An investor’s behavior has every bit as much of an effect on their returns as the stock market environment they happen to live through. I know this as well as anybody.

In 2021, I earned a measly 6% in a year where everything - absolutely everything - went up, and putting my money in a global ETF would have scored me 23.5% in sterling. Why did this happen? Because I behaved like an idiot, traded too much, and racked up massive brokerage fees.

Re-opening this wound to write a recent article reminded me of how important it is to be aware of how we behave as investors and why. In that sense, a podcast appearance by previous Firstlinks contributor Professor Michael Finke popped up at exactly the right time.

Here are four things I learned from his discussion with Standard Deviations podcast host Daniel Crosby about the impact of behavior on investment and retirement outcomes.

The three main sources of panicked trading

Overtrading like I did in 2021 is a classic case of poor behaviour stunting returns. Another classic is our very human tendency to get carried away in the good times (buying high) and overly scared in the not so good times (selling low).

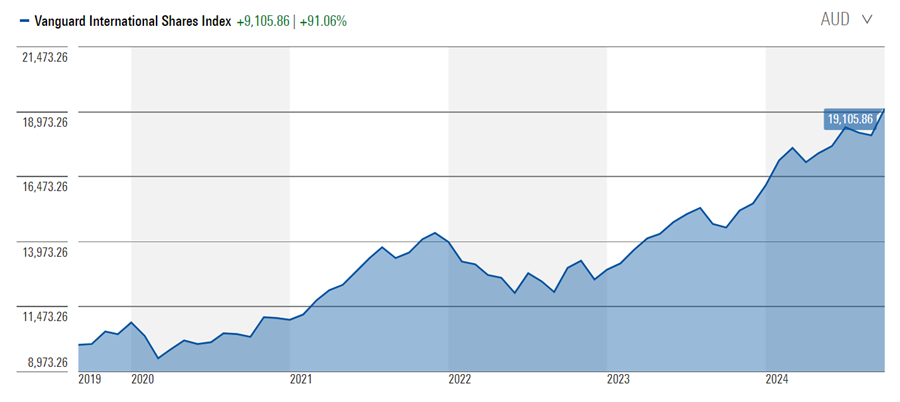

For those investing over the past 25 years or so, perhaps the worst thing you could have done was to panic and sell everything whenever stock markets wobbled. Even in the years since Covid reared its head, this has happened several times. And pretty much every time, markets have tended to bounce back very strongly.

Source: Morningstar

Finke has done a lot of research into how likely different buckets of investors (measured by the type of retirement account they have) are to panic when markets fall. As I understood it, three things seem to have an outsized impact on an investor’s likelihood to sell everything and move into cash:

- The investor’s time horizon – how long until the person is due to retire? Investors with less than ten years to go until retirement were far more likely to sell out of equities and go into cash at times of market tumult.

- The investor’s time in the market – has the investor lived through market panics before and realised that it’s usually OK on the other side? If they haven’t, the investor is probably more likely to sell at the first sign of trouble.

- How engaged the investor is with their portfolio and markets. The least interested investors (those in a simple lifecycle product) were least likely to panic. The most engaged, self-directed investors were most likely.

The first two make a lot of sense. The third might seem counter-intuitive because it suggests that the more informed you are as an investor, the more prone you are to making poor decisions. But when you think about it, it makes perfect sense.

Ignorance is bliss?

The likelihood of making a poor, emotionally driven decision increases at times of extreme market volatility. This, according to Finke, is where ignorance can be far more of a super power than knowledge or a keen interest in markets.

Why? Because those who take no interest in markets and no role in managing their investments don’t care or know enough about what is going on to panic. To illustrate this, Crosby told a story about Betterment, a so-called robo advisor in the US.

Whenever a stock market correction came along, Betterment used to email every single one of their clients with messages telling them not to worry and to focus on the long-term. They did this in the hope that it would encourage better investor behaviour. A noble act.

Instead, Betterman found that their email blasts actually seemed to encourage worse behaviour. Why? Because previously “ignorant” investors became more worried than they would have otherwise. Betterman switched to only emailing investors that logged into their accounts during periods of volatility.

This rings true even outside of market corrections. If I didn’t enjoy reading stock pitches and macro articles so much, would I have tinkered with my portfolio so much in 2021? I doubt it. I probably would have been far more focused on the savings part of the equation rather than the investing part.

An active interest in investing might be every bit as dangerous to your returns as it is helpful. Just another reason that I recommend you read my colleague Shani’s earlier piece for Firstlinks on her disinterested investing strategy.

The double-edged source of engagement

One measure of engagement is how often somebody tracks their portfolio balance. I’ve always wanted to reduce the frequency with which I do this, but I find it hard not to check up on the shares that I have selected for myself. As for the index funds I own in my super, I find it far easier to ignore.

According to Finke, being more engaged in this manner isn’t all bad, but it is a double-edged sword. His research suggests that people who track their investments more tend to save far more than those who don’t. This is potentially because during good times, of which the stock market has had many in recent years, a rising balance provides positive feedback and motivation to keep investing.

If the stock market was to reverse course, however, constantly logging in and getting negative feedback could induce feelings of panic and make the attentive investor more prone to making an emotional or rash decision.

Behaviorally optimal versus ‘spreadsheet optimal’

Finke and Crosby also discussed the need for a shift in mindset from ‘optimal’ asset allocations to those that make it easier for investors to avoid poor behaviour.

As an example, stock markets have generally been very strong over the past 25 years. Because of this, most back-tested returns will show that holding excess cash in your portfolio was a grave error. But would it have been an error?

If presence of a ‘safe’ cash bucket helps the investor think longer-term with the remaining equities allocation, it might help them capture more of the market’s strong return than they would have otherwise. I have thought about this a lot in regard to investing in actively managed funds.

It is easy to write off active funds because we all know how hard it is for them to outperform market averages over time. But as Morningstar’s Mind The Gap study shows every year, asset class averages do not equal the returns that investors actually achieve.

If you, for example, have deep rooted concerns about the index’s concentration – be it in a small group of individual stocks, a certain sector, or a certain country - you might find it harder to simply ‘set and forget’ that investment. And find yourself more prone to panicked buy and sell decisions.

As a result, I think there is every chance that finding a fund with 1) a manager you trust and 2) a process that fits your own investing philosophy could produce a better overall return for you. Even if that fund does indeed lag the market average.

Joseph Taylor is an Associate Investment Specialist at Morningstar. You can listen to Michael Finke’s appearance on the Standard Deviations podcast here.