The Labor Party franking credit proposal to scrap the cash rebate when franking credits exceed tax payable has come under renewed scrutiny. The unapologetic response from Shadow Treasurer Chris Bowen on ABC radio to a retiree that would be $5,000 a year worse off under the policy fuelled the fire:

“I say to your listeners, if they feel very strongly about this, if they feel that this is something which should impact their vote, they are of course perfectly entitled to vote against us”.

Given the opinion polls currently indicate it is probable that Labor will win the 2019 Federal Election, a frequent question raised is the impact of the implementation of this policy on hybrid valuations. When this policy was first proposed on 13 March 2018, the hybrid market reacted by the average trading margin on major bank hybrids rising 23bp (0.23%) over the following three trading days.

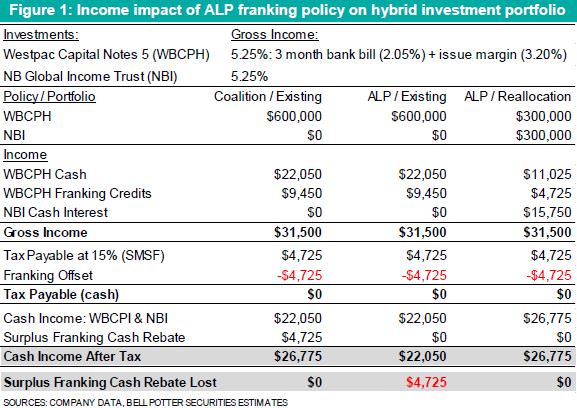

In quantifying the impact on an SMSF in accumulation phase, we considered the following example of an SMSF that currently only holds one asset, a Westpac hybrid (ASX:WBCPH):

- a $600,000 investment in WBCPH generates $22,050 cash and $9,450 in franking credits.

- the SMSF would lose a surplus franking cash rebate of $4,725 under the Labor policy.

- to maintain the same level of after-tax income, this investor allocates $300,000 or half their WBCPH holding into an investment such as NB Global Income Trust (ASX:NBI), a high yield corporate bond fund which carries no franking credits in its payments.

- assume both WBCPH and NBI pay 5.25% per annum.

The results are shown below.

In holding only the Westpac hybrid under current rules, gross income including franking of $9,450 is $31,500 ($600,000 X 5.25%). This is taxed at 15% or $4,725, to give cash income after tax of $26,775.

Under the Labor proposal, the surplus franking rebate of $4,725 will be lost, reducing cash income after tax to $22,050.

Following the switch to a bond fund without franking, the smaller franking credits balance can be fully used by the 15% tax. In effect, more of the return is in the form of unfranked dividends, returning the SMSF to income after tax of $26,775.

Reallocating investments away from the capital structure of banks to an offshore high yield income trust is likely to increase bank funding and capital costs, although there are many holders such as institutional superannuation funds who will still claim the full refund to offset tax liabilities.

The availability of this investment strategy also brings into question the quantum of revenue the policy will generate. Of course, the assets have also changed, giving the investor a different risk profile, and there are many other assets which do not pay franked dividends.

Damien Williamson is an Analyst at Bell Potter Securities. This article is for general information only and does not consider the circumstances of any investor.