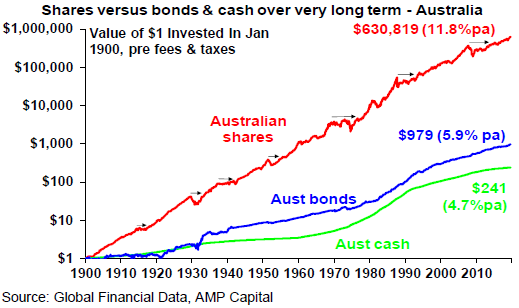

Some may argue it was Patsy Kensit! But when it comes to investing, your best friend is time and the earlier you start, the better. This is the best way to take advantage of the magic of compound interest. (And the worst way to experience its downside is letting credit card debt build up!) The next chart shows the value of $1 invested in various Australian asset classes since 1900 allowing for reinvesting any income along the way. That $1 would have grown to $241 if invested in cash, $979 in bonds but a whopping $630,819 in shares.

While the average share return since 1900 is only double that of bonds, the huge gap in the end result between the two owes to the magic of compounding returns on top of returns. A growth asset like property is similar to shares over long periods. Short-term share returns bounce all over the place and they can go through lengthy bear markets (shown with arrows on the chart). But the longer the time period you allow to build your savings, the easier it is to look through short-term market fluctuations and the greater the time the compounding of higher returns from growth assets has to build on itself.

“Do not take yearly results so seriously. Instead focus on four- or five-year averages.” Benjamin Graham

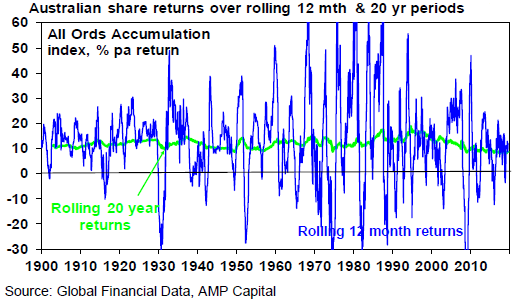

In the short-term, the share price for a company, asset class returns or returns from an investment product bounce around a lot. But this is mostly just noise and is no guide to the future and should be ignored. When it comes to share market returns the longer the investment horizon the better. As can be seen in the next chart while rolling 12-month share market returns are volatile rolling 20-year returns are solid and pretty stable.

Processes

“No matter how good the science gets, there are problems that inevitably depend on judgement, on art, on a feel for financial markets.” Martin Feldstein

This is about having the right balance between science (to keep you disciplined and immune to market sentiment) and art (because quant models can be wrong too and won’t know about everything impacting markets) in your investment process.

“If you aren’t thinking about holding a stock for ten years, don’t even think about holding it for ten minutes.” Warren Buffett

Unless you really want to put a lot of time into trading, its best to only invest in assets you would be comfortable holding long term. This is less risky than constant tinkering.

“I have always told people who asked for a stock tip that unless they were prepared to ring me every week for a sell decision, a stock tip was useless.” Nikki Thomas

Stock tips are interesting but unless you get them as part of a process with regular updates (including when to buy and sell) they are of dubious value beyond possible entertainment.

“Diversification for investors, like celibacy for teenagers, is a concept both easy to understand and hard to practice.” James Gipson

But you gotta try because if you only have exposure to two or three shares in your portfolio you could be exposed to a very wild ride at times and even the risk of permanent capital loss.

Noise

“Based on personal experience – both as an investor & an expert witness – rarely do more than three or four variables really count. Everything else is noise.” Martin Whitman

The information revolution has given us an abundance of information and opinion about investing. The danger is that information overload adds to uncertainty resulting in excessive caution, an overreaction to news and a focus on things that are of little relevance. So turn down the noise!

Pessimism

“Anything that can go wrong and doesn’t go wrong is just waiting for a much worse time to go wrong.” Anon

Those perpetually forecasting a crash in Australian home prices are an example of this sort of thinking. The human brain evolved in a way that it leaves us hardwired to be on the lookout for risks. So, it’s easier to be sceptical and pessimistic. As a result, bad news sells and there seems to be a never-ending stream of warnings of the next disaster. But when it comes to investing, succumbing too much to pessimism doesn’t pay. Since 1900 shares have had positive returns seven years out of 10 in the US and eight years out of 10 in Australia.

Self-perception

“Everyone has the brain power to make money in stocks. Not everyone has the stomach. If you are susceptible to selling everything in a panic, you ought to avoid stocks and [investment] funds.” Peter Lynch

If you can’t handle volatility in financial markets without making rash decisions, then either they are not for you or you should just take a long-term approach and leave it to someone else.

“If you have trouble imagining a 20% loss in the stock market, you shouldn’t be in stocks.” John Bogle

Ditto. Successful investing is all about knowing yourself. Smart investors have an awareness of their weaknesses and seek to manage them. One way to do this is to take a long-term approach. If you want to trade day to day then you need to recognise that this requires a lot of effort, a rigorous process and a willingness to go against the crowd.

“A fanatic is one who can’t change his mind and won’t change the subject.” Winston Churchill

Many let blind faith in a strongly held view (“debt is too high”, “global oil production will soon peak”, “paper money will lead to economic disaster”, “Obamacare will destroy the US economy”, “the digital revolution means this time is different”) drive all their investment decisions. They could get lucky and be right at some point but end up losing a lot of money in the interim.

“If you don’t like something, change it. If you can’t change it, change your attitude.” Dr Mary Angelou

Following on from the last quote, to be a successful investor you need to humble, flexible and accepting of the reality of investment markets. Tilting at windmills doesn’t work.

Life balance

“Money is better than poverty if only for financial reasons.” Woody Allen

Classic Woody. But he’s definitely right.

“Money frees you from doing things you dislike. Since I dislike doing nearly everything, money is handy.” Groucho Marx

That may be true for him. But some of the best things in life are free (well, they don’t need money).

“Wealth consists not in having great possessions but in having few wants.” Epicetus

There is much more to being wealthy than just having money and possessions. We often focus on getting great possessions and hence the financial wealth to obtain them, but numerous studies show that beyond a certain level, more money won’t make you happier. And if we have fewer wants we are better able to focus on achieving those wants.

“Even right up to the end we found conflict with each other, which now means nothing. It just means nothing. If there is conflict in your lives – get rid of it.” Barry Gibb (on his relationship with Robin Gibb after Robin’s death)

Money often drives conflict. Try to make sure it doesn’t.

Dr Shane Oliver is Head of Investment Strategy and Chief Economist at AMP Capital, a sponsor of Firstlinks. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs.

For more articles and papers from AMP Capital, click here.