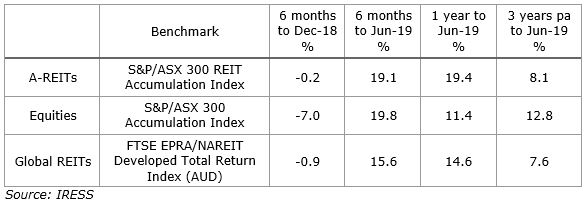

The A-REIT (Australian Real Estate Investment Trusts) sector generated a total return of +19.4% in 2018/2019, outperforming the broader S&P/ASX300 Accumulation Index return of +11.4%. The returns were heavily skewed to the second half of the financial year and largely driven by firming bond yields and the rotation of capital into the yield sectors such as A-REITs and infrastructure. A-REITs also outperformed the Global REIT benchmark.

A-REIT and global REIT returns

The A-REIT index was boosted by the industrial and office sectors that delivered +57.7% and +33.4% respectively in FY19, whilst the retail sector delivered -7.6%.

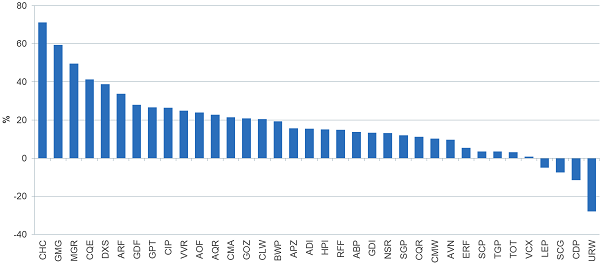

At the security level, the dispersion of returns between the best and worst performing A-REITs was one of the largest on record, as shown below. The x-axis corresponds to the ASX codes.

A-REIT returns by Security: Year to June 2019

Source: IRESS

Massive difference in performance

The best performing A-REITs in FY19 were the fund managers, led by Charter Hall Group (ASX:CHC) at +72.4% and Goodman Group (ASX:GMG) at +59.9%. Both platforms benefited from strong demand for their real estate funds, their access to the strongly-performing office (CHC) and industrial logistics (CHC and GMG) sectors and the embedded performance fees in a number of their funds.

Unibail-Rodamco (ASX:URW) and Scentre Group (ASX:SCG) recorded negative annual returns, delivering -27.5% and -7.7% respectively. This was driven by concerns over their significant exposure to the discretionary retail sector. Vehicles exposed to non-discretionary retail spend, including convenience centres, such as Charter Hall Retail (ASX:CQR) and SCA Property Group (ASX:SCP) fared much better.

We have witnessed a significant flow of capital from domestic and global general equities managers into A-REITs, with higher multiples being paid by investors seeking the relatively-secure earnings growth in the sector. Many A-REITs took advantage of the strong appetite for yield and raised more than $3.7 billion in the past six months, $1.7 billion of which was raised in June 2019 alone. This was the highest level of equity raised since 2009 when the sector was forced to recapitalise at the height of the GFC. Anecdotal evidence from the investment banks indicates each of the raisings were significantly oversubscribed.

In addition, there was more than $4.2 billion in A-REIT debt issuance in the first half of 2019. The US private placement market was a key source of debt finance, with four A-REITS (GrowthPoint, GPT, Mirvac and Stockland) tapping the US debt market, securing $1.7 billion in borrowings with tenures of between 10 and 14 years and margins between 170 and 224 bps.

Market snapshot

Office

Australia’s main office markets are well-positioned with historically low vacancy rates and modest supply levels. This has led to strong rental growth along the east coast. The Sydney CBD vacancy rate is the lowest it has been in 18 years, while Melbourne’s vacancy rate is at a 10-year low. Vacancy rates in Brisbane and Perth are now falling on the back of positive demand. Given the strong positive office market fundamentals, capital values are expected to be supported by continued investment demand from A-REITs, superannuation funds and foreign investors.

Retail

The retail sector has been impacted by a combination of cyclical and structural issues. Cyclically, retail sales have been under pressure due to higher living expenses that have not been offset by wage growth. Structurally the market, particularly discretionary retail, is suffering from the rise of e-commerce. FY20 retail sales are expected to be boosted by the flow through of the Coalition’s tax refund plan. This will see $7.6 billion tax refunds (~0.4% of GDP) flow to consumers, with a large proportion of the refunds to be spent on retail consumption.

Industrial

The structural trends of urbanisation, rising e-commerce and the need for convenience is requiring logistics providers to reconfigure their supply chains. This has led to strong demand for urban industrial premises and higher investment into state-of-the-art distribution centres, driving longer leases. A significant pipeline of infrastructure projects and a lower AUD has also benefitted demand, leading to rental growth in most regions. The investment market is expected to remain strong given solid rental growth expectations and demand from institutions underweight the logistics sector.

Residential

Optimism appears to have returned to the housing market, following the Federal Election, RBA cuts and APRA easing of lending buffers. Whilst sentiment is up, this positive shift will take time to filter through the market and positive earnings of those A-REITs exposed to the residential sector.

The outlook for A-REITs

With interest rates at record lows and continuing low inflation, there are not many options for investors seeking a healthy yield. A-REITs is one sector that investors will focus on.

The sector benefits from solid operating fundamentals, low gearing and strong interest cover, good dividend coverage and demand for institutional grade real estate. A continuation of low interest rates, reasonable consumer confidence, and corporate activity (M&A) will support the sector. The lower Australian dollar adds to the appeal for offshore investors.

The sector is offering a 4.5% dividend yield, with forecast growth in dividends of ~3% per annum for the next four years. Profit growth is reasonably predictable driven by contractual rental arrangements and annuity-type management fees. Unlike some of the broader industrial companies, there are few question marks over A-REIT dividends.

In perspective, the current A-REIT dividend yield is 3.5x the current 10-year bond yield and 4.5x the cash rate. The greatest risk to the sector is a rising in bond yields, which would negatively impact pricing. This seems unlikely at the moment, but as the past year has shown, not all A-REIT are equal, and there will be winners and losers. This is a market for active stock-pickers.

Patrick Barrett is Portfolio Manager, Listed Securities at Charter Hall, a sponsor of Cuffelinks. This article is for general information purposes only and does not consider the circumstances of any person, and investors should take professional investment advice before acting.

For more articles and papers from Charter Hall (and previously, Folkestone), please click here.